DXY eased last night:

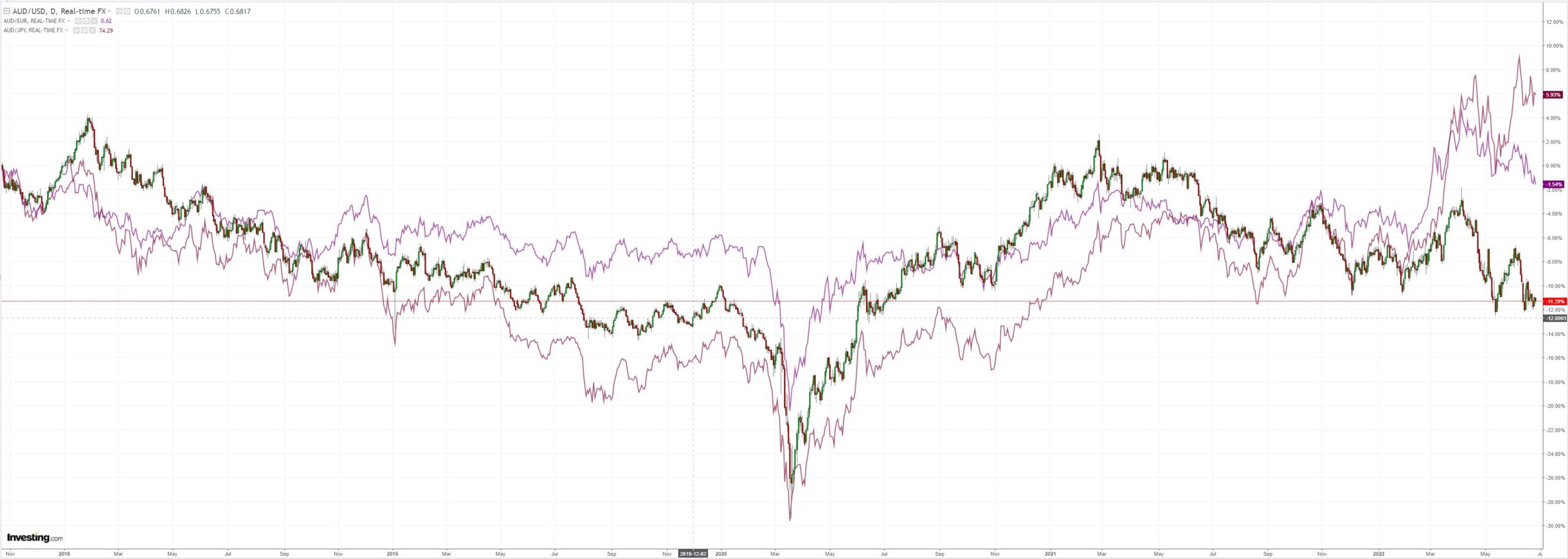

AUD fell across the board:

Oil lifted:

Even some metals too:

And miners (LON:GLEN):

EM stocks (NYSE:EEM) didn’t break new lows in the last leg lower but they’re not exactly tearing higher either:

