In this article, we will take a look at the stock market and the gold market and draw a comparison. We do not want to take sides too quickly, but instead look at the figures objectively and answer the question of whether gold is a better investment than shares and whether it makes sense to hedge assets with gold.

First of all, we have to look back to the past to understand the current situation. An important milestone was the introduction of the Bretton Woods system after the end of the Second World War.

Bretton Woods system

The Bretton Woods system was introduced in 1944 to promote economic stability after the Second World War and to reorganise international financial relations. The core of the system was the pegging of the currencies of the participating countries to the dollar. The dollar was firmly linked to the price of gold, which was set at 35 dollars per troy ounce.

The reasons for its introduction can be summarised as follows:

Avoiding economic instability:

In the 1930s, the world economy experienced the Great Depression, which was exacerbated by uncoordinated monetary policies and protectionist measures. In order to avoid such extreme economic fluctuations and crises in the future, the aim was to create a stable and coordinated monetary system.

Promoting world trade:

A key objective of the Bretton Woods system was to facilitate international trade. By introducing fixed exchange rates between the major currencies, it was hoped to create a stable basis for global trade, as companies and countries would no longer have to worry about sudden exchange rate fluctuations.

Preventing currency devaluations:

In the 1930s, many countries introduced so-called "beggar-thy-neighbour" policies, in which they devalued their currencies to make their exports more competitive. These devaluation races exacerbated the global economic crisis. The Bretton Woods system was intended to prevent such devaluation competitions through fixed exchange rates.

Creation of institutions for economic cooperation:

Bretton Woods led to the establishment of the International Monetary Fund (IMF) and the World Bank. The IMF was to monitor international currency stability and provide short-term financial assistance to countries in payment difficulties, while the World Bank was to promote reconstruction and development.

US dollar as anchor currency:

The system established the US dollar as the world's central currency, which was linked to gold (35 US dollars per ounce of gold). Other currencies were pegged to the dollar. This allowed the US to play a leading role in the global financial system while also creating a stable currency environment.

The end of the Bretton Woods system

The Bretton Woods system was abandoned in 1971 because it was coming under increasing pressure and no longer worked in line with changing global economic realities. The main reasons for the end of the system are:

Growing economic imbalances:

In the years following the Second World War, the US experienced enormous economic growth, which, however, began to falter in the 1960s. At the same time, the economies in Europe and Japan were growing rapidly. These changes led to imbalances in international trade: the US had large trade deficits, while countries such as Germany and Japan had trade surpluses. These imbalances put increasing pressure on the system of fixed exchange rates.

Dollar dependence and loss of confidence:

Since the US dollar was tied to gold and other currencies were linked to the dollar, the system was heavily dependent on the stability of the dollar. However, in the 1960s, confidence in the dollar began to erode because the US was no longer able to sufficiently cover its currency reserves with gold. The USA found itself in a difficult financial situation due to the increasing money supply and high government spending, including on the Vietnam War and social programmes. More and more countries began to doubt that the USA would be able to exchange the dollar for gold, which led to a flight from the dollar and an accumulation of gold claims.

Speculation and capital flows:

As confidence in the system waned, countries and investors began to speculate against the dollar, further destabilising the fixed exchange rate system. Capital flows became more unpredictable, making it harder for countries to keep their currencies stable.

Inflexibility of the system:

The Bretton Woods system was based on fixed exchange rates that could only be adjusted in exceptional circumstances. This proved increasingly impractical in a world economy that was becoming more dynamic and globalised. The fixed exchange rates led to economic tensions, as they made it more difficult for countries to react to economic changes.

The US decision to abandon the gold standard:

On 15 August 1971, President Richard Nixon announced that the US would suspend the convertibility of the dollar into gold. This move, known as the "Nixon shock", effectively ended the Bretton Woods system. Without the gold peg, exchange rates could no longer be kept stable and the fixed exchange rate system collapsed.

Transition to floating exchange rates:

After the end of Bretton Woods, the world's currencies gradually evolved into a system of floating exchange rates, in which currency values are determined by supply and demand in the foreign exchange markets. This gave countries more flexibility in monetary policy and allowed them to respond better to economic fluctuations.

