December boom: Where to find the highest returns

And here we are, FINALLY the Monday before the December FOMC meeting. The week before Christmas: the traders version. The biggest, most anticipated meeting (really this time) since… well the last time the Fed raised back in June 2006. As widely expected, we are likely to see a 0.25% hike in the short term interest rate, lifting rates off the current near zero levels.

Jon Hilsenrath of the WSJ penned this piece (Hint: Copy and paste the headline into Google (O:GOOGL) and click the Google News link that appears first) over the weekend, warning that Fed officials may be nervous that interest rates will go up, only to come back down again without the benefits of a rate hike cycle taking hold and adversely affected the economy.

“But that’s if all goes as planned. Their big worry is they’ll end up right back at zero.”

With expectations and an overcrowded long USD trade heading into the decision, it is not about the hike itself, but the direction of future interest rate decisions after that. I would normally have said subsequent interest rate ‘hikes’ after that, but maybe I too am getting cold feet. Will persistently low inflation continue to pick up alongside rising rates? Will the jobs numbers continue their upward trajectory? Will Chinese and European woes continue to remain relatively contained away from the US economic bubble?

Questions we’re going to find out answers to the hard way!

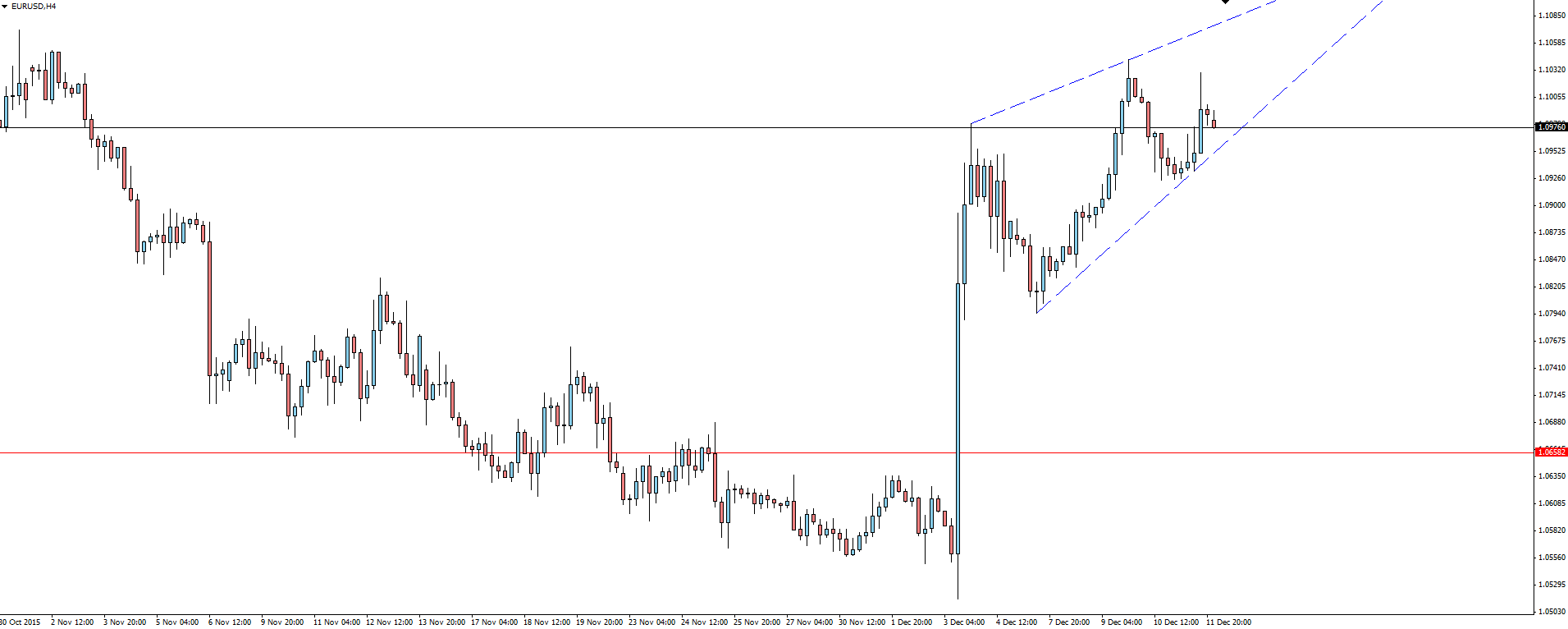

EUR/USD 4 Hourly:

Click on chart to see a larger view.

