DXYfirmed again Friday night supported by the energy crisis. EUR was soft:

Australian dollar was universally weak:

Oil broke out. Very bad news for the world. Gold is stalled:

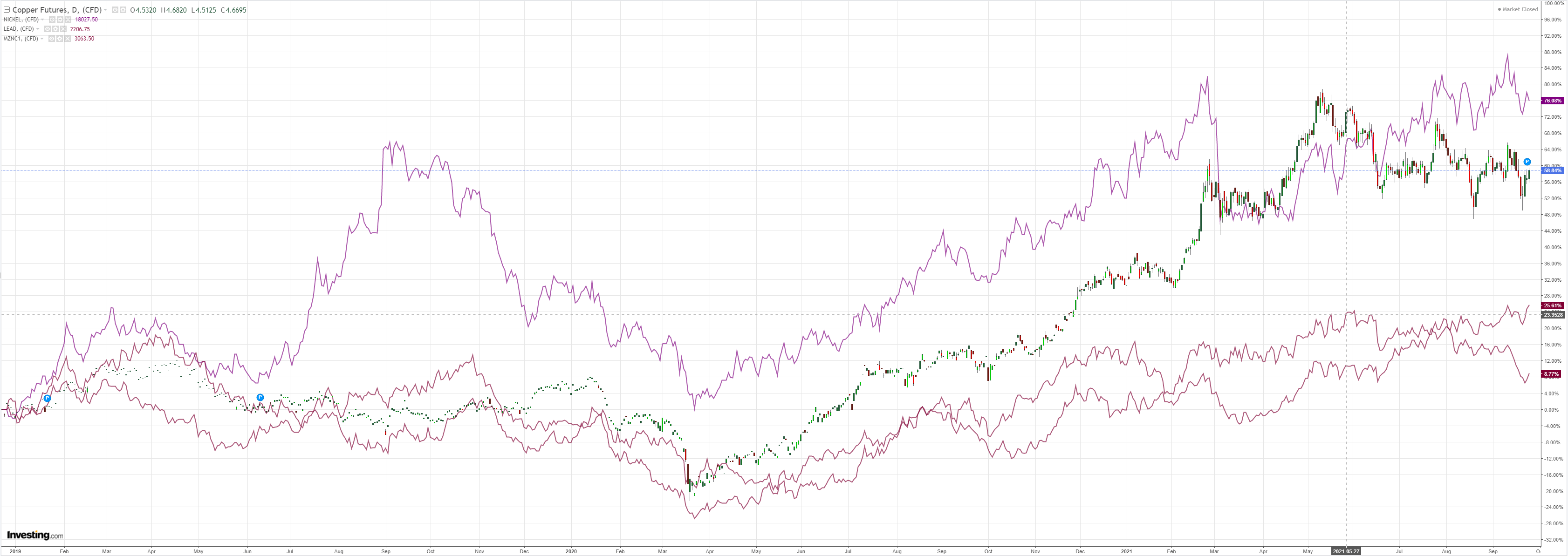

Base metals were mixed:

EM stocks faded:

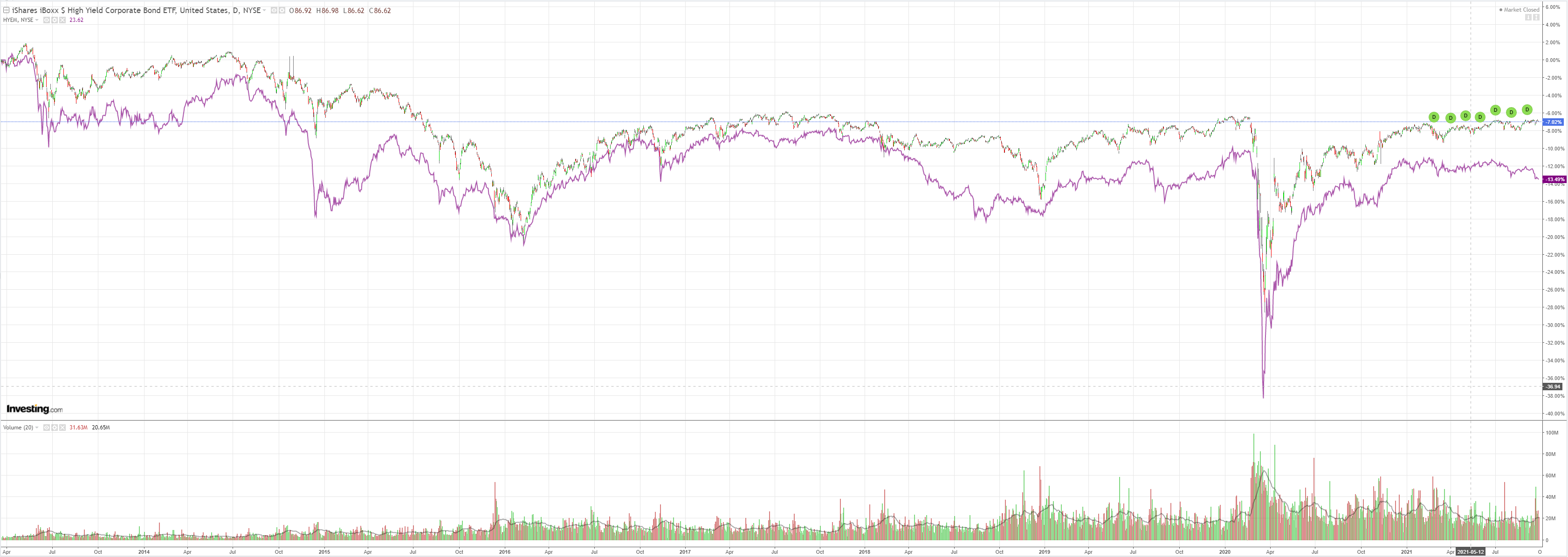

The junk siren is still going off:

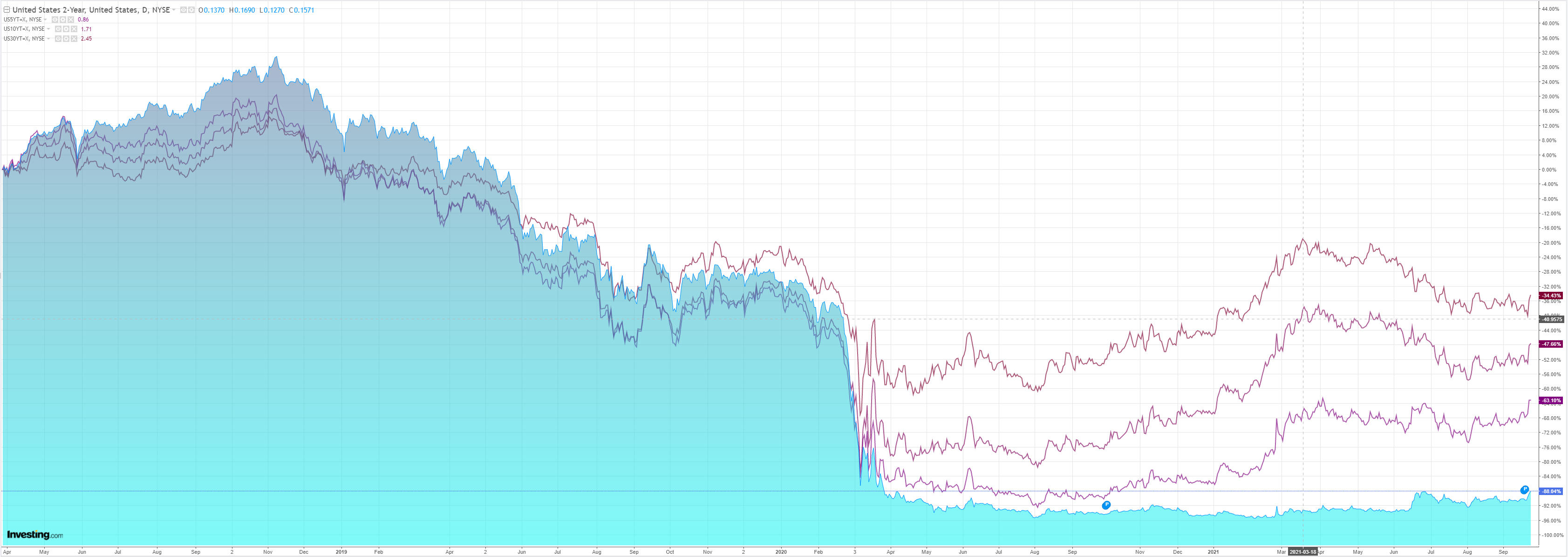

But US yields backed up anayway:

Stocks paused:

