Street Calls of the Week

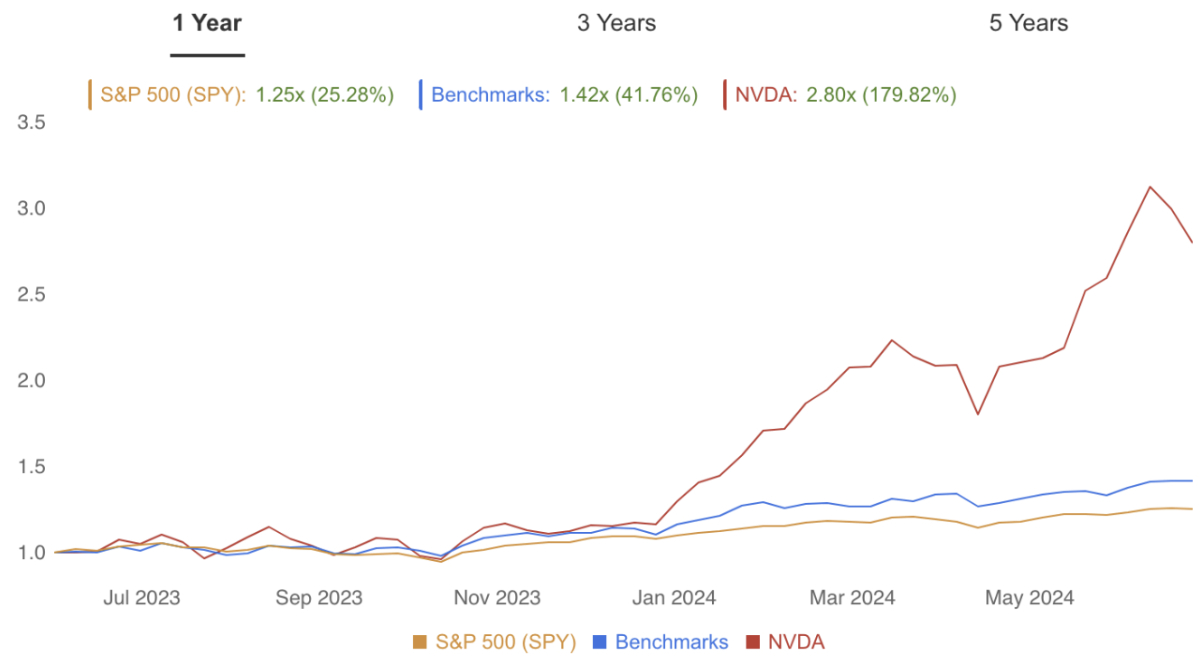

Nvidia's stock has been on fire lately, zooming nearly 200% in the past year. No wonder everyone's talking about it and analysts are recommending it left and right.

AI is definitely a game-changer, and it's going to shake things up in a big way. But that doesn't mean the market is valuing Nvidia perfectly. Here's the thing: this whole situation feels a bit like a bubble, it was this way in the past and it seems it is happening again.

During the dot-com bubble, the internet's transformative potential fueled a surge in investor excitement. Although the assessment that the internet was truly transformational was right, the prices got way out of whack. Companies' stock prices soared to unsustainable levels, disconnected from their actual value.

Seems like a similar story might be playing out with Nvidia. Their price-to-sales ratio is a whopping 36.4x. Basically, that means it would take over 36 years of their current sales to make your money back if you bought the whole company (and that's ignoring costs, expenses, taxes, or anything like that).

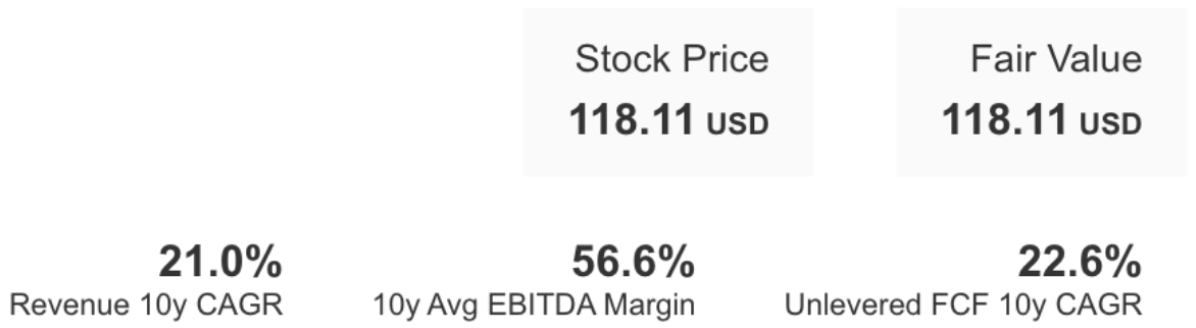

Let's look at it another way. To justify the current price, doing the maths roughly, Nvidia's sales would basically need to grow more than 20% every single year for the next decade. On top of that, they'd have to maintain their very high EBITDA margins (56.6%) – the best they've ever had in the last 10 years. Just to keep the stock price where it is, there is no upside here!

So, the risk is way higher right now because the price and multiples are inflated, with a PE ratio of 69.12, for instance. Investors could lose money if the market gets less excited about Nvidia (contracting multiples), or if the company doesn't meet expectations. My bet is both of those things should happen in the first or second miss of expectations by the analysts.

Now, I'm not saying Nvidia is a bad company, or that their stock is doomed. But I do think the risk of losing money in the medium and long term is high right now, and there are probably better places to put your investment at this moment.

InvestingPro has been a valuable tool for my investment research, assisting in my analysis and in identifying global investment opportunities. Subscribe using coupon code proadb24 and get a 10% discount.