DXY is looking toppy:

AUD is off the lows:

But, the Fed has a big problem in the oil market, which is threatening to break out:

Base metals were calmer:

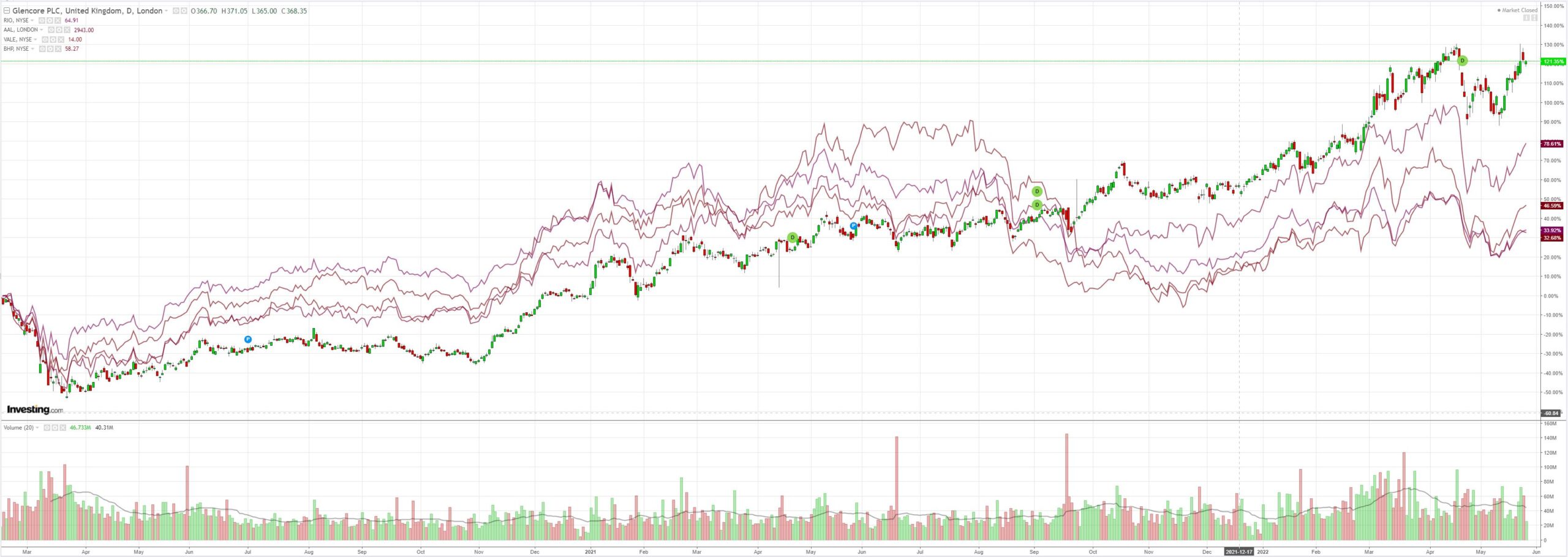

Big miners Glencore PLC (LON:GLEN) did OK:

EM stocks (NYSE:EEM) too:

