It is interesting to me that, with as important and liquid as the inflation-linked bond market is, the tactical allocation between TIPS and nominal bonds is at best an afterthought for most investors.

Perhaps this is because TIPS – if you think in nominal space like most investors do – can be quirky and complex to analyze on a bond-by-bond basis.

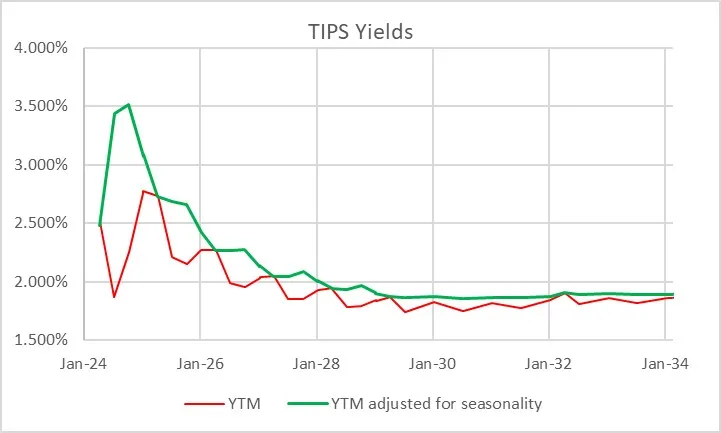

Here’s a picture of the TIPS yield curve. The red line is the way that TIPS real yields are calculated, and therefore the curve as perceived in the market.

The green line is the true yield curve, adjusting for the way the seasonality of inflation prints affects each particular bond.

That’s understandable, but I don’t think it’s sufficient. Most investors do not invest in individual bonds, especially in the TIPS space.

They invest via mutual funds or ETFs, although the ‘laddering’ of TIPS to form a crude inflation-linked annuity is a popular approach amongst do-it-yourselfers.

So why do so many investors own nominal bonds, instead of inflation-linked bonds, as an immutable strategic allocation?

Even those who make occasional tactical shifts into TIPS seem to do so when they are expecting inflation to rise, and so are making a macro call instead of a quantitative call.

But there are lots of times when owning TIPS instead of nominal bonds is just a good bet, regardless of your immediate inflation view.

The most obvious one I wrote about back in March 2020 was “The Big Bet of 10-year Breakevens at 0.94%."

I’ve also written generally about why you might want to be long inflation-linked bonds even if the current level of implied inflation (aka ‘breakevens’) is near to fair based on your view about the trajectory of inflation.

(See “A Guess at the Value of Long Inflation Tails” as an example).

But the times when just being long TIPS instead of nominal or being long breakevens or inflation swaps if you do it as a leveraged play is advantageous are not limited to unusual circumstances.

TIPS also have tended to be systematically cheap over long periods, which I’ve also documented.

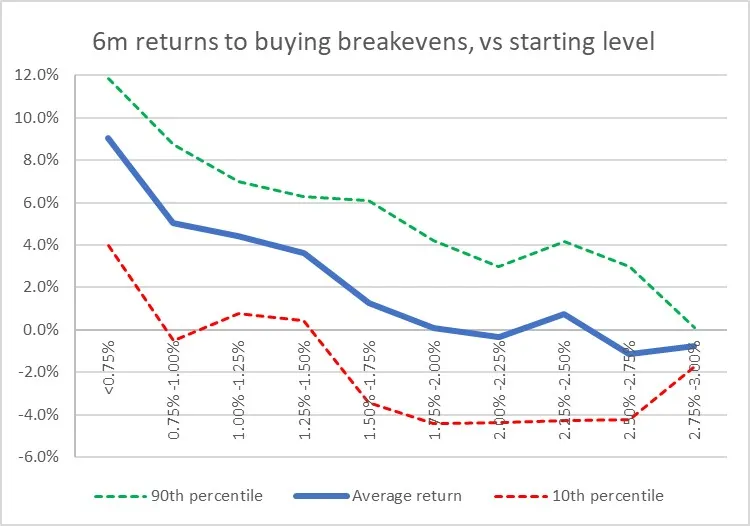

Another way to consider the same question is to ask, “If I bought 10-year breakevens when they were at a particular level, how would I have done it historically?”

