Gold has been on the back foot lately. Since hitting a yearly high of $1,365.40 on April 11, the price of the precious metal has slipped nearly 11%.

The market narrative explaining the sluggish price action was the recent rally in the US dollar and expectations of higher US interest rates. However, gold traders have noticed a new correlation trend that appeared in the market at around the same time prices started tanking: the yuan-gold correlation.

China Policymakers in Play?

Gold's ongoing decline took the precious metal to its lowest level in 19 months, hitting $1,161.40 on August 16. The price has bounced back slightly since then and is currently trading just above the $1,200-level.

As a rule, gold is extremely sensitive to rising US interest rates, since this increases the opportunity cost of holding non-yielding bullion, while boosting the dollar, in which gold is generally denominated. This makes it more expensive for holders of other currencies.

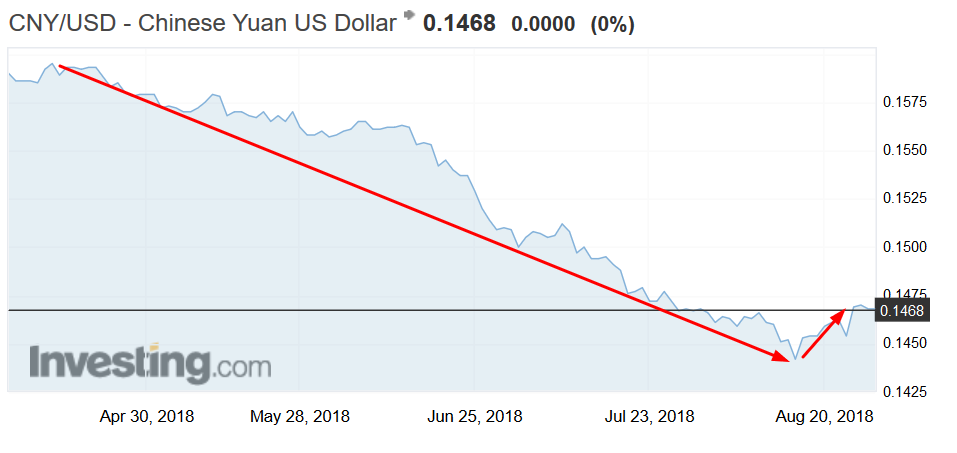

Since the beginning of June, when the People's Bank of China (PBOC) began to actively devalue the yuan versus the dollar, the price of gold traded on the Comex division of the New York Mercantile Exchange has essentially tracked the yuan nearly tick-for-tick. This is clearly visible on the chart below, where both assets are plotted together. The price of Comex gold is shown in candlesticks, while the yuan's movements are represented as a blue line.

To make this correlation even clearer: during the same period beginning in mid-April in which gold fell around 6.5%, China's yuan slid about 6.7%. Mirroring the drop seen in gold, the Chinese currency also slumped to a 19-month low earlier this month on concerns about the impact the trade conflict with the United States would have on its economy.

The ongoing weakness in the yuan has prompted some to wonder whether policymakers in Beijing are allowing their currency to weaken in order to offset the impact of US trade tariffs. The theory making the rounds is that China is actively attempting to lower the dollar price of many commodities, including gold.

Put simply, if the dollar price of these goods can be dropped by roughly the same percentage as the yuan devaluation, the relative cost of the goods in yuan remains unchanged. In addition, by linking the dollar price of gold directly to the yuan, policymakers in Beijing have eliminated a level of foreign exchange risk to their nation's gold portfolio.

In a recent column, David Brady, CEO and co-founder of the site Global Pro Traders, wrote:

"China would be okay with this in the short-term, because it would mean that they can sell dollars and buy gold at cheaper and cheaper prices, especially if they believe the dollar’s days as global reserve currency are coming to an end."

While other factors, such as movements in the dollar, can affect the price of gold on a minute-by-minute basis, the primary driver in the past few months appears to be the yuan-dollar exchange rate. The gold-CNY correlation has prompted traders to wonder just how much further prices might fall if China attempts to continue their yuan devaluation.

That might also help explain the lack of safe-haven bids seen in gold ever since the US-China trade conflict started to worsen a few months back.