- The U.S. Dollar Index climbs above 107—the highest since 2002

- As EUR/USD nears parity, a strong U.S. dollar will pressure corporate profits this earnings season

- Stocks citing unfavorable currency changes might get a pass, while EPS misses due to weak consumer demand will likely see worse stock price reactions

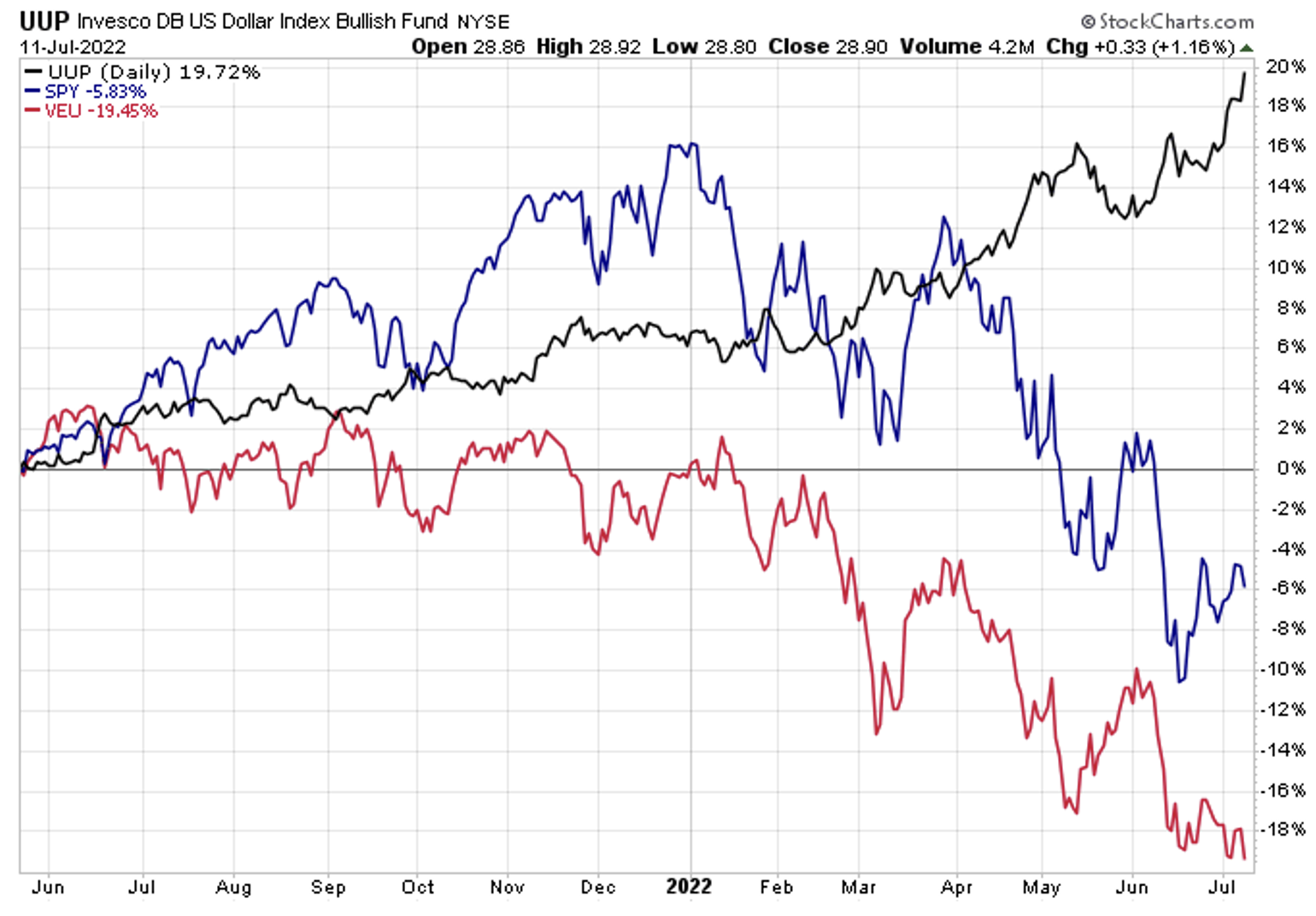

Earnings season begins in earnest Thursday. That’s when JPMorgan Chase (NYSE:JPM) issues Q2 results to the street. More big banks and brokers report earnings that afternoon and on Friday morning. The week of July 25, though, might be more important when large technology companies provide EPS numbers and pivotal guidance comments. Among the biggest headwinds from Q2 is undoubtedly the surging U.S. dollar. The DXY, as it’s known, is up a whopping 18% from the middle of the second quarter last year. The U.S. Dollar Index has climbed to its highest level since late 2002 as the EUR/USD cross nears parity.

