Forget Conventional Economics, You’re a Trader Now:

I don’t want to rain on anyone’s parade, but tomorrow’s FOMC meeting is most probably going to be the least volatile, biggest non-event of all time. I mean lets be honest, markets and traders have been speaking about, and planning for this Christmas present for what, 5 years now?

Futures contracts have priced in a whopping 78% likelihood that Yellen and friends in the Federal Reserve will raise their short term interest rate from near zero levels to 0.25%, while also pricing in a further 2 during 2016 to take the Fed Funds Effective Rate to 0.75 this time next year.

History of course is on the side of the contrarian, with past data suggesting that after the first rate hike in each of the last 3 cycles, the US dollar has actually fallen rather than rallied like the text books will tell you. With all this relying on an overly dovish tone in the accompanying statement, are traders who follow the herd setting themselves up for a rude shock?

Remember it’s all about trader expectations and whether the fact matches what’s already been priced in, rather than the news itself. If you’re trading around the decision, this needs to be at the forefront of your mind.

Aussie Expectations:

On a side note for traders of the Australian Dollar, Reserve Bank of Australia Governor Glenn Stevens gave his regular year-end interview with The AFR which was published this morning.

It’s well worth a listen and a read if you’re interested, but all answers are fairly high level and obviously meticulously scripted to minimise market impact.

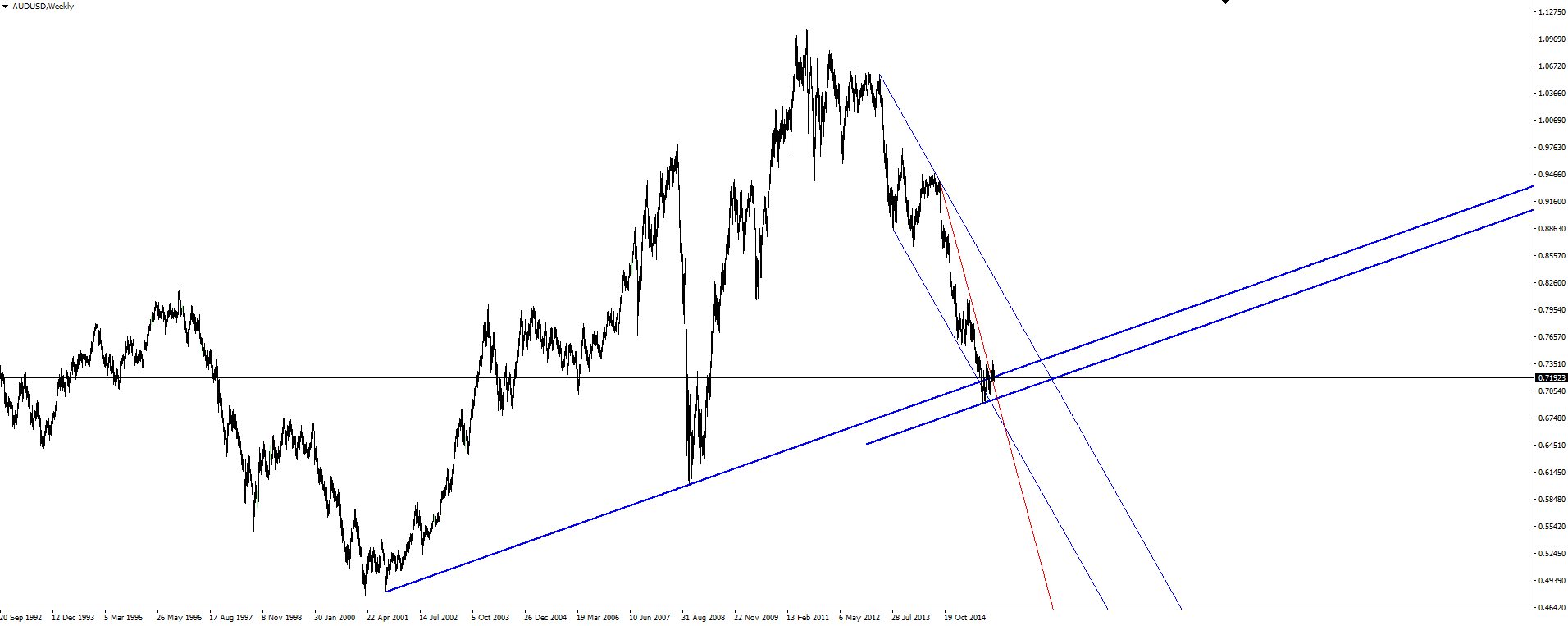

AUD/USD Weekly:

Click on chart to see a larger view.

