DXY launched last night as EUR sagged:

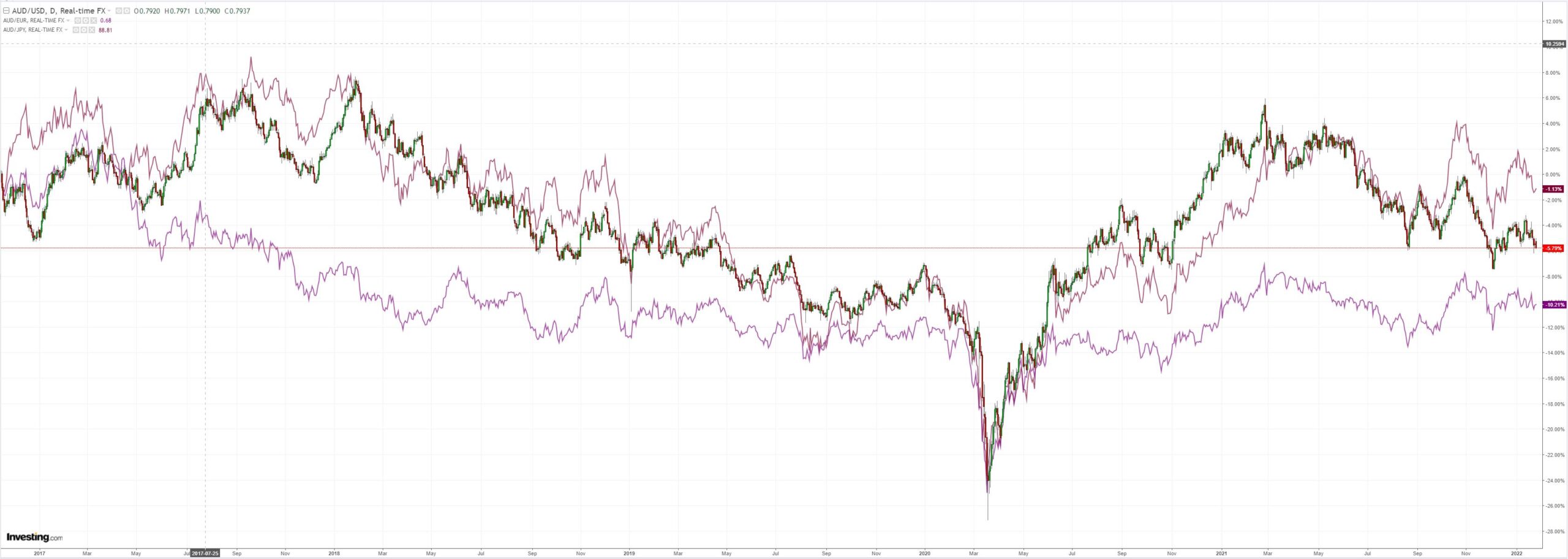

That dropped the AUD despite the a risk trade rip and dip:

Which sent Oil to new highs only bringing forward more Fed action:

Base metals too:

Big miners (LON:GLEN) bounced:

EM stocks (NYSE:EEM) not so much:

