- Reports Q2 2022 results on Thursday, Dec. 16, after the close

- Revenue expectation: $22.41 billion

- EPS expectation: $4.27

Despite surging e-commerce deliveries and expanding sales, investors have given FedEx (NYSE:FDX) the cold shoulder. Shares of the freight and logistics giant have fallen more than 18% during the past six months, massively underperforming the US benchmark indices.

This weakness comes even as Memphis-based FedEx estimates it will deliver 100 million more packages this year than it did from Black Friday to Christmas in pre-pandemic 2019, and 10% more than during the record 2020 season during COVID.

Instead, investors are focusing on the company’s escalating costs and labor shortages, which are likely to hurt margins even as sales soar. That’s what happened in the first quarter, when the shipment company cut its outlook for annual profit and missed analysts’ quarterly earnings estimates.

Investors turned bullish on FedEx early this year, pushing its stock to a record high, amid growing demand for the company’s delivery services during the pandemic when shoppers switched to e-commerce.

The company's business restructuring—which had been planned before the pandemic—proved to be a great launching pad for FedEx in this new environment. Before COVID-19 spread across the globe, the company had already moved to a seven-day service model, expanded capacity for larger packages, introduced new routing software and began pushing more Express packages into its lower-cost ground network.

Those changes helped FedEx increase profit on a flood of residential packages, while its more lucrative business delivery service suffered during the U.S. lockdown. Going forward, the big challenge for the company is to contain its costs in an environment where inflation and worker shortages are lingering, hurting its expansion plans and margins.

Favorable Ratings

FedEx executives said in September that a tight labor market, higher wages, and reduced network efficiencies resulted in $450 million in added costs during Q1 from a year earlier. The cost headwinds—which totaled $800 million, including capacity expansions during Q1—likely continued into the second quarter.

Despite these challenges, many analysts continue to give a favorable rating to FedEx, citing its long-term appeal with the ongoing expansion of online shopping. Citi, in a note last week, reiterated FedEx as a 'buy,' saying it sees a positive risk/reward preposition. The note said:

“Clearly investor sentiment has improved during F2Q22 on the back of more constructive commentary from the company regarding labor availability. With that in mind, we think F2Q results are likely to exceed consensus expectations and be flat to up sequentially from F1Q.”

JPMorgan also reiterated FedEx as overweight in its recent note to clients, saying:

“We are constructive on FDX into the F2Q22 earnings release on Dec. 16. After a brief rally lost momentum the stock is trading at a near-record valuation discount to UPS, which provides a decent margin of safety on a relative basis.”

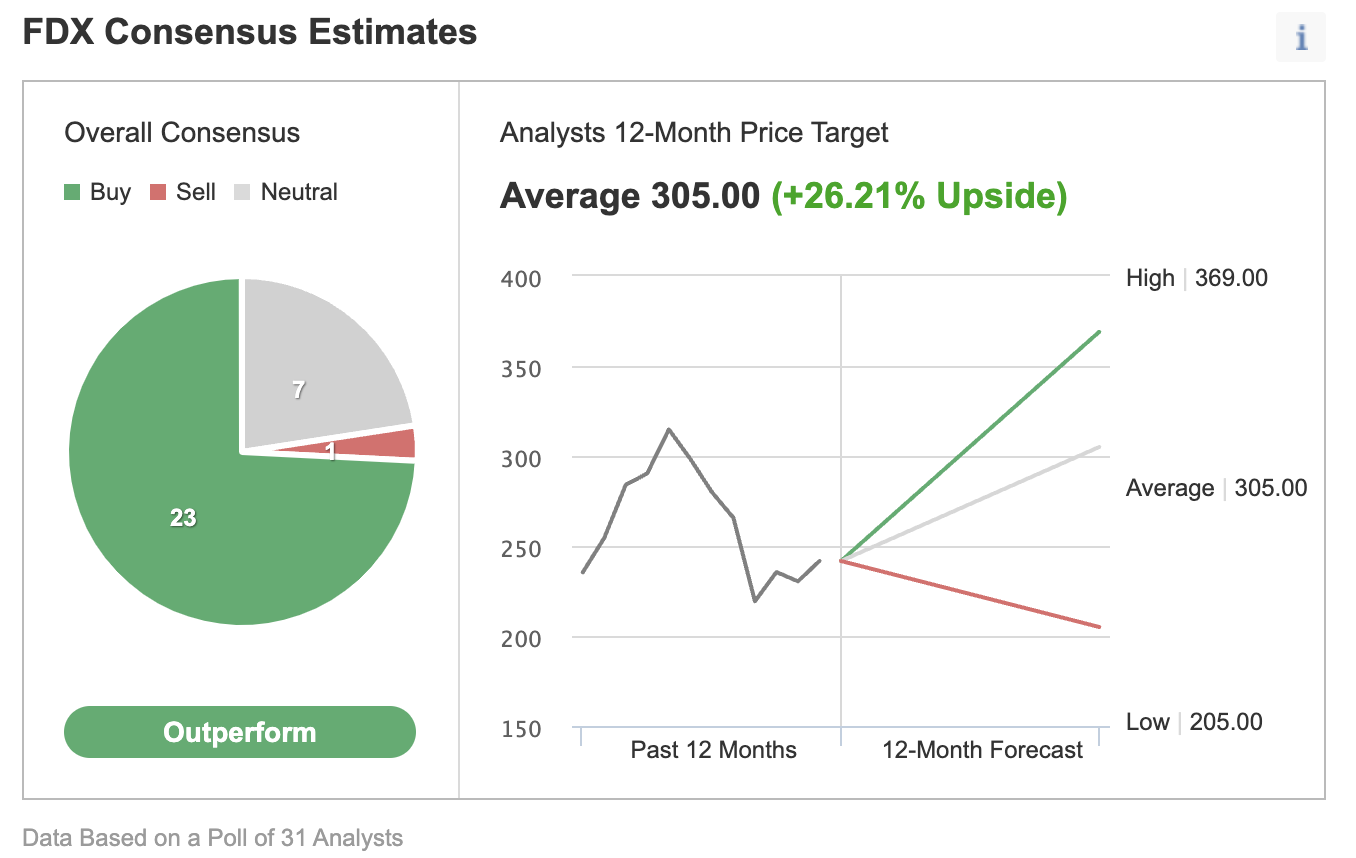

Of 31 analysts covering the stock for Investing.com, 23 have given it an “outperform” rating.

Chart: Investing.com

The consensus average price target among analysts polled by Investing.com is $305—a 25% upside potential objective from Tuesday's closing price of $240.17.

Bottom Line

FedEx’s quarterly report tomorrow may not provide a positive surprise despite the rising costs and labor shortages, but the company remains in a strong growth mode amid the robust demand for e-commerce shipments. The current weak spell for FDX shares could reverse quickly once these challenges are contained.