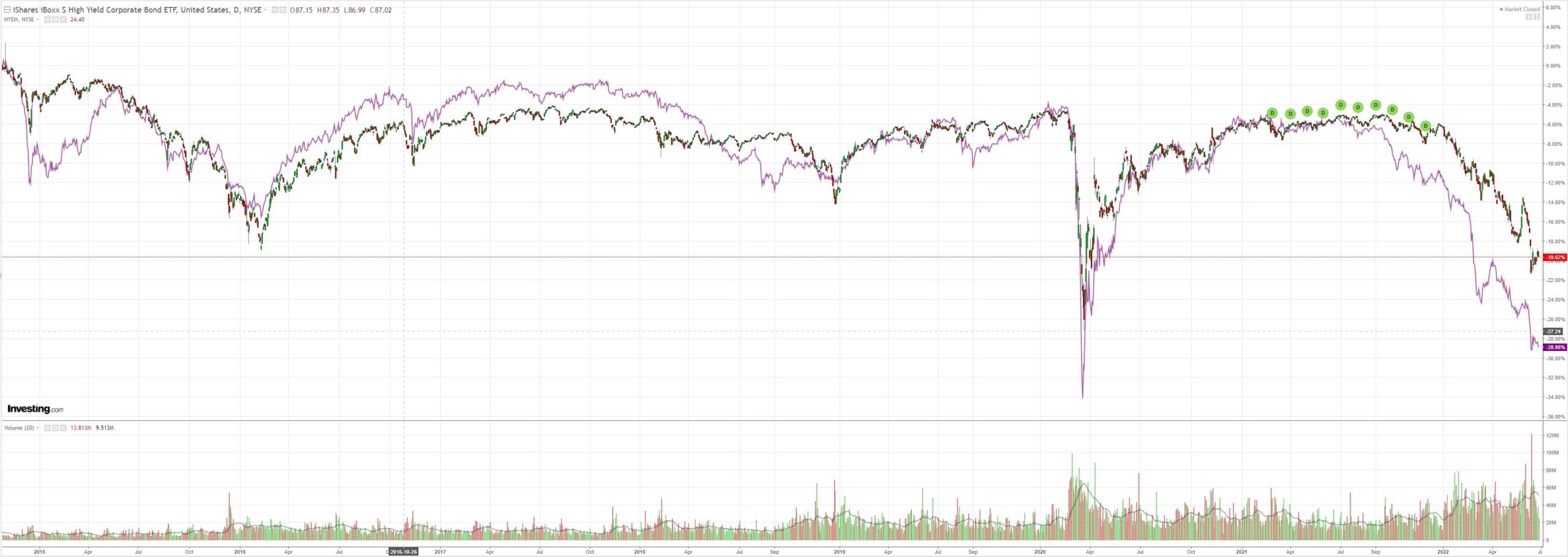

EM junk (NYSE:HYG) is a fiery comet still screaming sell everything!

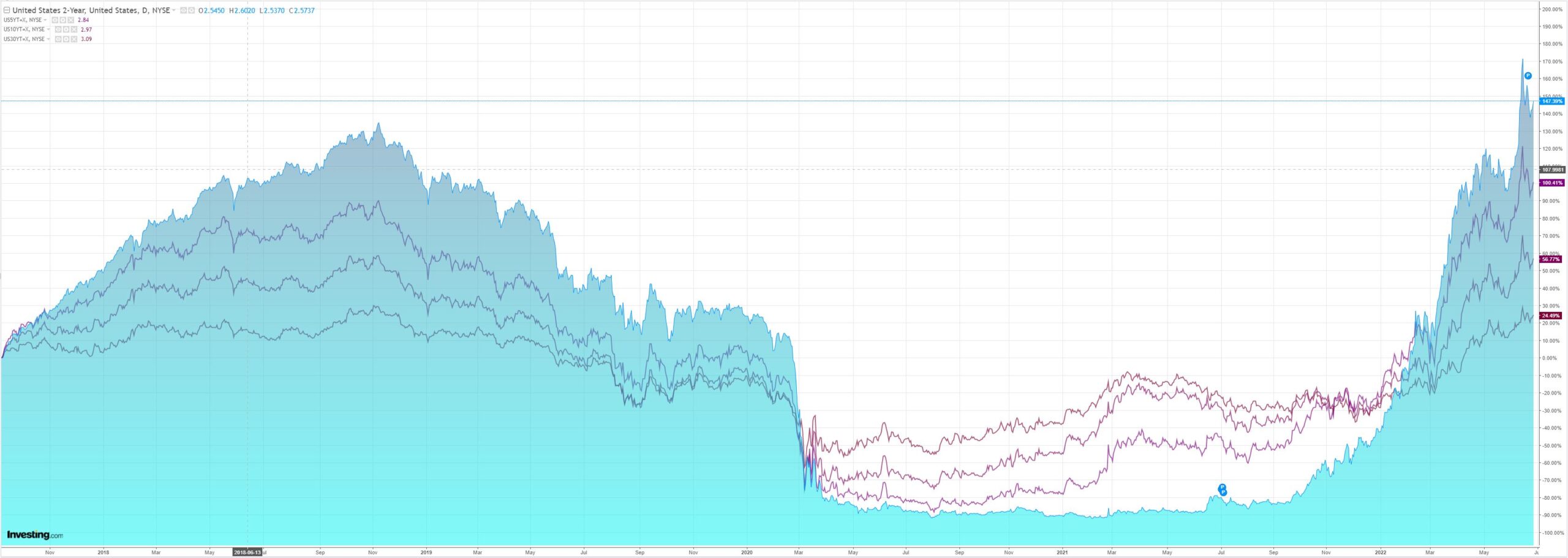

As yields lifted with oil:

And stocks fell:

The problem? Westpac:

Event Wrap

US durable goods orders in May were firmer than expected, rising 0.7%m/m (est. +0.2%m/m), with ex-transport up 0.7%m/m (est. +0.3%m/m), signalling stronger than expected business investment in Q2. Pending home sales in May also surprised to the upside, rising 0.7%m/m (est. -3.9%m/m). The Dallas Fed manufacturing activity survey fell sharply to -17.7 (est. -6.7, prior -7.4) – the lowest level since May 2020, with weakness broad based.

Event Outlook

NZ: Westpac anticipates a modest rise in filled jobs in the May employment indicator – a data series of renewed interest given the RBNZ’s focus on the labour market (Westpac f/c: 0.2%).

US: FHFA’s house prices and the S&P/CS home price index should reflect a slowing in price momentum as rate hikes begin to take effect (market f/c: 1.6% and 1.85% respectively). Inflation worries will continue to weigh on consumer confidence in June (market f/c: 100). Although robust growth in wholesale inventories is anticipated in May (market f/c: 2.2%), supply-side constraints are an ongoing concern in the Richmond Fed index (market f/c: -5). The FOMC’s Daly is also due to speak.

Too much good news to sustain the bear market rally. Monetary policy takes time to impact an economy. So don’t worry, more downside economic data is coming.

The question is, will it support a bid into risk? When the market realises it’s bad enough to be recessionary then no it won’t.

AUD included.