Gold is facing a tough week as prices near 2009 levels, but what lays ahead for the previous metal given the pending US NFP result and an eternally bullish US dollar.

Gold continued to slide lower last week as the market sentiment swung strongly towards the US dollar. The move was also fuelled by a strong US unemployment claims result at 260k, which saw the metal closing the week down near the 6 year low at $1057.07. The coming week will be a volatile one for gold as the much watched US nonfarm payroll figures fall due and will be watched closely for any signs of strength.

Gold remained strongly under pressure over the past week as the market looks for hints as to the Fed’s direction in the December FOMC meeting. Subsequently gold continued to slide throughout the week which culminated in some sharp falls in Friday which saw the metal trading around the 6-year low at $1057.07. The move was primarily a sentiment swing towards the US dollar but was also assisted by a stronger than expected unemployment claims result at 260k.

Looking ahead, gold is likely to have an exceedingly volatile week as the US nonfarm payroll figures fall due. The market will be looking for a strong result to support the Fed’s case for a rate hike in December. Also, keep a close watch on Janet Yellen’s speech, due on Wednesday, for any statements that could be seen as hawkish.

Adding to the current bearish view is the fact that some market pundits are now suggesting that deflation could be a very real downside risk for the metal. This is exceedingly prescient given that last week saw a supposed `leak’ from the ECB that suggested that the Eurozone was facing deflation. However, given the excessive amount of quantitative easing that has occurred worldwide, deflation might end up being the least of gold’s worries.

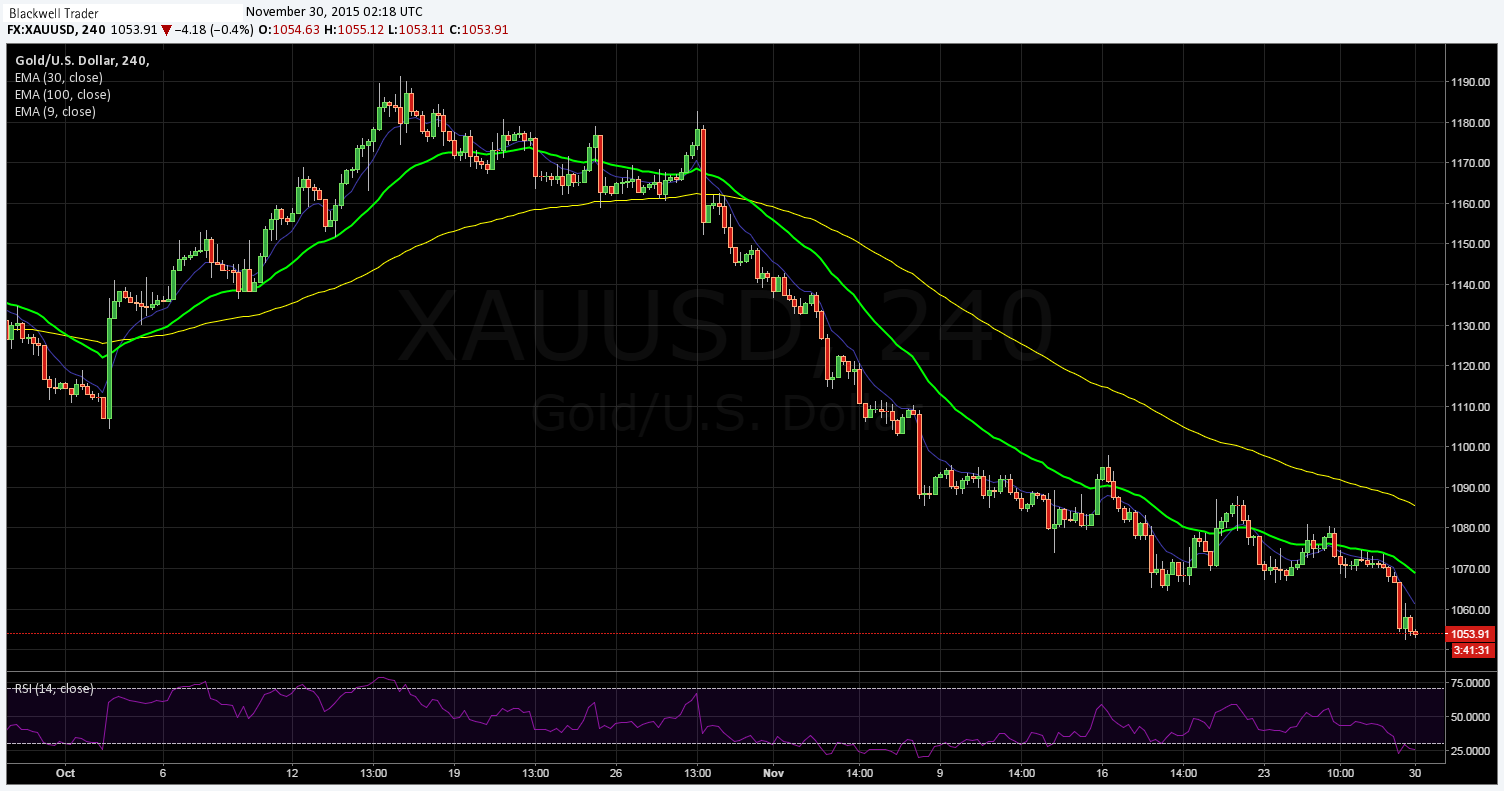

From a technical perspective, gold is in a rout and retains a highly bearish position below the 100-day moving average. The 12 and 30 EMA’s have also retained their bearishness, however, the RSI oscillator currently rests within over-sold territory. Given the recent strong falls, our bias remains to the short side ahead of the US NFP decision. Support is currently in place for the pair at $1048.36, $1025.19, and $989.55. Resistance exists on the upside at $1191.38, $1233.71, and $1306.78.

Overall, the upcoming week is likely to be critical for the metal and it’s near term viability. A strong US NFP result could further ignite speculation of a Fed rate hike in December and that could certainly provide plenty of doom and gloom for gold bugs.