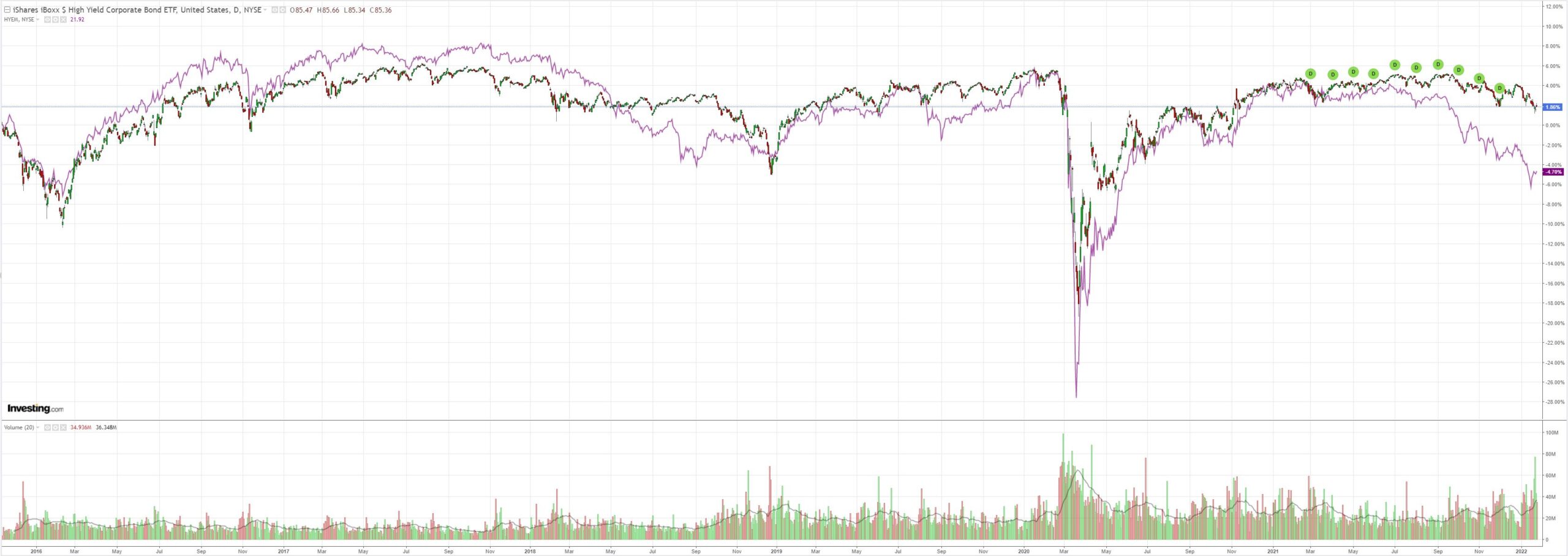

Junk (NYSE:HYG) is precariously poised still:

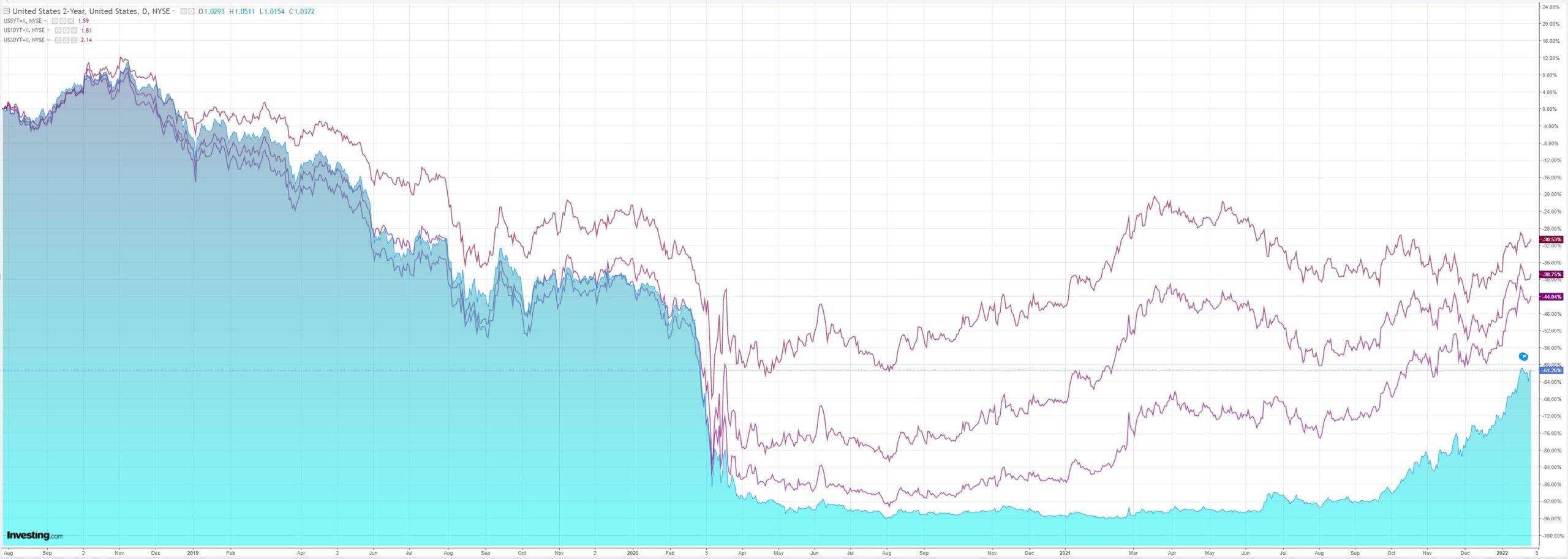

As yields took off:

With stocks:

Westpac with the wrap:

Event Wrap

As expected, the US Federal Reserve left its policy rates unchanged but signalled a rate hike is likely at the next meeting in March, saying it will ” the Committee expects it will soon be appropriate to raise the target range for the federal funds rate“. On bond purchases: “The Committee decided to continue to reduce the monthly pace of its net asset purchases, bringing them to an end in early March”. Economic indicators were seen as improving, while supply/demand imbalances continued to contribute to elevated levels of inflation. The vote was a unanimous 11-0. Chair Powell’s press conference starts soon.

