According to testimony prepared for today’s hearing in the House Financial Services Committee, Federal Reserve Chairwoman Janet Yellen is convinced that 2015 will be the appropriate time for a rate hike “if the economy evolves as expected.” Although she is anticipating higher interest rates and early indications from FOMC members seem to confirm the general path for rates, she keenly left herself an exit strategy in the event that the outlook makes a turn for the worse. After yesterday’s retail sales figures, it is not hard to see why she is attempting to temper expectations and not make any promises regarding the future of monetary policy. While market participants still seem unsure about the outlook, Yellen explicitly remarked that labor conditions and the broader economy continue to improve, the two hallmarks of any potential conditions needed to normalize interest-rate policies. The conviction of her tone belies the overarching challenges in hiking rates at a time when the US economy is experiencing substantial cyclical weakness.

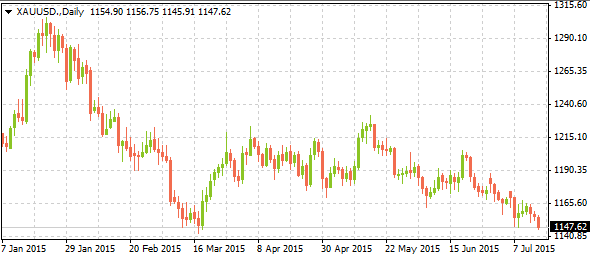

Exports are still soft as a result of the stronger US dollar, a factor that is not likely to disappear over the near-to-medium term. Inflation remains stubbornly low despite the idea forwarded by the Fed that the components influencing the figure are merely transitory. The weak global fundamental backdrop is more supportive of the notion that another crisis is around the corner and not in the distant future as conveyed by the majority of central bankers representing global economic powers. The flight to quality has quietly resumed this week as evidenced by the renewed strengthening of the dollar with the bad-news-is-good-news strategy back in play. The appreciation of the dollar has also seen more pressure on gold prices, which are in the process of retesting multi-month lows amid the potential crisis unfolding in China and the one that has already landed in Greece. “Least dirty shirt in laundry” trading is the name of the game until the sun once more shines on the global economy.