The impact on the stock market and the price of gold

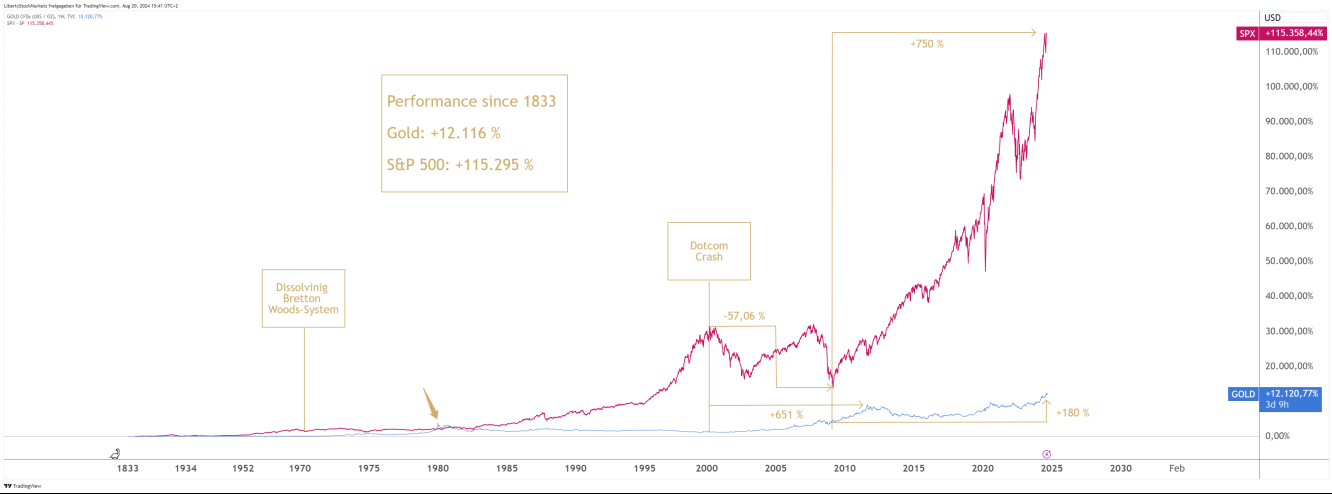

After the system was abandoned, the S&P 500 initially faced a volatile environment. The 1970s were characterised by weak economic growth and high inflation, which was reflected in a sideways movement in the stock market. Between 1971 and 1981, the S&P 500 generated a relatively modest return as the markets struggled with the new economic uncertainties and the effects of the oil crises of 1973 and 1979.

The abolition of the Bretton Woods system decoupled the dollar from the fixed gold price and also left the gold price to the free forces of the market. This initially led to a sharp rise in the price of gold until the early 1980s. During this period, gold was clearly a better investment than the stock market.

The gold price also significantly outperformed the stock market in the period between 2000 and 2009, which is known as the bursting of the dotcom bubble and the financial crisis caused by the collapse of Lehman Brothers Bank in the USA. From 2000 to 2009, the price of gold rose by a whopping +651%, while the S&P 500 fell by over 57%.

However, from 2009 to the present day, the S&P 500 has risen by a strong 750%, while gold has only managed a meagre 180% over the same period. If we look at the two price curves from 1833 to the present day, we have to conclude that the stock market is the clear winner. The S&P 500 has increased by a brutal 115,295% since 1833, while gold has "only" increased by 12,116%. The S&P 500 has therefore beaten gold by over 100,000% in the long term.

We cannot therefore say that gold is a good way of protecting assets, because in the long term, gold investors are the clear losers compared to equity investors. However, in periods of stock market crashes, gold can be a good alternative. But to do this, you have to know exactly when to make a switch.

However, we favour a completely different approach. We still see the best opportunity for building up assets in rising equity markets. In falling markets, we take profits and hedge our positions with short positions. This is clearly the easier and more lucrative approach.

We do not see gold as a hedge for assets, but in the worst case as a life insurance policy. Because if gold is the only lifeline to secure food and other goods for daily use, we will certainly have more serious problems than asset protection. And that is precisely why we believe that only 5% to a maximum of 10% of total assets should be held in the form of physical gold. Of course, this does not apply to cultures in which gold has a completely different, and above all traditional and idealistic, value. We cannot and must not judge that.

We are currently experiencing an interesting development: both markets are rising in parallel. This could be a harbinger of the stock market heading for a very significant high and then entering a very strong correction phase. And what happens if the stock market crashes and the price of gold also falls? This has not yet happened in this form, but it is not impossible. Who knows, maybe the oil market will be the better safe haven?

Is the stock market dying of overheating, or are the crash prophets once again looking in the wrong direction? This question is particularly important at the moment, because anyone who gives up their good stock positions too early could soon regret this decision. Trading is always about perfect timing.

Hundreds of investors read our analyses every day, follow our recommendations and thereby steadily increase their assets. Become part of our rapidly growing community. We don't just talk, we act. You can join us by clicking on the link next to my profile picture above this text.

Disclaimer/Risk warning:

The information provided here is for informational purposes only and does not constitute a recommendation to buy or sell. It should not be understood as an explicit or implicit assurance of a particular price development of the financial instruments mentioned or as a call to action. The purchase of securities involves risks that may lead to the total loss of the capital invested. The information provided does not replace expert investment advice tailored to individual needs. No liability or guarantee is assumed, either explicitly or implicitly, for the timeliness, accuracy, appropriateness or completeness of the information provided, nor for any financial losses. These are expressly not financial analyses, but journalistic texts. Readers who make investment decisions or carry out transactions based on the information provided here do so entirely at their own risk. The authors may hold securities of the companies/securities/shares discussed at the time of publication and therefore a conflict of interest may exist.

- English (USA)

- English (UK)

- English (India)

- English (Canada)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Gold vs. shares – both are rising. Who will come out on top?

Published 21/08/2024, 12:21 am

Gold vs. shares – both are rising. Who will come out on top?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.