- Disruptive innovation creates a product or service that transforms markets and industries or substantially improves something that already existed.

- Cathie Wood is one of its leading exponents by bringing to market several ETFs that are very popular.

- The stocks we will look at are Lilium, Origin Materials, and Aeva Technologies.

- Looking for actionable trade ideas to navigate the current market volatility? Unlock access to InvestingPro’s AI-selected stock winners for under $9 a month!

Disruptive innovation reshapes industries by using cutting-edge technology to overhaul existing markets or create entirely new ones. As a result, it alters market dynamics and industry structures, typically involving a high level of risk and the exploration of new technologies.

Cathie Wood stands out as a leading figure in this area, primarily through her series of ETFs known as the ARKs, which focus on investing in disruptive companies. These ETFs have gained immense popularity, with some boasting impressive returns during certain periods.

They are as follows:

- ETF ARK Innovation (NYSE:ARKK)

- ETF Genomic Revolution (NYSE:ARKG)

- ETF Fintech Innovation (NYSE:ARKF)

- ETF Next Generation Internet (NYSE:ARKW)

- ETF Autonomous Technology & Robotics (NYSE:ARKQ)

These ETFs have even extended their reach to Europe and are listed on prominent exchanges, including Germany's Deutsche Bӧrse Xetra, the London Stock Exchange, Amsterdam's CBOE, Italy's Borsa, and Switzerland's SIX Swiss Exchange, with a commission rate of 0.75%.

Some notable disruptive companies include Tesla (NASDAQ:TSLA), Nvidia (NASDAQ:NVDA), Roku (NASDAQ:ROKU), Baidu (NASDAQ:BIDU), Zillow (NASDAQ:ZG), Teladoc Health (NYSE:TDOC), et cetera.

Now, let's dive into a few disruptive stocks that offer significant upside potential in the market, albeit with considerable risk. It is a sector suitable only for aggressive investors with a well-diversified portfolio.

1. Lilium

Lilium (NASDAQ:LILM) is a German aerospace company listed on Nasdaq that develops the Lilium Jet, an electric-powered aerial vehicle capable of flight.

The company is revolutionizing the urban mobility sector with its concept of electric air cabs by offering fast, zero-emission transportation while helping cities stay free from congestion.

It recently raised $114 million to support its operations and initial flight tests. It has also completed the first phase of integration testing for the Lilium Jet's electric power system—a crucial step toward flight condition approval.

With more cash than debt on its balance sheet, Lilium enjoys financial flexibility as it works to certify its product. This cash position could be crucial, given the capital-intensive nature of the aerospace industry and the ongoing development phase.

Lilium will report its results for the quarter on November 19.

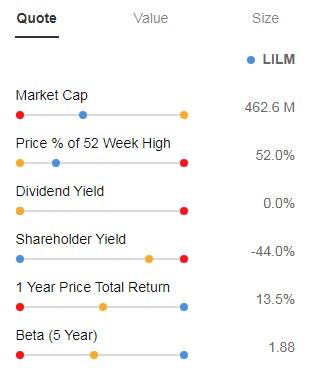

Its Beta of 1.88 reflects its shares moving in the same direction as the market but with considerably more volatility.

Source: InvestingPro

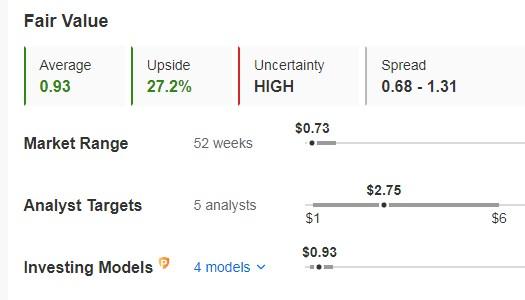

Lilium's shares are undervalued on a fundamental basis. Specifically, its fair value is, at the beginning of the week, 27.2% above the share price, exactly at $0.93.

The market estimates an average potential of around $2.75 for these shares.

Source: InvestingPro

2. Origin Materials

Origin Materials (NASDAQ:ORGN) aims to facilitate the global shift toward sustainable materials by replacing petroleum-based materials with decarbonized alternatives. The company is committed to reducing carbon emissions and producing materials with lower environmental impact.

A year after it announced its breakthrough in developing a process for 100% recyclable plastic bottle components, the company has secured a Memorandum of Understanding (MOU) for two years of production and expects this agreement to generate $100 million in revenue starting in early 2025.

The company's CEO, Rich Riley, demonstrated his confidence in the company's potential by purchasing an additional 300,000 shares.

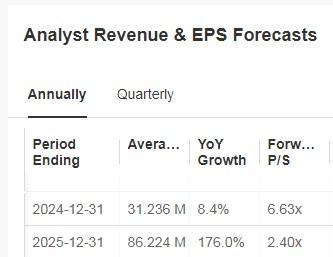

On November 7, it presents its quarterly accounts. Earnings are expected to increase by 8.4% this year and 176% by 2025.

Source: InvestingPro

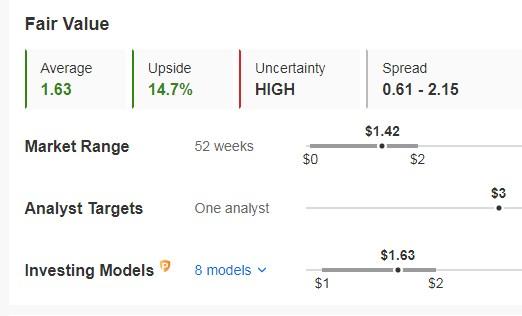

Origin's shares are fundamentally undervalued, with a fair value 15% above the current share price of $1.63 at the week's start.

The market estimates an average potential of around $3 for its shares.

Source: InvestingPro

3. Aeva Technologies

Aeva Technologies (NYSE:AEVA) is a US-based company that designs, manufactures, and sells LiDAR sensing systems and sensing software solutions.

The company offers solutions that are more efficient and cost-effective than alternatives, which can facilitate mass adoption, positioning itself to drive disruptive change.

Aeva recently announced that its technology will be utilized by a major European automaker to validate its automated vehicle systems. It expects its technology to enable quick differentiation between static and dynamic objects, like pedestrians or vehicles. Furthermore, its technology has been selected by a leading U.S. national defense security organization and for Germany's automated train program.

Source: InvestingPro

It will release its earnings report for the quarter on November 7. The company maintained a solid cash position, with a total of $285.2 million at the end of the quarter.

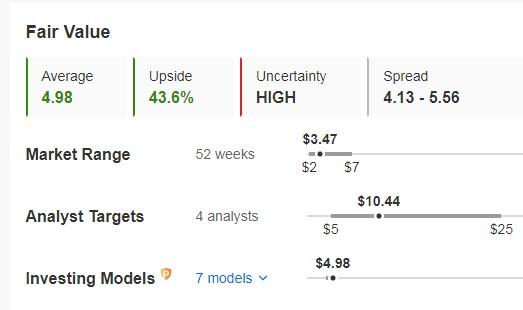

Its shares are trading 43.6% (at the beginning of the week) below its fair value or price to fundamentals, which would be at $4.98.

The potential assigned by the market would be at $10.44.

Source: InvestingPro

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.