The Bank of Canada kept its policy rate on hold at 0.25% but signalled rate hikes were imminent. It said: “Looking ahead, the Governing Council expects interest rates will need to increase, with the timing and pace of those increases guided by the Bank’s commitment to achieving the 2% inflation target.”

Event Outlook

Aust: The December Westpac-MI leading index will include positive updates on the ASX200, commodity prices, dwelling approvals and reopening from delta lockdowns; slightly offset by the emergence of omicron. A higher AUD in Q4 is set to temper the lift in import prices (Westpac f/c: 1.4%) and weigh further on the fall in export prices (Westpac f/c: -2.2%).

NZ: Q4 CPI will be released. Broad-based inflation pressures are boosted by both supply-side pressures and strong domestic demand; construction prices and transport costs will be key drivers. Westpac forecasts a 1.2% (5.7%yr) rise in the headline CPI.

US: The recent up-tick in initial jobless claims due to omicron will likely be temporary. Q4 GDP is expected to post a strong gain with the impact of omicron likely concentrated in Q1 2022 (market f/c: 5.3% annualised). December’s durable goods orders are expected to decline but remain steady in the ex-transportation segment (market f/c: -0.6%). Pending home sales are anticipated to fall in December as rising rates start to weigh on demand (market f/c: -0.8%). The January Kansas City Fed index should continue to reflect a positive manufacturing outlook for the region.

The Fed came in with what it had predicted. Ending QE and readying rate hikes with QT in the wings:

Indicators of economic activity and employment have continued to strengthen. The sectors most adversely affected by the pandemic have improved in recent months but are being affected by the recent sharp rise in COVID-19 cases. Job gains have been solid in recent months, and the unemployment rate has declined substantially. Supply and demand imbalances related to the pandemic and the reopening of the economy have continued to contribute to elevated levels of inflation. Overall financial conditions remain accommodative, in part reflecting policy measures to support the economy and the flow of credit to U.S. households and businesses.

The path of the economy continues to depend on the course of the virus. Progress on vaccinations and an easing of supply constraints are expected to support continued gains in economic activity and employment as well as a reduction in inflation. Risks to the economic outlook remain, including from new variants of the virus.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent. With inflation well above 2 percent and a strong labor market, the Committee expects it will soon be appropriate to raise the target range for the federal funds rate. The Committee decided to continue to reduce the monthly pace of its net asset purchases, bringing them to an end in early March. Beginning in February, the Committee will increase its holdings of Treasury securities by at least $20 billion per month and of agency mortgage‑backed securities by at least $10 billion per month. The Federal Reserve’s ongoing purchases and holdings of securities will continue to foster smooth market functioning and accommodative financial conditions, thereby supporting the flow of credit to households and businesses.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals. The Committee’s assessments will take into account a wide range of information, including readings on public health, labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Sensible enough.

The last few weeks have continued the Amphetamine Cycle of accelerated market factors. Since Xmas, we’ve had a Growth stocks bid, a bond back-up, and Growth stock crash, a commodity blowoff, a 10% stock crash, a Fed panic and now moderately hawkish reality.

Such is the madness of markets with too much money to spend. Last night witnessed a crash up in risk trades then a hammering as the Fed came in less hawkish than expected! Though Jerome Powell put a cat amongst the pigeons:

Federal Reserve Chair Jerome Powell said the central bank was ready to raise interest rates in March and didn’t rule out moving at every meeting to tackle the highest inflation in a generation.

“The committee is of a mind to raise the Fed funds rate at the March meeting” if conditions are there to do so, Powell told a virtual press conference on Wednesday, while noting that officials have not made any decisions about the path of policy because it needs to be “nimble.”

I remain of the view that there is more market and forex volatility ahead. Inflation is going to come off but with OMICRON disrupting China, Russia playing silly buggers in Ukraine and Wall Street hooked on a spectacularly self-defeating commodity bid, not fast enough to prevent the Fed from tightening in a pro-cyclical manner.

That means a recession scare is ahead and one more leg down for AUD before the Fed rolls over and we start the whole crazy, stupid thing again.