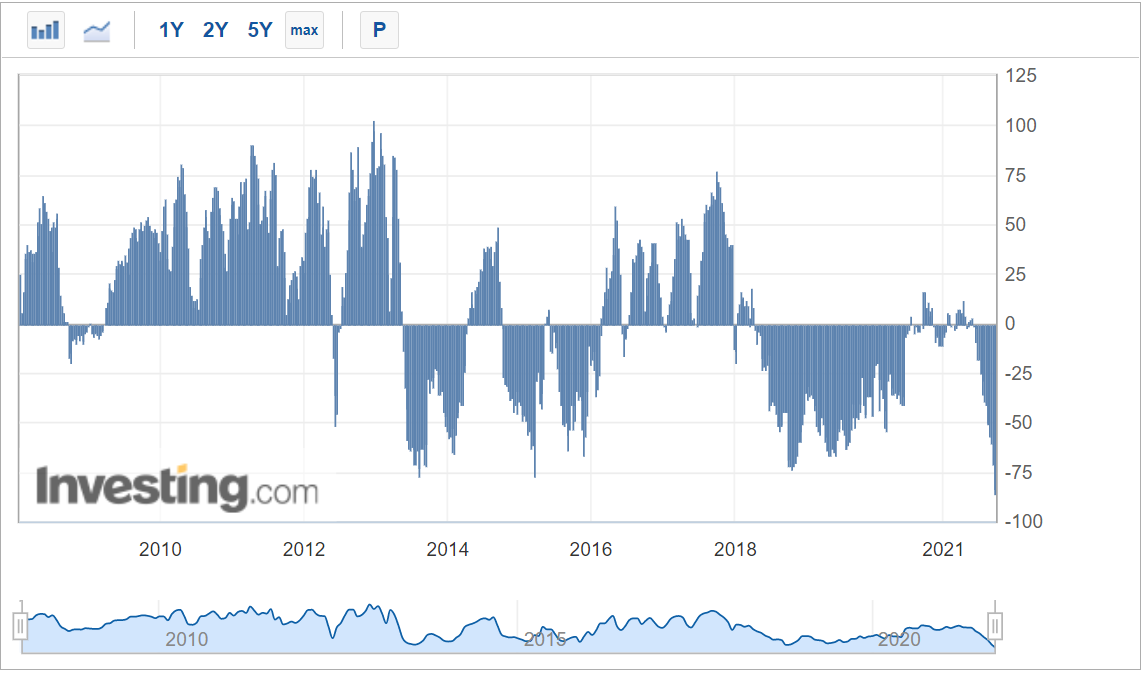

CFTC market positioning hit another AUD record short:

A note from Goldman agrees:

USD: Look for stability if risks from China growth are contained. At Wednesday’s FOMC meeting Chair Powell indicated that the committee would like to wrap up its QE tapering process “around the middle of next year”. This was earlier than consensus expectations beforehand, although clearly a risk scenario following press reporting before the blackout period. An earlier end date for QE implies an earlier potential start date for rate hikes, and markets priced additional risk premia into front-end rates on the news. While the latest FOMC meeting represented another hawkish surprise, from this point forward the US monetary policy outlook should depend more on incoming growth and inflation data, rather than policymaker communication about the balance sheet. This should allow the Dollar to stabilize over the near-term, and potentially weaken against pro-cyclical crosses, given the improving medical situation globally. Moreover, slowing US growth and lower inflation should eventually help price out Fed rate hikes, resulting in broad Dollar weakness over the medium-term. However, in the weeks immediately ahead, risks from the property sector in China may continue to cloud the cyclical outlook. While contagion through the country’s financial system seems unlikely, our economists estimate that property sector weakness could weigh on domestic growth and commodity demand. Our modelling typically finds that AUD, NZD, EUR/JPY, CAD, and KRW are the most sensitive to shifts in China growth expectations(relative to their volatility); CLP and ZAR may also be exposed through the effect on commodity prices. Because weakness in China’s construction/real estate sector results from policy tightening, government actions should be able to limit contagion to the broader economy. But we are holding off on any new FX trade recommendations until we have more clarity on policymakers’ reaction function.

AUD/NZD: Domestic and external factors point to further downside. Recent comments from RBNZ Assistant Governor Hawkesby, one of the more hawkish members of the MPC, signaled “small, considered steps” in removing stimulus, leading markets to price out odds of greater than 25bp hike increments at the next few meetings. That said, if the labor market continues to tighten and vaccine roll-out progresses as expected, the market could once again start pricing in some probability of a faster pace of RBNZ hikes after lift-off. Thus, we continue to expect further monetary policy divergence relative to the RBA, with Governor Lowe’s latest comments reiterating that rate hikes remain a long way off. The external picture also points to further downside for the cross as growing concerns around China’sproperty sector slowdown may start to weigh on copper and iron ore prices, both of which would represent the biggest headwinds to AUD in G10 FX. We continue to expect AUD/NZD to trade down towards parity over the next 6 months.