The Draghi induced USD November squeeze has continued into December’s FOMC week and EUR/USD has forged higher into some sort of bullish ascending triangle continuation pattern. Alongside the over expectation narrative, momentum is still extremely strong here and I wouldn’t be surprised to see a rally right up to the decision on Thursday.

Big week ahead!

———

On the Calendar Monday:

JPY Tankan Manufacturing Index

JPY Tankan Non-Manufacturing Index

EUR ECB President Draghi Speaks

———-

Chart of the Day:

With the long USD trade obviously crowded and expectations way too focused on the Fed hiking in December rather than how hard each subsequent hike from them on will be, we have spoken about a USD squeeze being a possibility.

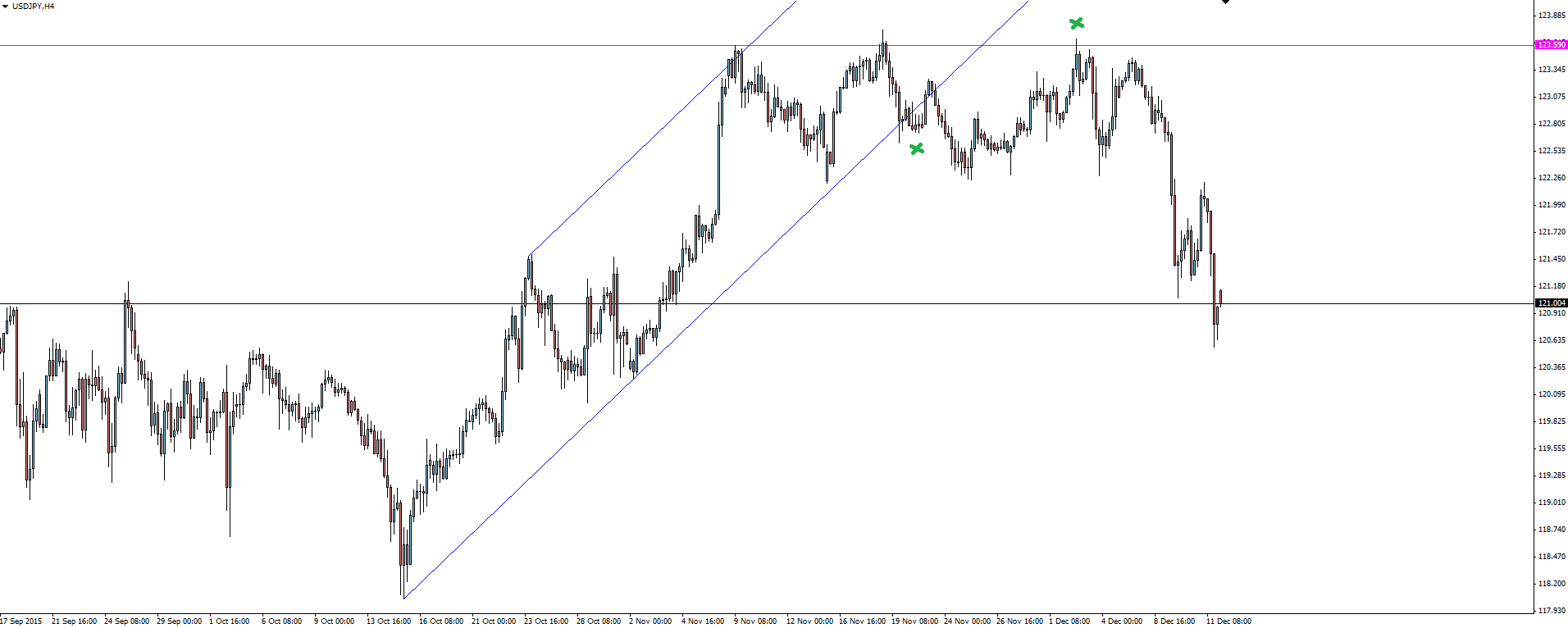

USD/JPY 4 Hourly:

Click on chart to see a larger view.

Compare where we were to where price sits now and we see the channel break out was followed by sideways consolidation. Again, breakouts never happen as clean as the textbook images show (broken record I know, but too important not to continue saying) and consolidation in the direction of the original trend is what we so often see following a break.

In the case of USD/JPY, we see price continued up, in the direction of the original trend, finding resistance at the previous swing high and subsequently dropping hard from there. A squeeze or a healthy pull-back into major news, depending if you were long or short I guess.

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Forex broker Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently any person opening a trading account and acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the Forex account of the reader. We always aim for maximum accuracy and timeliness, and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.