Good afternoon, traders; welcome to our market week preview, where we take a look at the economic data, market news and headlines likely to have the biggest impact on the price of gold this week and beyond, as well as other key correlated assets.

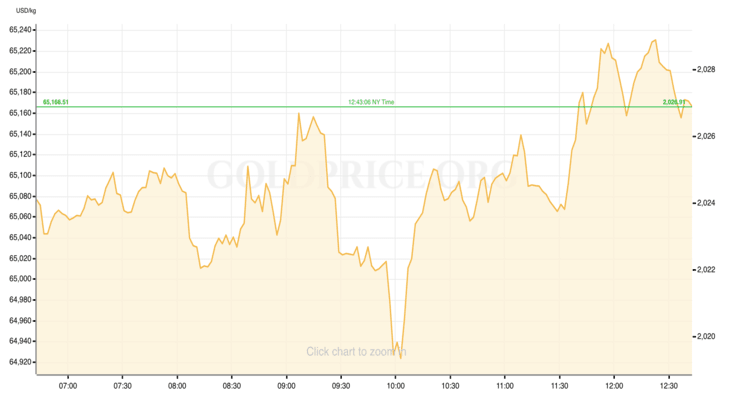

Spot prices for gold are kicking-off the week with the front foot, gaining $5-10/oz on Monday morning. The precious metal, alongside other Dollar-denominated commodities, are taking advantage of some softening in the US currency as markets prepare for a key inflation update mid-week.

Similar to last week, the major US stock indexes are trading slightly softer and lower on Monday, suggesting less conviction in the minds of equity investors about what the CPI report will deliver and what it will suggest for the near- and medium-term for individual names, now that the momentum of earnings season as abated.

US Economic Data to Watch

Wednesday, May 10 at 8:30 am EDT // Consumer Price Index (Apr)

[(core CPI) consensus est.: +5.5% YoY // prev. +5.6%]

[(headline CPI) consensus est.: +5.0% YoY // prev.: +5.0%]

The consensus projections for this week’s CPI update are set for April’s price pressures to remain mostly on pace with the month prior. A positive sign that inflation isn’t rebounding, but not quite a strong argument for there being enough downward pressure to lock in a June pause from the FOMC. In Monday’s marketplace, it looks like investors are positioning for inflation data that does support the case for no-hike at the next meeting, so whether that momentum (a positive to gold prices, and also for the US stock market in general) will continue or suffer a claw-back may come down to how the second- or third-level details are interpreted. The best case for gold and equity market upside is the expectation that core CPI, on an annualized basis, is expected to decline marginally. The downside case will be if markets overreact to a similarly small uptick that is expected month-over-month in the more volatile “headline” CPI number.

FedSpeak this Week

Now that the FOMC has “officially” opened the door to take a break from hiking interest rates in June, virtually every public comment from key Fed officials will have focused pulled to whether or not individual voters are leaning towards a halt. Accordingly, markets could be sensitive to that signal from any one appearance, with a mark in the “pause” column offering a tailwind to gold, bond prices, stock, etc., with a softer US Dollar.

Monday: Minneapolis Fed President Neel Kashkari (FOMC voter) (445p)

Tuesday: Fed Governor Phillip Jefferson (FOMC voter) (845a); New York Fed President John Williams (FOMC voter) (12p)

Thursday: Fed Governor Christopher Waller (1015a)

Friday: St Louis Fed President James Bullard (745p)

And that’s how the week lays out ahead of us, traders. As always, I wish you all the very best of luck in your markets in the coming days, and I’ll look forward to seeing you all back here next week.