U.S. Dollar Index: 20-Year High

Source: Investing.com

The greenback has risen dramatically just in the last 14 months. Since the middle of the second quarter of last year, the Invesco DB US Dollar Index Bullish Fund (NYSE:UUP) is up 20%. In that time, stocks have struggled with the SPDR® S&P 500 (NYSE:SPY) falling more than 5% (including dividends), while ex-USA stocks are down a massive 19%. Foreign shares often underperform when the USD rallies.

U.S. Dollar Rallies 20% Since Mid-2Q21

Source: Stockcharts.com

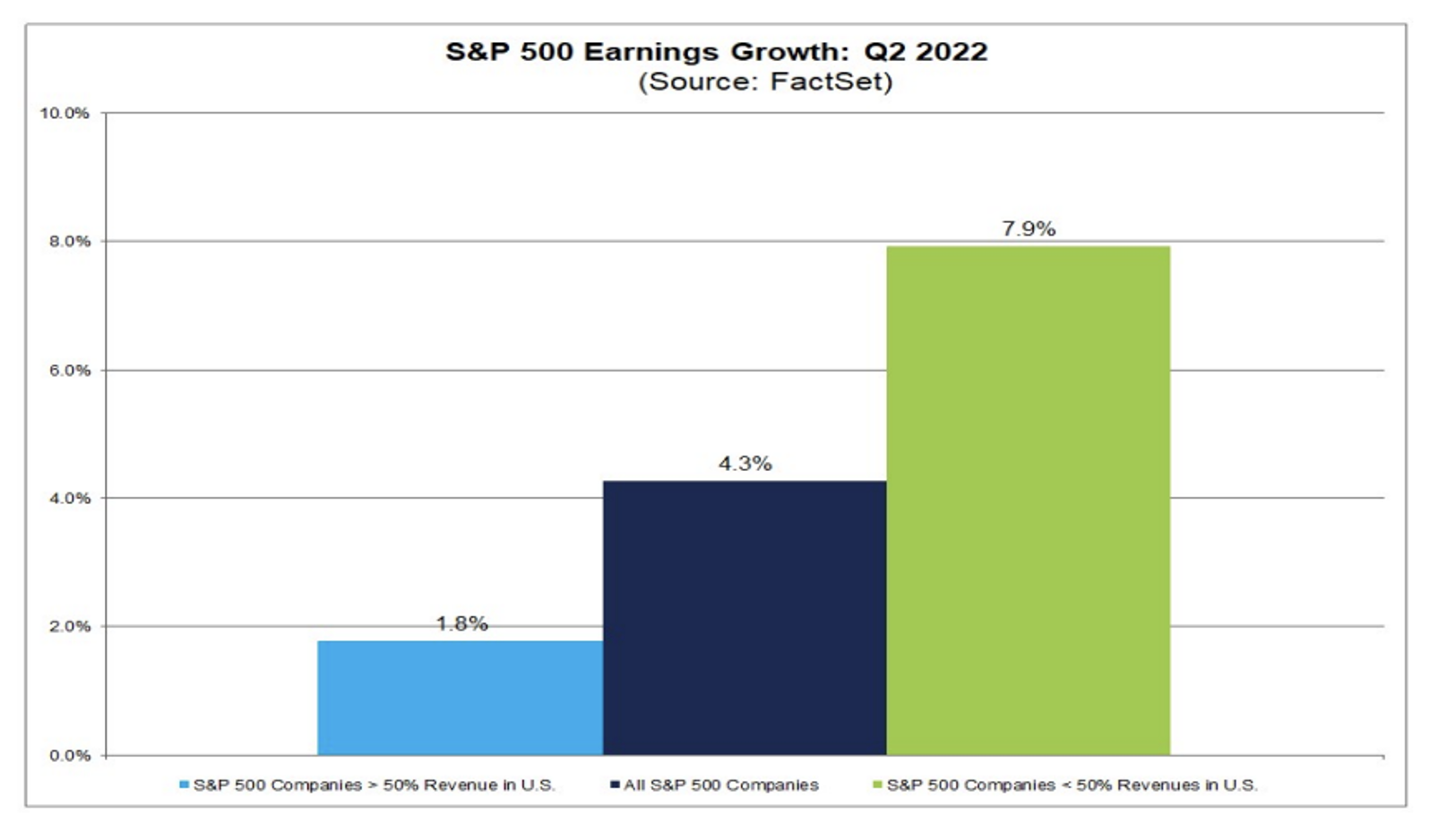

For domestic companies, though, more foreign sales means a bigger currency hit in a rising dollar environment. FactSet reports that 2Q earnings growth is forecast to be best for corporations that do business primarily within the United States. Profits are seen as being weakest for those companies that have a relatively high percentage of non-U.S. sales.

