The economic landscape is eroding quickly, and that's causing inflation rates and the expectation for future inflation to plunge. It paints a murky picture for interest rates, and with traders betting on the possibility of negative interest rates out of the Federal Reserve in 2021, yields on the 10-year Treasury could be heading toward 0%.

Should that happen, the one sector that could suffer are the banks. This group has been pounded in recent weeks, with the Financial Select Sector SPDR® Fund (NYSE:XLF) falling a stunning 11% since April 29. Overall, the year has been dismal for the group, with the ETF down by more than 30%. Yes, it can still get worse.

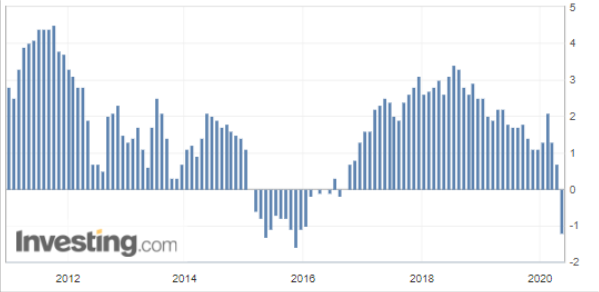

Inflation Reading Plunge

The latest reading for the consumer price index and the producer price index both plunged in April. The producer price index fell by 1.2% year-over-year, its steepest decline since 2015. Meanwhile, the consumer price index increased by only 0.3% year-over-year, its smallest also since 2015. Even worse, Fed Fund futures for March 2021 at one point this week were pricing in -0.05% for the benchmark interest rate next year.

But the prospects for inflation grow worse because the 10-year breakeven inflation expectations have fallen to 1.07%, their lowest levels since 2008. At the same time, the velocity of MZM has fallen to its lowest level ever at 1.23, and is likely to fall even further in the second quarter, as money printing has exploded higher, and GDP has crashed.

10-Year Could Fall Towards 0%

It all indicates that US 10-year Treasury rates may still have further to fall in the months ahead. The 10-year has been challenging a downtrend in recent days and appears to have failed despite multiple attempts to break out. A drop meaningfully below 55 basis points could result in the 10-year heading towards 0%. The pattern that appears to be forming in the chart is a descending triangle, a bearish pattern, and a break of 55 basis points on the chart would confirm the pattern.

Banks Stock May Drop

Should that happen, the bank stocks could suffer even more as interest income declines even further. Additionally, a sharp decline in interest rates would paint a gloomy outlook for an economic recovery and the bank stocks.

The XLF ETF is showing signs of further decline with a bearish technical pattern that has formed, known as a double top. The ETF broke below a critical level of support on May 13 at $21.20, all but confirming the pattern. The ETF has tried to recover from those losses on May 14, but to this point, it has been unable to reclaim that price successfully. It would indicate that the ETF falls even further, perhaps back to its March lows.

If the economic scenario continues to worsen, then it seems likely that the banks can suffer as rates fall to even lower levels. While it may seem unimaginable to many for rates to sink further, the harsh reality of it is that US yields, although low by our historical standard, are rather high when compared to the rest of the world, despite the spreads shrinking in recent months. Therefore, if inflation and the economy continue to struggle, not just here in the US, but around the world, it seems likely that this scenario could play out.

Only time will tell just how deep the economic fallout of the coronavirus pandemic will be, but based on recent data points, it appears it may be the worst we have seen in about 90 years.