Be sure to check out our interactive AUD/USD Weekly TradingView chart featuring the key weekly levels embedded on the page here. Remember you can make the chart display full screen as well as ‘make it your own’ where you can scroll through different time-frames and play with lines of your own.

Stay safe out there.

On the Calendar Wednesday:

EUR French Flash Manufacturing PMI

EUR German Flash Manufacturing PMI

GBP Average Earnings Index 3m/y

GBP Claimant Count Change

USD Building Permits

USD FOMC Economic Projections

USD FOMC Statement

USD Federal Funds Rate

USD FOMC Press Conference

Note: I get the odd question about the days of the week I print here and why they don’t match up with their own calendar. As I write this morning report during the Asian Session morning in Sydney, I try to make the day’s calendar encompass all news until the next report.

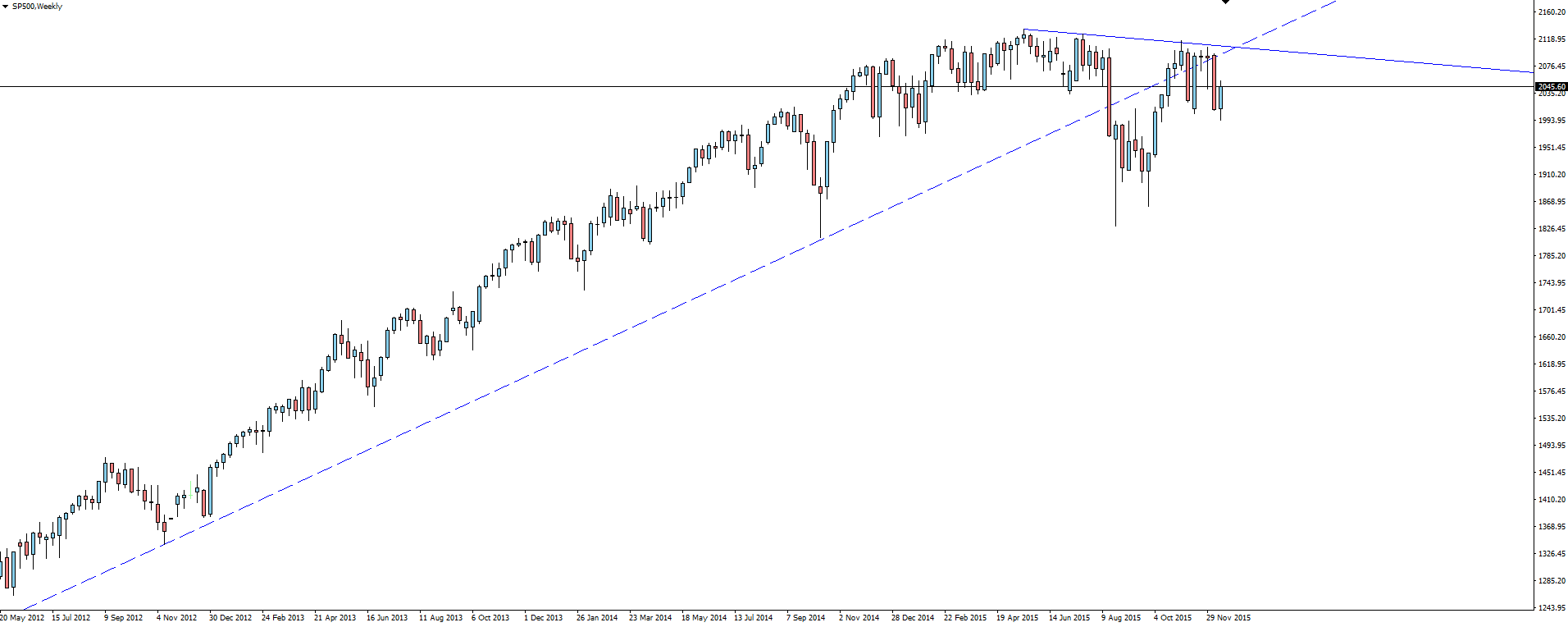

Chart of the Day:

It seems crazy as the Fed is hiking rates, making the free money that has been fuelling the stock market bull run for so long now more expensive, but the SP500 weekly chart is screaming rally.

S&P 500 Weekly:

Click on chart to see a larger view.

With no doubt a tonne of stops sitting above those clean highs and early shorts from the August fall getting nervous, I just can’t help but expect some sort of a clean out above those highs.

New highs in stocks on a Fed rate hike. Forget about every conventional, what should happen economics lesson you’ve ever learned. You’re a trader now.

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by trusted Forex broker Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently any person acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the Forex account of the reader. We always aim for maximum accuracy and timeliness, and Forex broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.