The Fed understands that banking stress is ultimately disinflationary as the flow of credit to the real economy slows down and so does economic activity, and inflation with it.

Markets are now busy interpreting what it all means. Here is my assessment of Powell's words after the hike.

Wait: Have We Broken Something Here?

“Recent developments are likely to result in tighter credit conditions for households and businesses and to weigh on economic activity, hiring, and inflation.”

With inflation sticky and still trending above 5%, for the Fed to come out of the gate with a forward-looking statement like this is quite something.

Powell & Co deeply understand the disinflationary nature of banking stress.

This was also reflected in the economic forecasts, particularly in the uncertainty surrounding them.

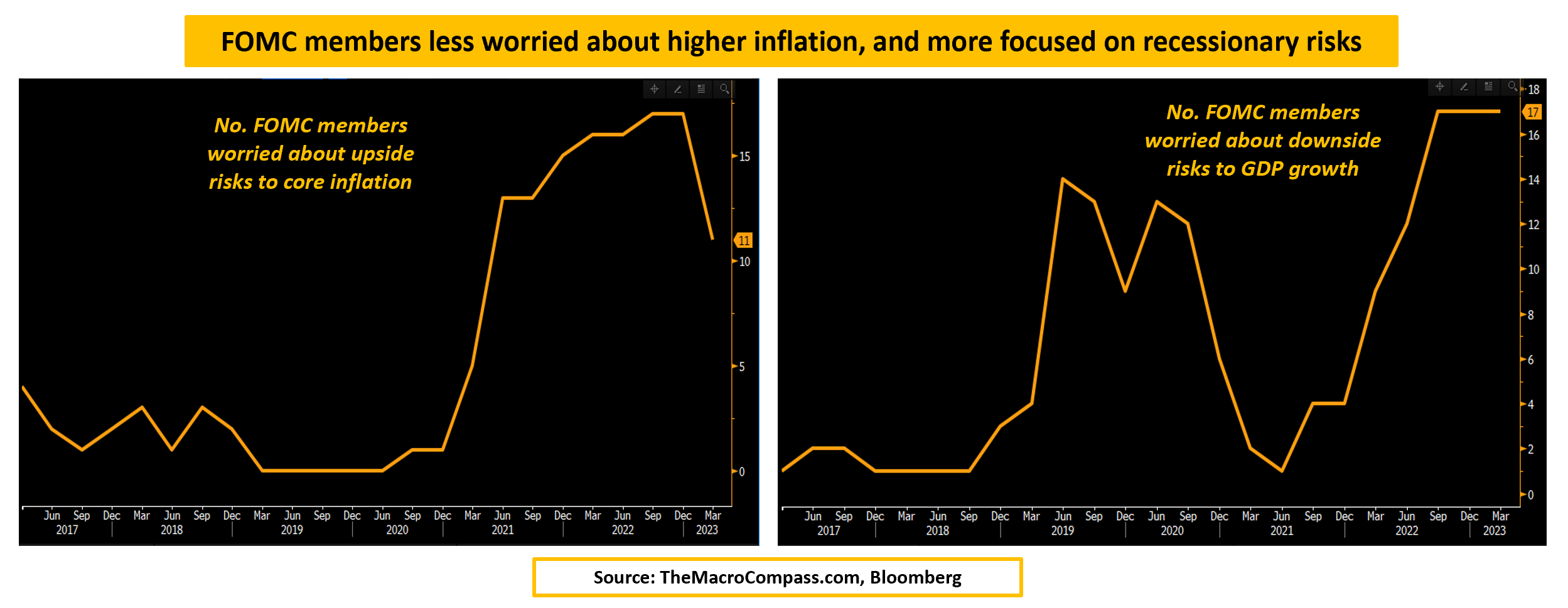

Due to the banking stress, a large number of FOMC participants are worried about downside risks to GDP growth, while fewer participants expect an upside surprise on inflation.

In other words, the FOMC is more worried about a disinflationary recession than anything else.

“The Committee anticipates that some additional policy firming may be appropriate to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time.”

From 'Ongoing Rate Increases' to 'Some' and 'May'

Again, this shows that the Fed will be on the lookout for signs that they might have done enough damage through this banking stress.

This is something deeply new, as until now, the Fed was effectively on autopilot: keep monetary policy incrementally tight until you get people unemployed and inflation comes down.

Don’t make any assumptions. Just get the job done. Here, we are looking at a different Fed.

And the Summary of Economic Projections (SEP) clearly shows it.

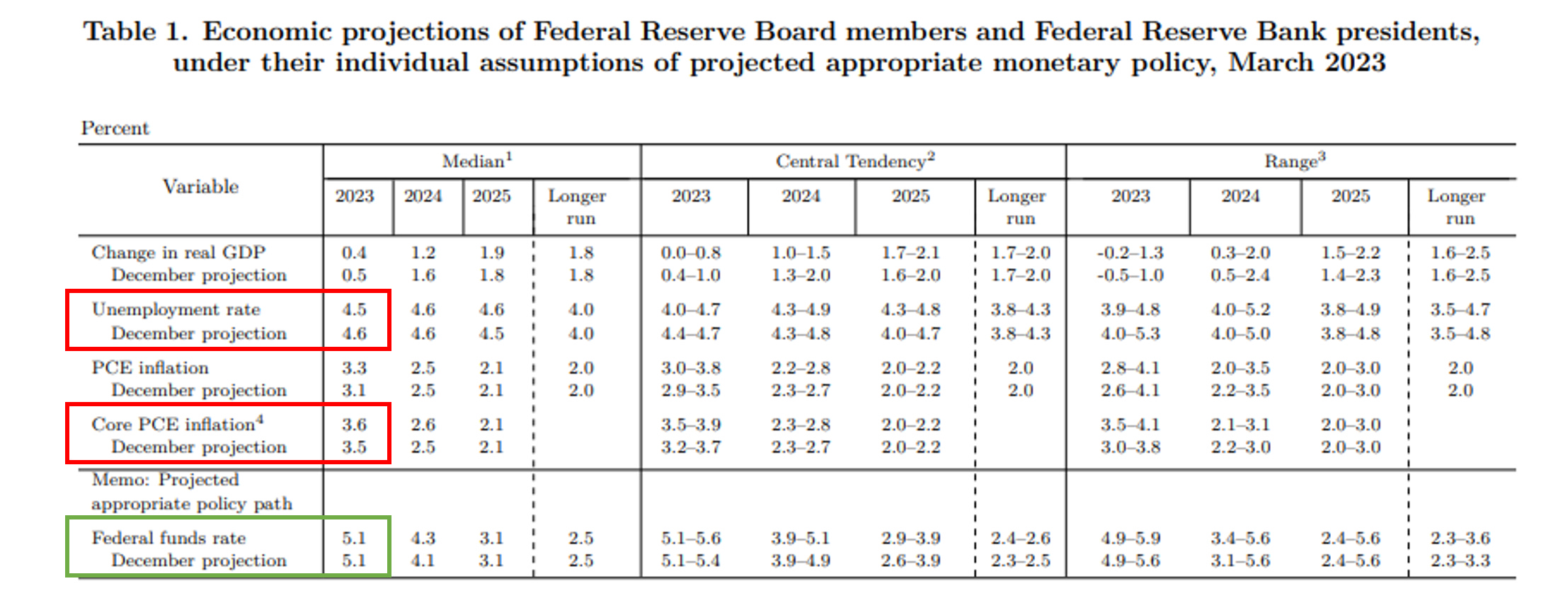

Despite predictions for lower unemployment rate and higher core inflation in 2023, most likely to account for the banking stress uncertainty, the median Fed Dot for December 2023 wasn’t revised higher.

This is a proactively cautious Fed looking to assess the damage despite inflation still running hot.

But the second point was even more important, as it led to crucial market moves and opened the door to interesting market opportunities.

***

This article was originally published on The Macro Compass. Come join this vibrant community of macro investors, asset allocators and hedge funds - check out which subscription tier suits you the most using this link.