Looking to add value stocks to your portfolio? Buying undervalued shares can pay off in the long-run. Today we'll take a closer look at value investing and an ETF to provide exposure:

Value Vs. Growth

While growth investors seek shares of companies expected to achieve steadily high earnings growth, value investors look for companies trading at a significant discount to their intrinsic value.

There has been a longstanding debate over which approach to investing is more profitable. However, most financial planners believe that when used together, the two approaches can boost diversification and achieve solid results over the long-term.

Value stocks tend to be underpriced and oversold, potentially as a result of negative news and sentiment. Share prices will often be low relative to other measures like earnings per share, cash flow per share, or book value per share.

Another key characteristic: these companies have years or even decades of experience with established business models that generate profits. Many are also dividend payers and belong to cyclical industries.

Given the intrinsic value of these companies, investors expect them to eventually bounce back.

Value seekers are typically contrarian investors with a long-run horizon, aiming to buy robust securities at a bargain price.

Warren Buffett—CEO and Chairman of Berkshire Hathaway (NYSE:BRKa), (NYSE:BRKb)—is regarded as one of the most successful value investors of all time. His annual shareholder letters highlight Buffett's approach to value investing.

Buffett was a student of the father of value investing, Benjamin Graham, at Columbia University in New York. Upon graduation, he worked for (NYSE:Graham and later became the single largest shareholder of Berkshire Hathaway, a struggling group of textile milling firms at the time. Fast forward five decades plus, and the most expensive, publicly-traded stock ever is BRK.A, which, as of yesterday's close, costs $310,659 per share (no, that is not a misprint).

Over the years, other value investors have followed Graham and Buffett's market moves.

For those looking to invest in a basket of value stocks, this ETF should be on your radar:

iShares S&P 500 Value ETF

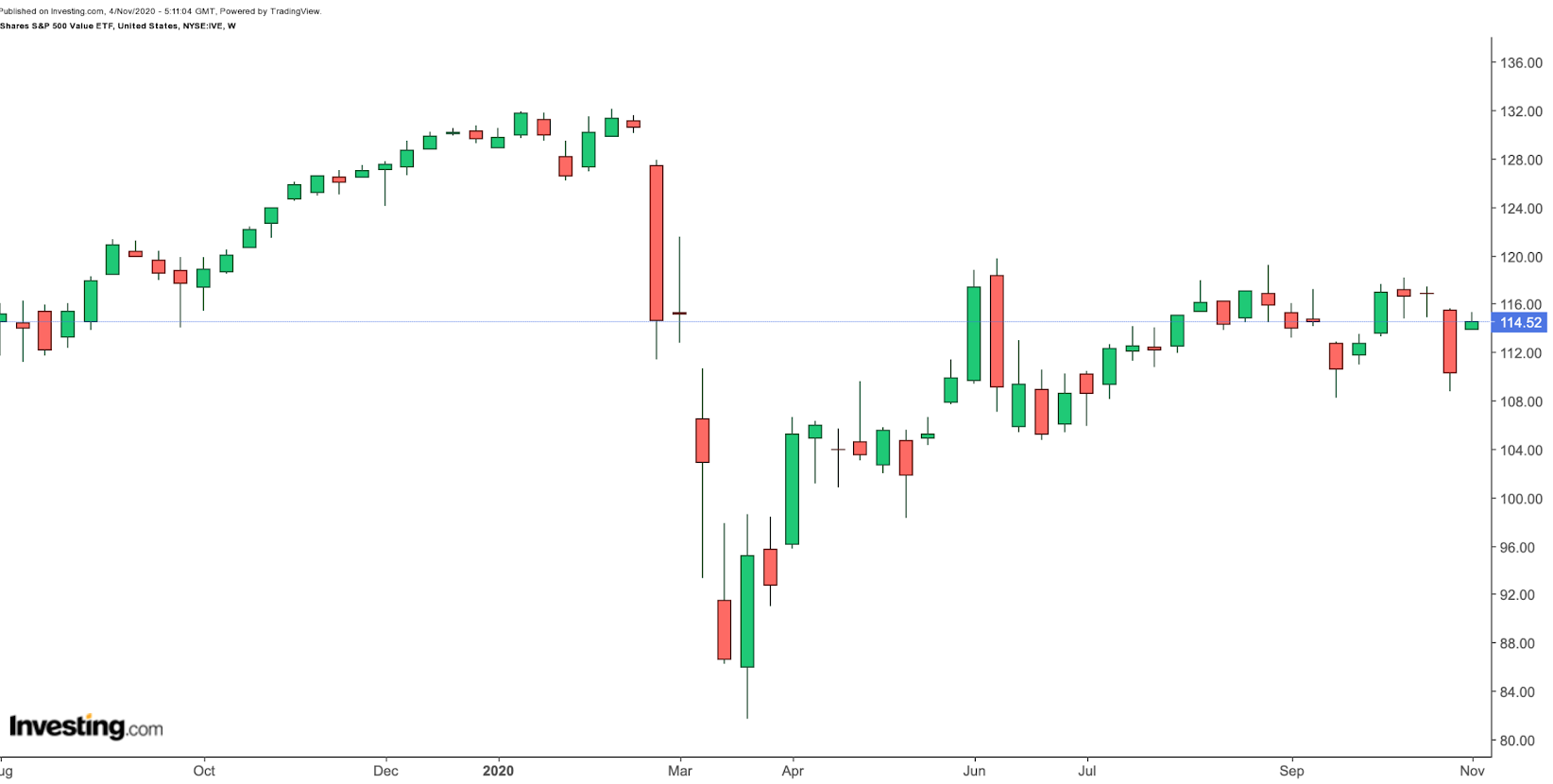

- Current Price: $114.52

- 52-Week Range: $81.70 - $132.10

- Dividend Yield: 3.29%

- Expense Ratio: 0.18%

iShares S&P 500 Value ETF (NYSE:IVE) provides exposure to US-based large-capitalization firms that are potentially undervalued relative to comparable companies and thus could offer long-term capital-appreciation prospects. The fund started trading in May 2000.

IVE, which has 386 holdings, tracks the S&P 500 Value index. When measuring stocks, the index uses three factors, i.e., the ratios of book value, earnings, and sales-to-price. In terms of sector allocation, health care and financials have the highest weighting (around 20% each), followed by consumer staples and industrials.

The top ten stocks in the fund comprise over 20% of net assets of over $15 billion. Berkshire Hathaway, UnitedHealth (NYSE:UNH), Verizon Communications (NYSE:VZ), Johnson & Johnson (NYSE:JNJ) and Pfizer (NYSE:PFE) head the list of companies. In fact, six out of the first ten are also listed on the Dow Jones Industrial Average.

Since the start of the year, the ETF is down by about 13%. By comparison, the S&P 500 index is up around 3%; the DJIA is down 1%.

Trailing P/E and P/B ratios for IVE are 14.76 and 1.91. We'd look to buy the fund if the price goes below $110. Focusing on potentially undervalued, well-established, large-cap stocks that pay dividends could add a margin of safety to long-term portfolios.

Bottom Line

Value investing, in theory, is quite simple. Investors find and buy robust, undervalued companies and then wait for them to appreciate. The expectation is for the Street to bid them up in due course.

However, what looks like a value proposition could also turn out to be a value trap. Therefore, investors need to do due diligence when choosing companies if they're looking for diamonds in the rough. They may also use ETFs as a way of investing in a basket of securities in order to help them diversify.

Several other funds with similar goals may also be of interest including:

- Alpha Architect International Quantitative Value ETF (NYSE:IVAL)

- iShares Core S&P US Value ETF (NASDAQ:IUSV)

- iShares Russell Top 200 Value ETF (NYSE:IWX)

- Schwab US Large-Cap Value ETF™ (NYSE:SCHV)

- Vanguard S&P 500 Value Index Fund ETF Shares (NYSE:VOOV)

- Vanguard Value Index Fund ETF Shares (NYSE:VTV)

In the coming weeks, we plan to cover them as well as ETFs that could be appropriate for growth-style investing.