Street Calls of the Week

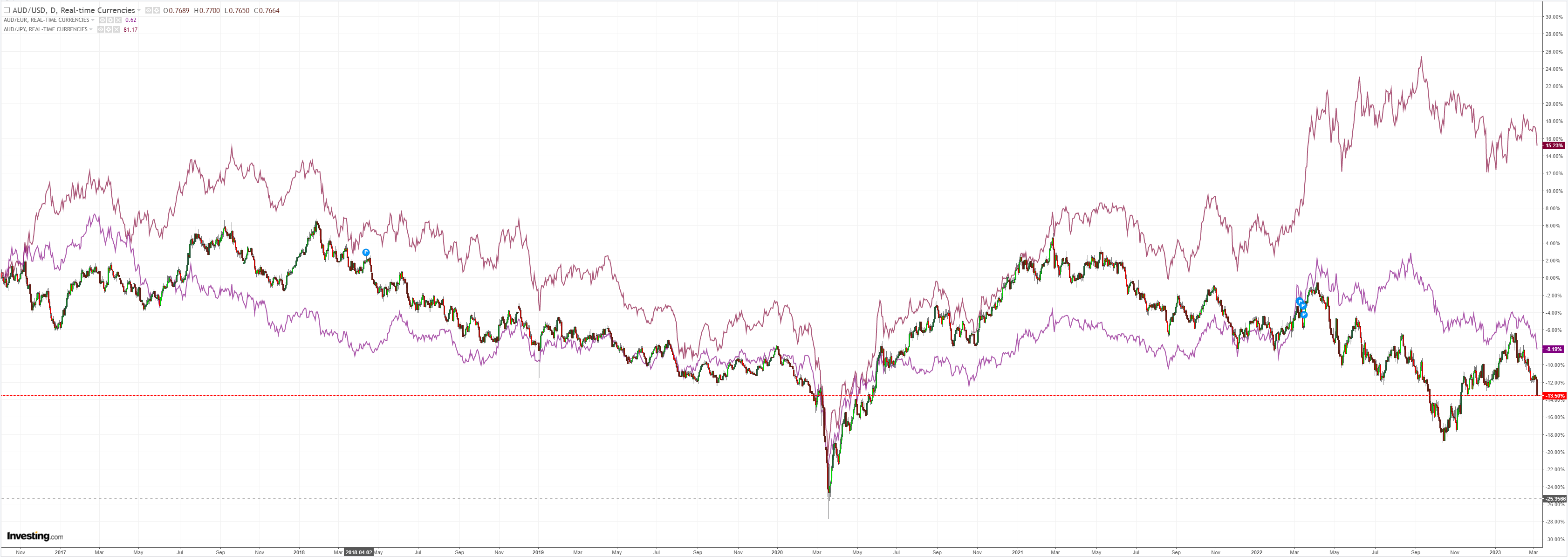

Wow. DXY to the moon, adieu Spewro:

AUD slaughtered by chainsaw:

