In 1992, judge Giovanni Falcone was killed by the Sicilian mafia.

Falcone and his colleague Borsellino were at forefront of major investigations that uncovered much of the mafia’s business and led to the incarceration of many criminals.

His method was pretty simple: follow the money, find the mafia. The same methodology can be very useful in understanding the real extent of today’s banking stress, which is crucial for macro and markets going forward.

Follow the money, assess the banking stress.

That’s why in today’s piece we will show you how to ‘’follow the money’’, explaining which reports to focus on and how to analyze them week by week to assess the depth of the banking stress.

Let’s follow the money together.

If banks are under stress from deposit outflows, they sure will be tapping the available liquidity facilities.

So, have they? And by how much?

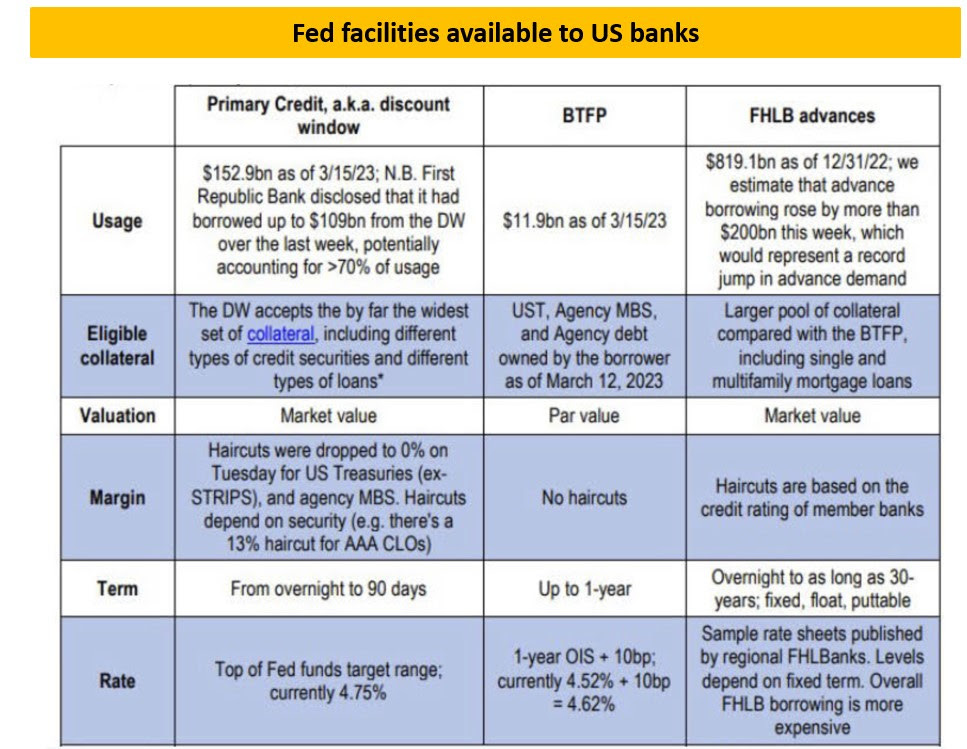

Before we answer this question let’s first define which liquidity facilities are available to US banks – they differ in conditions, eligible collateral, loan tenors etc.

- The Discount Window (Fed): very wide set of collateral accepted (not limited to Treasuries and MBS, but also some loans) at market value, max 90 days term lending at top of Fed Funds range (5% now); it comes with a strong stigma from the GFC.

- BTFP (Fed): newly created Fed facility that accepts Treasuries and MBS without any liquidity or market haircuts (!) and lends for up to 1-year at 1y OIS (~Fed Funds) + 10 bps (4.75% now);

- FHLB Advances (not Fed): the Federal Home Loan Banks program that allows member banks to post collateral with haircuts (UST, MBS and some mortgage loans) and at market value to get funding (‘’advances’’). Funding duration is flexible, but FHLB advances are relatively more expensive.

Here is a very handy table from JP Morgan summarizing the 3 facilities:

So, let’s now follow the money – did banks use these facilities, and by how much?

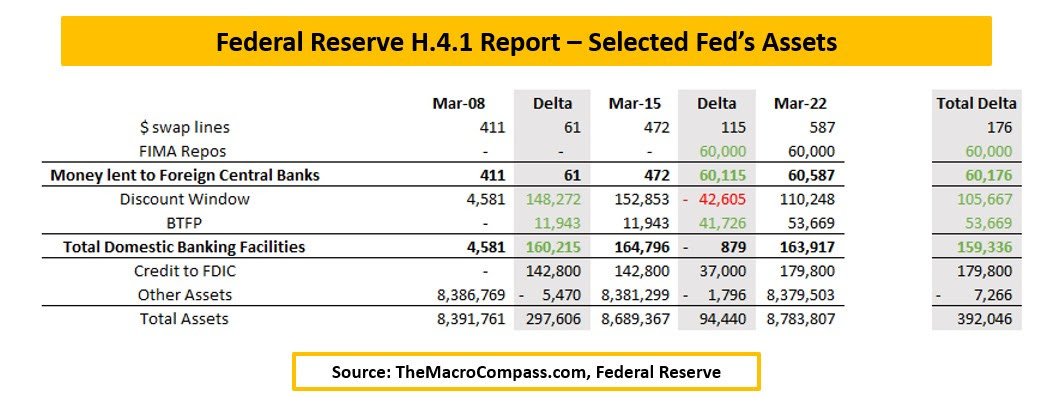

The Fed’s H.4.1 report is released every week (here) and it informs us on the Discount Window and the BTFP.

Banks drew $160 bn from these facilities in the SVB debacle week, and net zero (!) the week after.

We also know that First Republic Bank (NYSE:FRC) drew about $110 bn from the Discount Window, which means all other US banks only drew $50 bn from the combined Fed facilities 2 weeks after the stress started.

Not much, really.

But maybe banks used the third option - FHLB Advances more aggressively?

FHLB disbursed loans to commercial banks are only reported quarterly, but you can track the amount of money FHLB is raising through bond issuance here – even if not fully distributed, it gives us an idea about the potential incoming demand FHLB expects.

Now, stand ready for the number. The FHLB has raised as much as $300 billion in the last 7-10 days, largely outpacing its normal issuance pace.

A huge figure.

So, are US banks truly experiencing severe stress after all?

Tell me what you think in the comments.

***

This article was originally published on The Macro Compass. Come join this vibrant community of macro investors, asset allocators and hedge funds - check out which subscription tier suits you the most using this link.