This past week, Gold prices closed at the lowest level since early 2010

Precious metals, together with Gold, continue their bear market downtrend. Another month, yet another low.

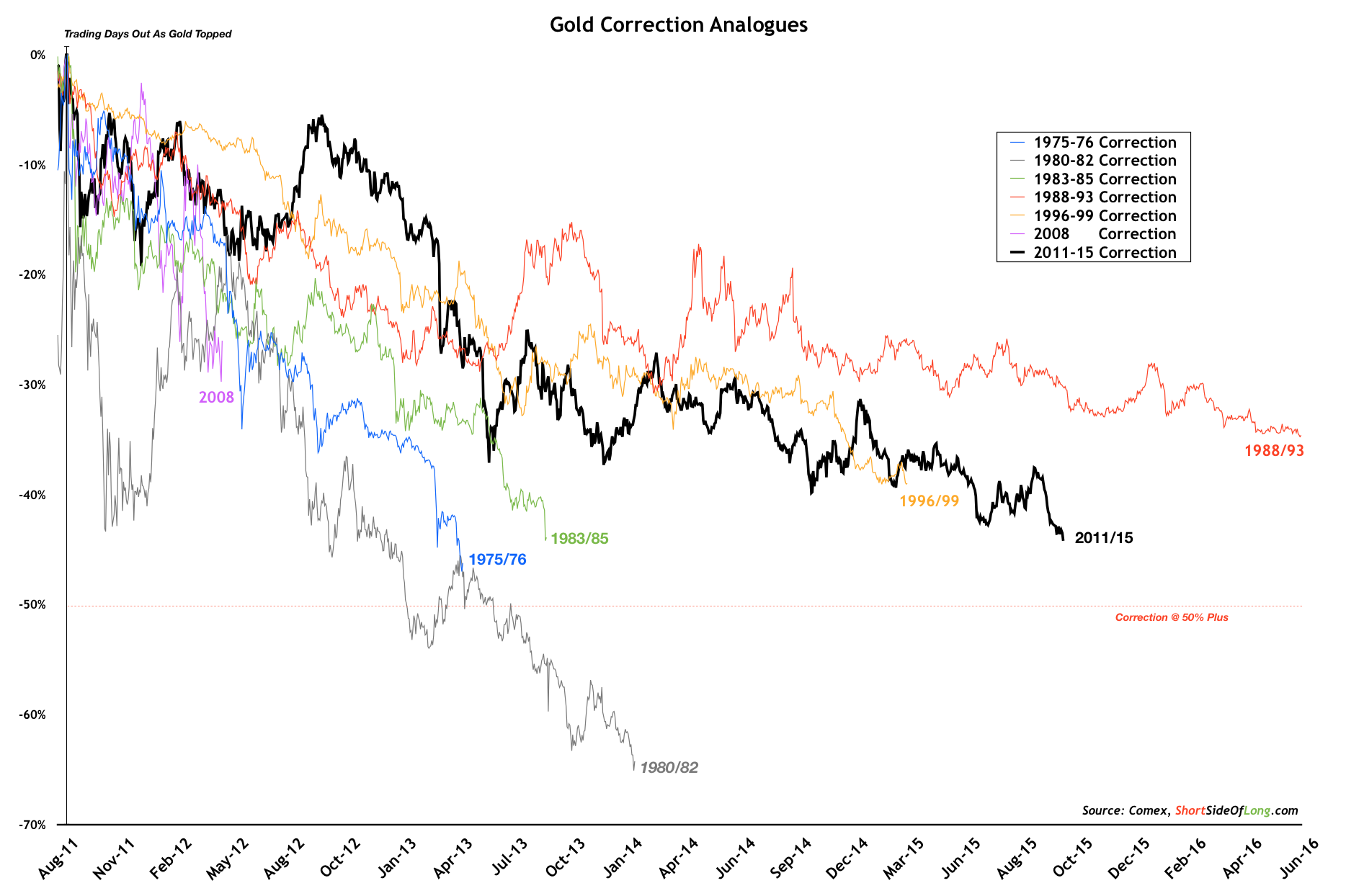

Silver, Platinum and Gold Mining companies aren’t too far behind. For now, Gold still manages to trade above the $1,000 per ounce physiologically important level, but the buffer is only about $57 before the 9 handle approaches. The current bear market is now almost 4 and half years old (222 trading weeks), and has declined by almost 45% on the closing basis.

There is only one other Gold bear market that has gone on for longer, and that happens to be 1988 to 1993. However, losses were nowhere as dramatic as they are today. Finally, as the chart clearly shows, there has only been one bear market since 1969 that saw the price of Gold decline by 50% or more. Are we in for a repeat?