Happy Monday, traders; welcome to our market week preview, where we look at the economic data, market news, and headlines likely to have the biggest impact on the price of gold this week and beyond, as well as other key correlated assets.

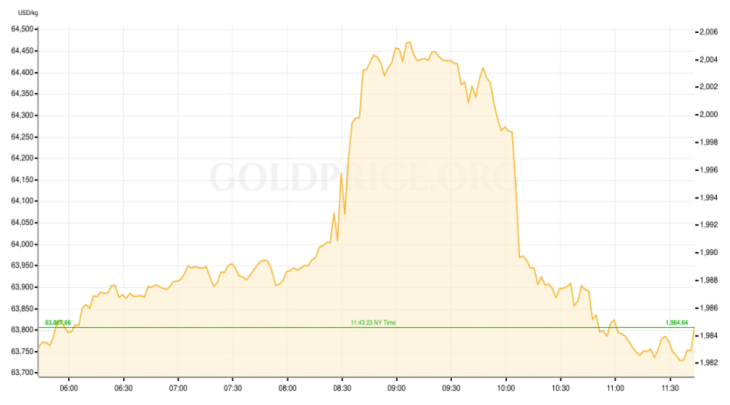

After some up-and-down from the key resistance range of $2000/oz, gold prices are roughly in-line with last week’s closing bids, consolidating a still strong position ahead of a big week of macroeconomic news and data to trade.

Even within a relatively wide band of $20/oz, the gold market was calmer over the last five trading sessions than in most weeks since the implosion of Silicon Valley Bank. Headline activity has been mostly light, as has the flow of high-value macroeconomic data, leaving investors with a long-range runway to prepare for this week’s FOMC meeting, the ending of another round of “what happens next?” and the beginning of the next. Now, just a few days from the Fed’s announcement, gold is again in a bit of a pause while digesting the news of JPMorgan’s “acquisition” of a distressed First Republic Bank. As investors try to find their bearings and place their FOMC and Jobs Report bets, we’re seeing similar indecisiveness in equity markets, where the major US indexes are mixed to start the week.

US Economic Data to Watch

Wednesday, May 3 at 2 pm EDT // FOMC Interest Rate Decision

[The FOMC is expected to announce a rate hike of +0.25%]

The broad expectation that the FOMC will hike, at the very least, by +0.25% again on Wednesday has kept a lid on the gold price and, as we expected, proved to be a limiter on any momentum rallies for the yellow metal. There has remained a hard cap at the key psychological level of $2000/oz, and whether or not investors find a reason to expect the Fed will hint at a near-term timeline for pausing the hiking cycle and (maybe) moving towards the relief of cuts. There is a growing number of desks and analysts projecting that Powell & Co. on Wednesday will, in fact, raise the possibility of a pause in June. Most of these calls, however, include a hedge that the committee will somehow do so while remaining mostly hawkish, so a clear piece of forward guidance to expect a pause is likely not priced-in to gold, Dollar, or equity markets at this point. Should Fed Day turn out to be that Dovish, we would expect a strong, possibly prolonged spike in volatility in those markets (a positive note for gold and equities, while the Dollar would shrink) as positions get caught offside.

Friday, May 5 at 8:30 am EDT // April Jobs Report

[(NFP) consensus est.: +180K // prev.: +236K]

[(Unemployment Rate) consensus est.: 3.6% // prev.: 3.5%]

After the monthly Non-Farm Payroll number wildly outperformed expectations for most of the last 14-18 months, economists and analysts are back to tuning down their projections for the most scrutinized metric of the US labor market (the relative strength of which remains the keystone of the Fed’s argument to continue over-tightening the US economy as a tradeoff to quell inflation pressure.) This brings us back to the same two most-likely market reactions that became rote last summer and fall: If NFP comes in close to expectations, we could see some volatility in our markets around the print— mostly to gold’s benefit— while another healthy upside surprise (which there is definitely room for now, with the consensus bet held below 200K) would be another boon for the US Dollar to the detriment of prices for just about every other major market asset.

And that’s how the week lays out ahead of us, traders. As always, I wish you all the very best of luck in your markets in the coming days, and I’ll look forward to seeing you all back here next week.