FactSet: More Foreign Sales Means Weaker Earnings Among S&P 500 Companies

Source: FactSet

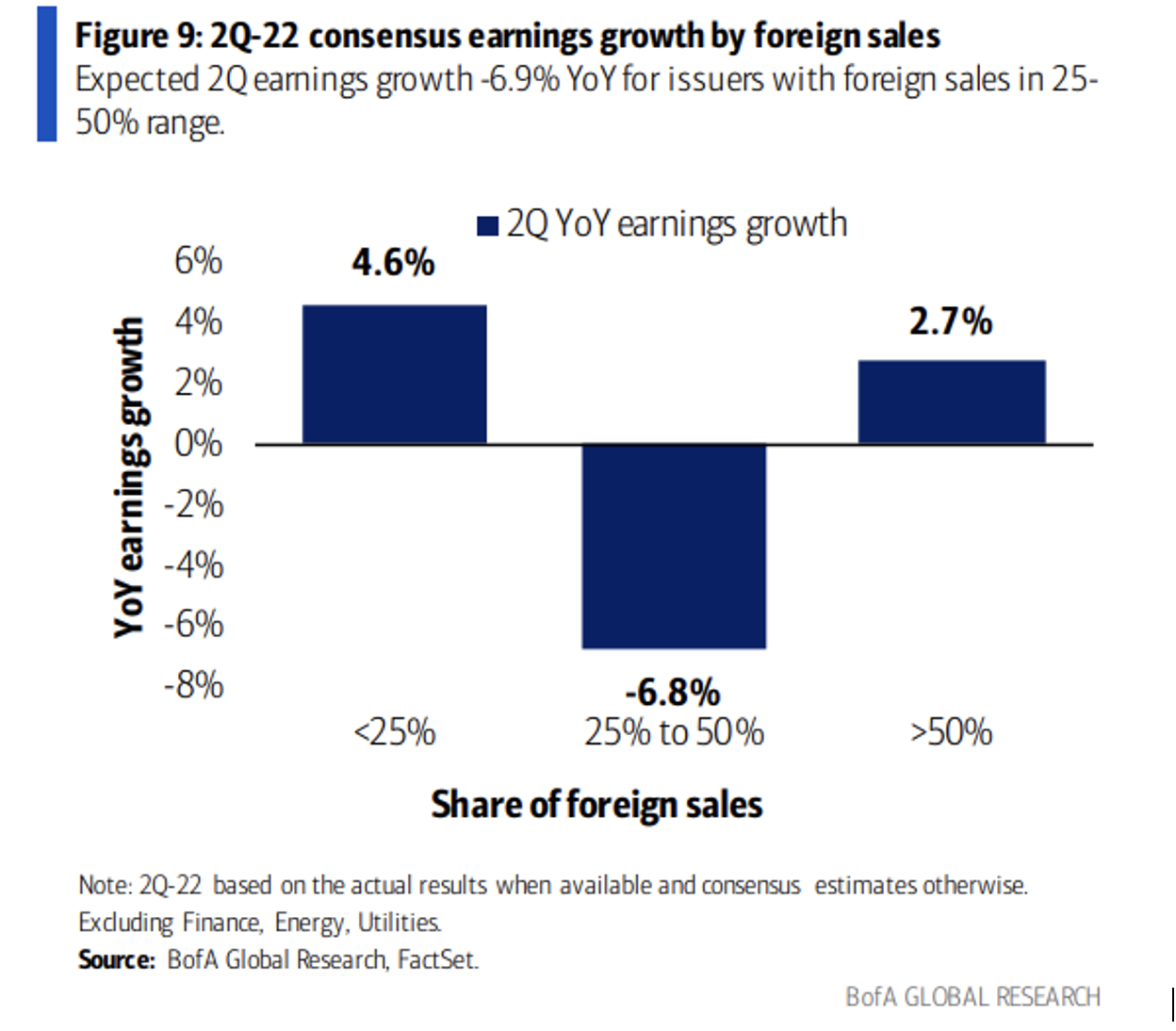

Digging in further, analysts at Bank of America Global Research estimate that if you remove the volatile energy and financials sectors (and the very domestic utilities sector), it is actually the group of companies that have foreign sales in the 25% to 50% range that might see the worst earnings growth versus 2Q a year ago. It’s companies with less than 25% of foreign sales exposure that should have the best EPS increase.

BofA: Best EPS Growth Seen Among Domestic Firms (Ex-Energy, Financials, Utilities)

Source: BofA Global Research

While the buck is at generational highs, I assert that companies might get a pass should earnings be dinged simply because of higher USD. In general, currency changes are typically mean-reverting—when one currency rises, it will often retreat in the years ahead. What really matters in this reporting period will be how large companies execute and what the consumer is doing.

For example, I expect a muted stock price reaction post-earnings should a company say they missed on bottom-line estimates due to unfavorable changes in foreign exchange rates. A stock is more likely to get slammed if they cite inventory problems and weakening demand.

Bottom Line

There are many moving parts ahead of one of the most crucial earnings quarters in years. Will firms attempt to throw the kitchen sink at the quarter and slash profit guidance figures to lower the bar for the rest of the year? It’s possible. They might also point to a soaring U.S. dollar as a reason for somewhat soft net income. The upside is that should the greenback retreat in the years ahead, that would be a tailwind for large multinational corporate profits.

Disclosure: I have no position in currencies mentioned in the article.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI