US traders are eagerly counting down the hours until the much-awaited Thanksgiving holiday, but our readers should is still a busy economic calendar between now and Wednesday afternoon, as well as a couple of noteworthy economic releases on Thursday and Friday.

Key economic data remaining this week (all times GMT):

- Today: BOJ monetary policy meeting minutes (11:50 GMT)

- Wednesday: AU construction work done (0:30), Speech by RBA Assistant Governor Debelle (10:20), UK Autumn forecast statement (12:30), US durable goods, unemployment claims, core PCE, personal income and personal spending (13:30), US new home sales (15:00), NZ trade balance (21:45)

- Thursday: AU private capital expenditures (0:30), JP household spending and Tokyo CPI (23:30)

- Friday: UK Q3 GDP second estimate (9:30)

Beyond tomorrow morning’s onslaught of US economic data, the other areas of note over the rest of the week will be the UK and Australia, so we wanted to take a look at the GBP/AUD cross.

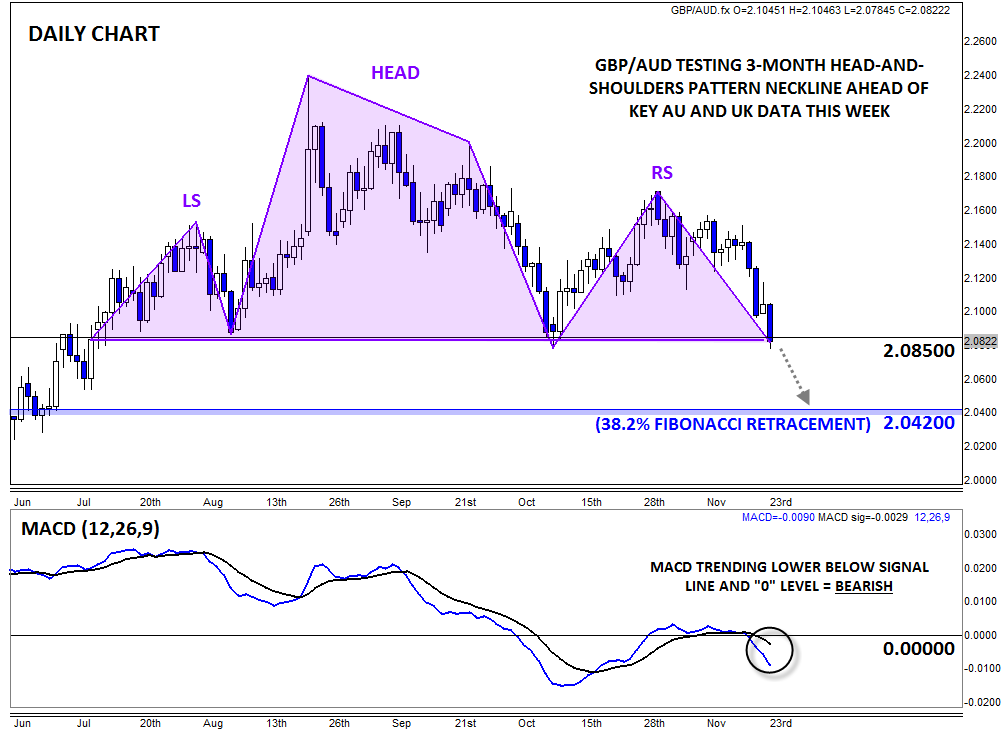

On a technical basis, GBP/AUD has carved out a potential head-and-shoulders pattern over the last four months. For the uninitiated, this classic price action pattern shows a shift from an uptrend (higher highs and higher lows) to a downtrend (lower lows and lower highs) and is typically seen at major tops in the chart.

The head-and-shoulders pattern would only be confirmed by a break below the neckline, which in this case comes at 2.0850, conveniently close to the current market price. Therefore, the price action over the rest of the week may set the tone for what to expect from GBP/AUD over the rest of the year.

If we see a confirmed break below 2.0850 support (which the downward trending MACD suggests), GBP/AUD could well fall to the 38.2% Fibonacci retracement of the entire September 2014-August 2015 rally at 2.0420 next. In fact, the measured move objective of the head-and-shoulders pattern would be well below the 2.00 handle. That said, if buyers are able to step in to defend the 2.0850 level, a bounce toward the 2.12-14 zone would be more likely.