Equivalently, “if I had switched into 10y TIPS, instead of 10y Treasuries, when the spread was at a particular level, how much would I have out- or under-performed historically?” The chart below answers that question.

I went back to February 1998. For each of 6,453 days (ending in June 2023 since I had to look forward 6 months), I considered the starting 10-year breakeven rate and calculated the return to being long that breakeven over the next 6 months.

That return is dependent on the relative yields of the different securities, how those yields (and hence the breakeven) changed over time, and how actual inflation developed.

It’s worth pointing out that this time period, core inflation was below 3% for 90% of the time. Ergo, you wouldn’t expect to have lots of big wins because of inflation surprise, although of course toward the end of the historical period you did.

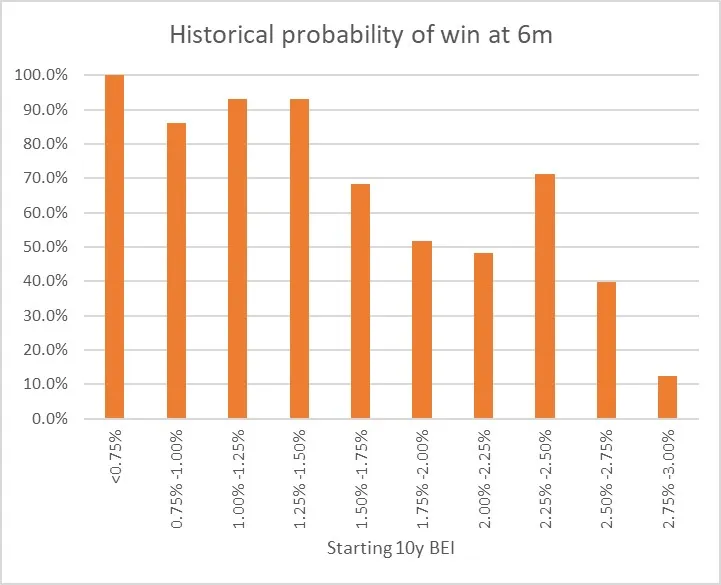

The chart shows for each bin (I threw all 58 days with 10-year breakevens lower than 0.75% into the same bucket, which turned out to be equal to the number of days in the 2.75%-3.00% bucket) what the average 6-month return was to being long 10-year breakevens along with the 10th percentile and 90th percentile.

So you can see that on average, you didn’t lose money being long breakevens anywhere under 2.50%, despite the fact that inflation throughout this period was very low.

That’s a function of what I said before, that TIPS in general were cheap throughout this period. And if you bought breakevens (or switched into TIPS) any time that the breakeven was below 1.5%, you had a 90% or better chance of winning.

Naturally, it shouldn’t be a surprise that if you buy breakevens at a cheap level – as with any asset – you stand a better chance of winning than if you bought it at a dear level.

What is a little more of a surprise is that there hasn’t historically been very much pain, on average, to being long breakevens even when they are high. In fact, unless you bought breakevens above 2.75% – basically, one event in 2022 – you had at least a 40% chance of winning your bet (10y TIPS outperforming).

This isn’t to say that there aren’t a lot of ways to lose, trade or invest in TIPS.

Like any other investment, they can lose money and in 2022-2023 being naked long TIPS was almost as painful as being naked long any other fixed-income instrument.

Almost. You did lots better than if you’d owned nominal Treasuries through the same episode!

***

I used the Bloomberg US 10-year Breakeven Inflation Index, which is a total return index (BXIIUB10 Index on Bloomberg), from its inception in 2006; prior to that I used Enduring Investments calculations which utilized roughly the same methodology.