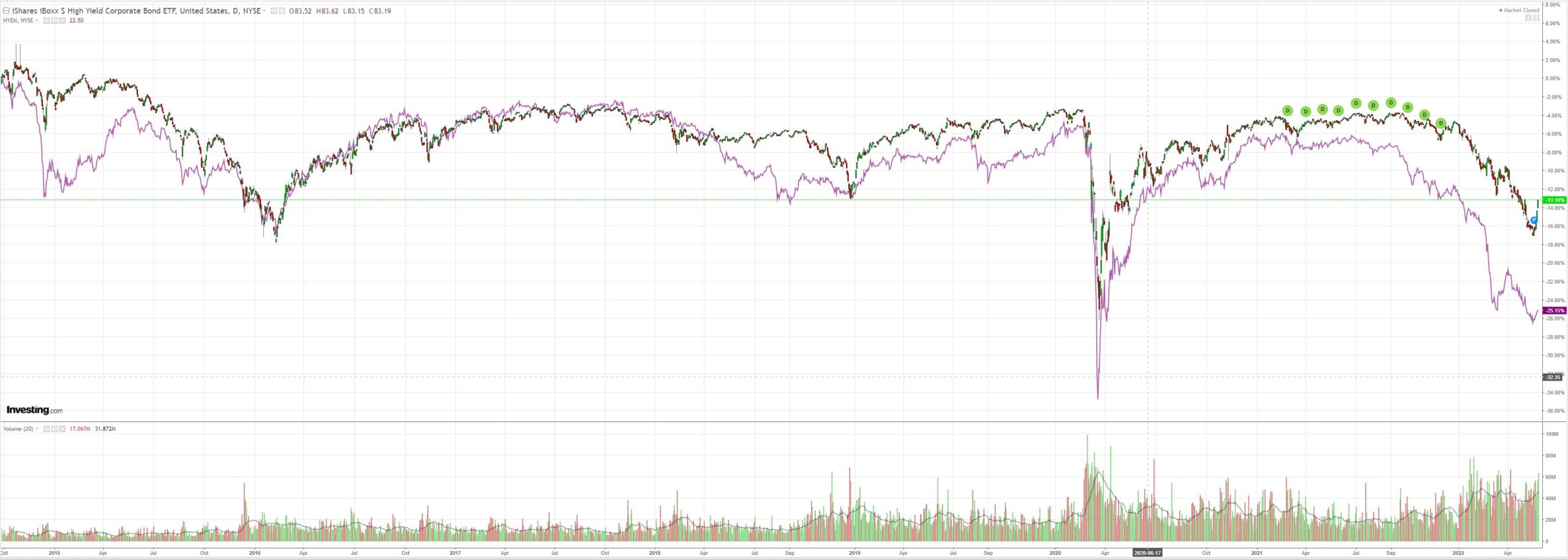

US junk (NYSE:HYG) is roaring, EM not so much:

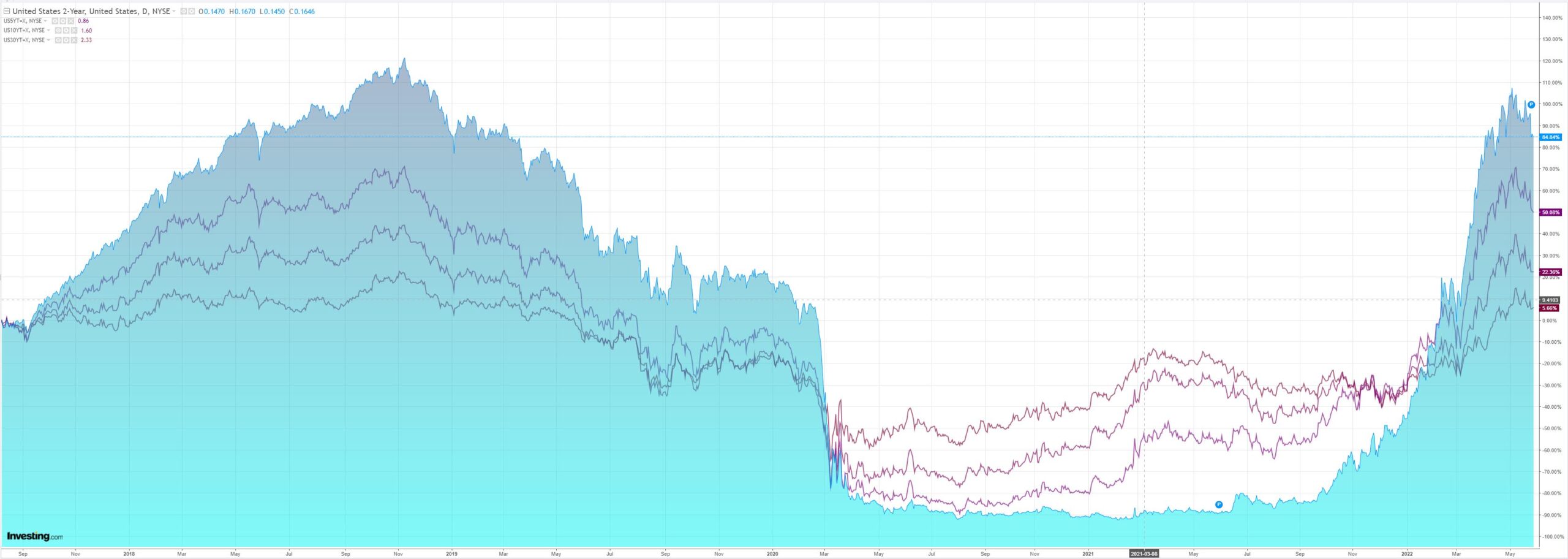

Yields are falling:

Which popped stocks:

Westpac has the wrap:

Event Wrap

US GDP in Q1 was revised slightly lower in its second estimate, from -1.4% to -1.5% annualised (vs -1.3% expected), inventories detracting. Personal consumption, though, beat expectations at +3.1% (est. 2.8%, prior 2.7%). Pending home sales for April fell 11.5% (est. -7.6%, prior -9.2%), to a low since April 2020, with rising mortgage rates and affordability weighing. The Kansas City Fed manufacturing activity survey beat expectations at 23 (est. 15, prior 25).

Event Outlook

Aust: Card spending indicators suggest retail sales should sustain its strong momentum in April but weakening sentiment and elevated prices add downside risk (Westpac f/c: 1.3%).

NZ: Cost of living concerns should continue to weigh on ANZ consumer confidence in May.

China: Industrial profits will build over this year as disruptions related to COVID-19 fade.

Eur: M3 money supply growth is expected to hold steady in April, indicating ample liquidity for the economy (market f/c: 6.3%).

US: Ongoing strength in wholesale inventories indicates businesses’ desire to lift productivity amid supply-side issues (market f/c: 1.9%). Weakness in personal income is raising concerns over purchasing power but the lift in personal spending on services is a clear positive (market f/c: 0.5% and 0.7% respectively). PCE inflation looks to have crested although price pressures will only slowly abate through this year (market f/c: 0.2% headline; 0.3% core). The final estimate to May’s University of Michigan sentiment survey will confirm that consumer optimism hinges on the inflation outlook (market f/c: 59.1).

So far, this is still a bear market rally for all. But there are growing hopes the Fed will pause in September. BofA:

A tenuous but remarkable change in communication

The market is still pricing the Fed to reach a terminal at or above 3% by mid-’23, which is the scenario we incorporate in our recent rates forecasts. Yet, we have recently seen a tenuous but remarkable change in Fed communications, where some Fed officials suggest the option of downshifting or pausing later in the year as they reach 2% given the challenging macro backdrop, tightening of financial conditions, and potentially softening inflation.

Focus on tighter financial conditions and a lower neutral

Much of the recent shift in communication has likely been driven by the material tightening of financial conditions with broader metrics of financial conditions now tighter than what prevailed during the late 2018 dovish shift in Fed communication.

So much for the new Paul Volker!

But the problem is obvious. The oil chart looks quite bullish again. If the market runs on the idea that the Fed “call” is gone then energy is going to break out. All the more so as China emerges from lockdown, albeit weakly but still much better.

Any Fed pause is going to immediately intensify the energy and commodity shock as DXY tumbles. That’ll hammer growth via demand destruction anyway.

I don’t think the Fed is this stupid but I may be wrong and if so then the AUD is entering a tradable rally.

Before the Fed is forced by oil back into further tightening directly into a much worse recession in 2023.