This article was written exclusively for Investing.com

- Late-season rally in soybeans, corn, and wheat

- August 10 derecho: a reminder of the fragile state of supplies

- Food demand continues to grow

- Three reasons why 2021 could be a bullish year for grain and oilseed prices

The beginning of September means that the 2020 harvest season in the US and countries in the northern hemisphere is on the immediate horizon. Grains and oilseeds are the agricultural products that feed the world. All signs are that there will be ample supplies to meet all requirements over the coming months.

Each year is always a new adventure when it comes to agricultural commodity output. Mother Nature determines the weather, so she's responsible for the size of crops. The US is the world’s leading producer and exporter of corn and soybeans, and a leading producer of wheat. Consumption is ubiquitous as all people worldwide require nutrition.

It has been eight years since a weather event caused corn, soybean, and wheat prices to soar. The 2012 drought sent corn and bean futures to all-time highs, and wheat rose to its highest price since the 2008 global drought. Since 2012, the world has added around 640 million more mouths to feed. The demand side of the fundamental equation for agricultural products is an ever-growing factor. Meanwhile, supply can be as fickle as the weather.

Late-season rally in soybeans, corn, and wheat

Grain and oilseed futures prices often experience rallies and increased price volatility during the spring planting and summer growing seasons because of the weather’s uncertainty and its impact on annual supplies. In 2020, the futures markets experienced late-season rallies beginning in mid-August.

Source, all charts: CQG

The daily chart of new-crop November soybeans highlights the rally from $8.6525 on August 10 to the most recent high of $9.6950 on September 4, a rise of 12% in under one month. The November beans were trading at the $9.69 level at the end of last week at the high.

New-crop December corn futures rose from $3.20 per bushel on August 12 to a high of $3.6425 on August 31 or 13.8%. The December futures were just below the $3.58 level on Friday, September 4.

December CBOT wheat futures rose from $4.97 on August 12 to $5.6850 on September 1 or 14.4%. The wheat futures were just over the $5.50 per bushel level at the end of last week.

August 10 derecho: a reminder of the fragile state of supplies

The US Department of Agriculture’s August World Agricultural Supply and Demand report was not all that bullish for grain and oilseed futures prices. It said supplies of the agricultural products will be ample in the 2020 crop year and sufficient to meet worldwide requirements.

However, two days before the USDA report, a derecho or violent winds and rainstorms swept across the fertile plains of the United States, causing some damage to crops. The weather event was a reminder that annual supplies of the products that feed the world are as fickle as the weather each year.

Mother Nature has cooperated with the agriculture markets in the US over the past eight years, but that is no guarantee for the future. The derecho was a wakeup call for consumers that abundant grain and oilseed supplies are a function of supportive weather conditions. The supply side of the fundamental equation in agricultural commodities is a year-to-year affair and can be highly variable.