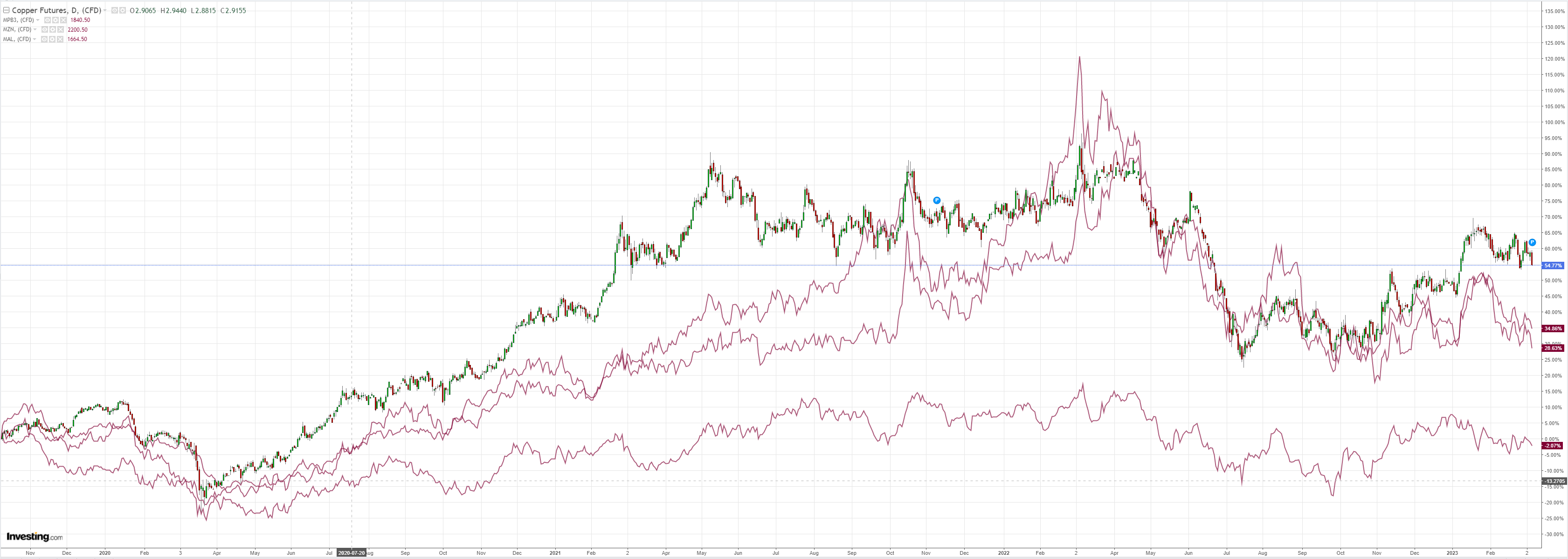

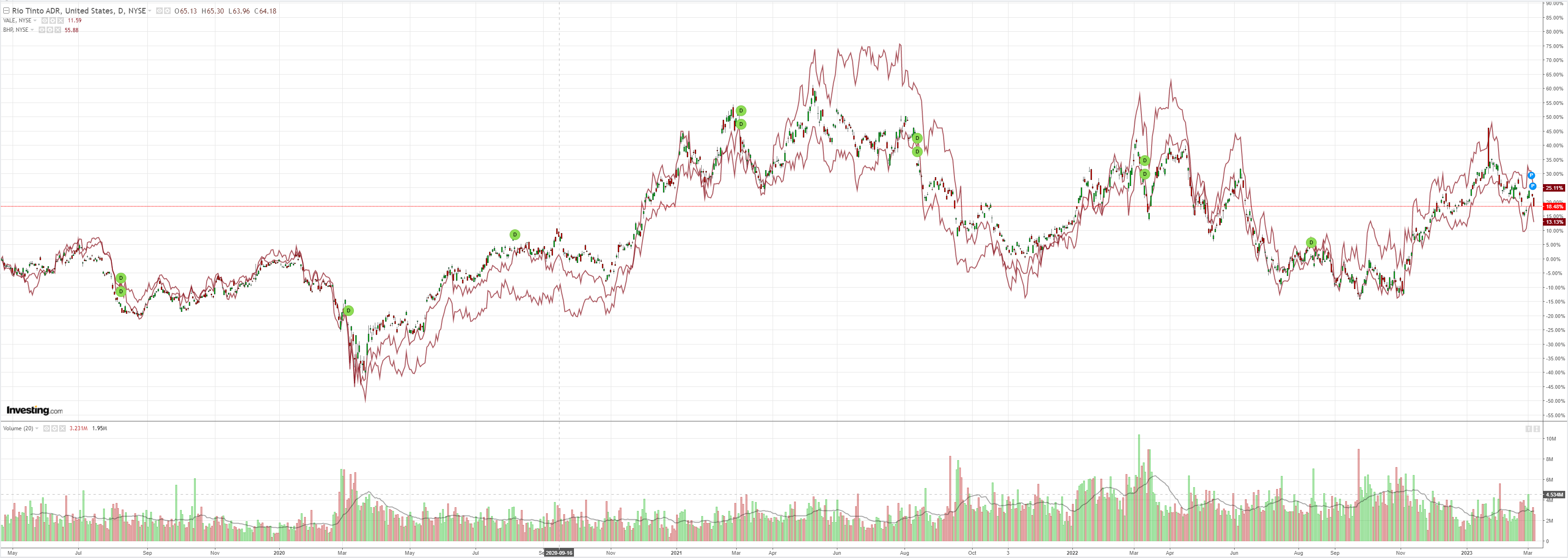

Commods, miners (NYSE:RIO), and EM (NYSE:EEM) slain:

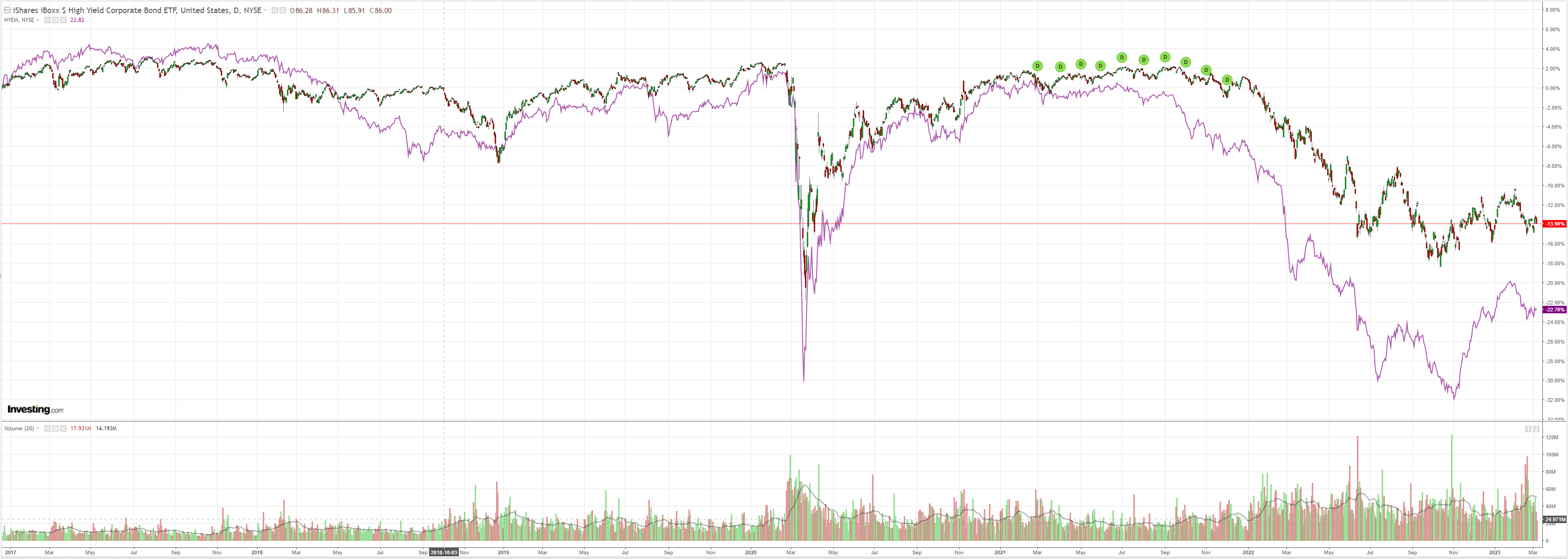

Junk (NYSE:HYG) was OK, oddly:

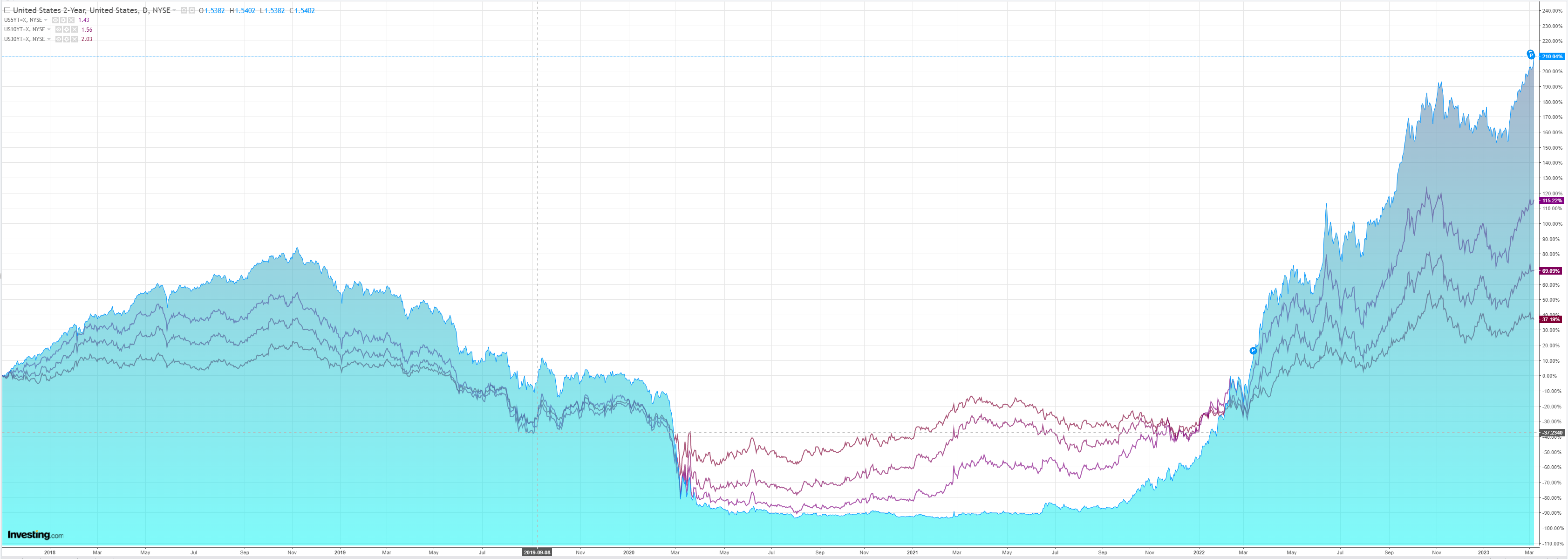

As the Treasury curve entered free fall toward hell:

Stocks fell but should have fallen more given the Treasury move:

The world’s poorest communicator, Jay Powell, did another backflip in Congress:

…inflation has moderated somewhat since the middle of last year but remains well above the FOMC’s longer-run objective of 2 percent… That said, there is little sign of disinflation thus far in the category of core services excluding housing, which accounts for more than half of core consumer expenditures.

…If the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes… The historical record cautions strongly against prematurely loosening policy. We will stay the course until the job is done.

Why this has not been the message right through is the question.

Where does this forex markets? DXY is, once again, the primary channel for global FCI tightening. So expect it to run.

The only way to change this would be a very bad NFP print on Friday. Which is not impossible, recalling that jobs reports are a craps shoot.

Even then, the market needs a lot of bad US data in a hurry or the DXY steamroller is rolling downhill towards commods and EMs, the two hottest trades of the crazed 2023 rally.

With RBA pivoted dovish and rate hikes odds-on to be ended, the AUD has no support in this environment.