Food demand continues to grow

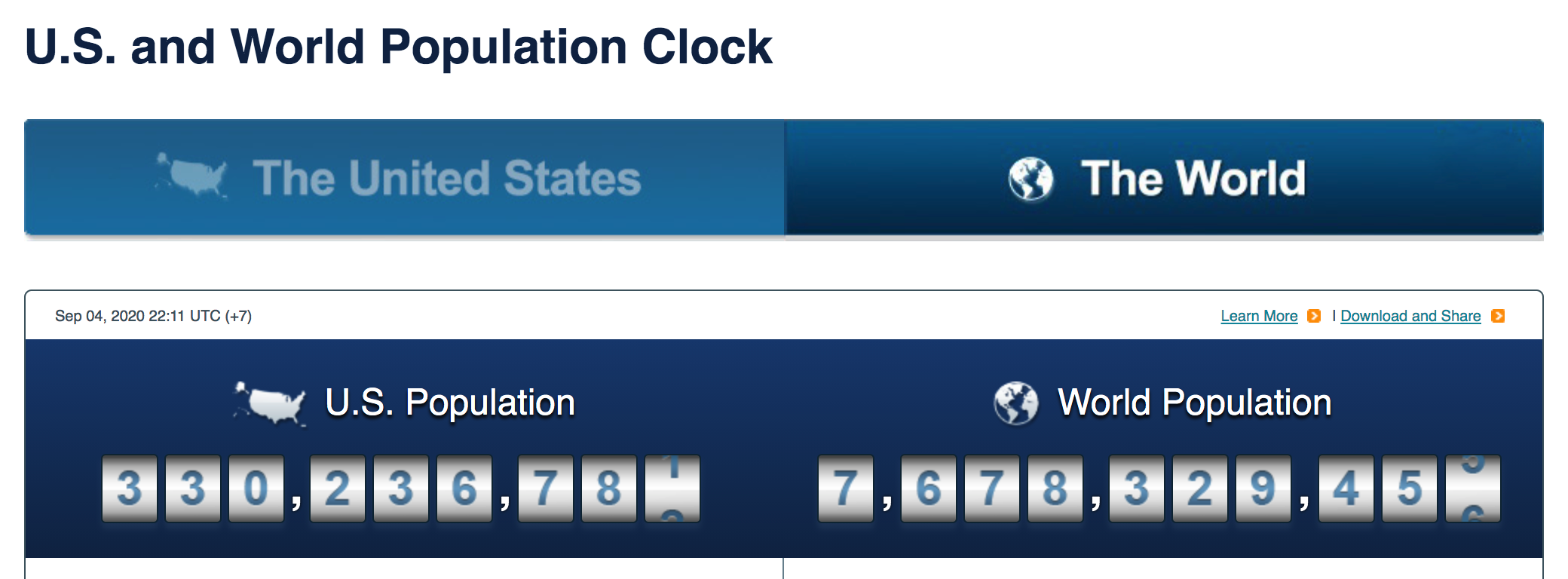

Meanwhile, the demand side of the equation is an ever-growing factor for the products that feed the world. Each quarter, the worldwide population increases by about 20 million people. At the turn of this century, there were approximately six billion mouths to feed on our planet.

Source: US Census Bureau

As the chart above shows, at the end of last week, that number stood at over 7.678 billion, almost 28% higher over the past two decades. The exponential population growth rate means that more people require more nutritional products each day.

The supply side of the equation for food needs to keep pace with the ever-rising demand. Therefore, the variability of supplies because of the weather could cause periods of extreme volatility in the grain and oilseed futures markets over the coming years if supplies become scarce.

Three reasons why 2021 could be a bullish year for grain and oilseed prices

The first reason for a bullish outlook in the agricultural markets in 2021 is demographics. The fundamental equation tells us that supply volatility and steadily increasing demand is a cocktail for significant price swings. Corn, soybean, and wheat prices are significantly lower than in 2012. A weather event could cause explosive rallies in the futures market. Since 2012, the global population and demand side of the equation has grown by 640 million people.

The second reason is the recent trend in the US dollar. The dollar is the pricing mechanism for most commodities, and the grain and oilseed markets are no exception. A falling dollar tends to push commodity prices higher.

The US Dollar Index chart shows that it moved into a bearish trend since March 2020 and broke through technical support at the September 2018 low of 93.395. A falling dollar is bullish for corn, soybean, and wheat prices.

Finally, in late August, the US Federal Reserve told markets they are willing to tolerate higher inflation levels over the coming months and years. The 2% target became more of an average, with members of the Fed saying that since inflation has remained below the target for so long, they would be willing to see it above the target before raising short-term rates. Rising inflation, the unprecedented level of central bank liquidity, and government stimulus programs are all highly inflationary. Higher inflation is extremely supportive of rising commodity prices.

Meanwhile, Mother Nature holds the key to the agricultural markets. While the prices of corn, beans, and wheat are likely to move higher because of economic factors, a weather event in 2021 has the potential to ignite rallies that could take prices to new all-time highs given the ever-growing demand side of this fundamental equation.