- The global energy complex is in the midst of a supercycle, according to a recent note by JPMorgan

- Exxon’s first-quarter earnings were the highest since 2014

- The US oil giant is favoring returning capital to investors instead of spending the spare cash on expansion plans

- For tools, data, and content to help you make better investing decisions, try InvestingPro+

Shares of US energy giant Exxon Mobil (NYSE:XOM) have been on fire for more than a year now. After surging 67% in 2021, the Irving, Texas-based company gained another 45% this year, vastly outperforming other market sectors. XOM closed Wednesday at $86.79.

But as the rally continues, investors in energy stocks also begin to see macroeconomic risks mounting on the horizon. Foremost, they wonder how far the current oil demand boom can go when the post-pandemic economic expansion grows increasingly uncertain.

Crude has jumped more than 35% this year to around $107 a barrel, mostly due to Russia’s invasion of Ukraine in late February. The European Union is moving closer to a formal ban on Russian energy imports to punish Moscow for the war.

While supply constraints continue to keep oil prices elevated, the demand side of the equation could reverse if the US economy slips into a recession.

This unease is evident from this year’s massive sell-off in equity markets, as the fear of persistent inflation and fast-climbing interest rates prompts investors to keep shunning risk assets.

Although it’s almost impossible to predict the direction of highly volatile energy markets in the short-run, it is clear that the US energy giant Exxon favors returning capital to investors instead of spending the spare cash on capacity expansions—a move that should bring stability to the stock in the long run.

Exxon told investors last month that it’s tripling its share-buyback program to $30 billion, while Chevron (NYSE:CVX) said it would repurchase a record $10 billion of stock before this year. These oil giants can reward investors as they reap cash windfalls from the multi-year high oil prices.

Exxon’s first-quarter earnings, excluding a $3.4 billion impairment due to its decisions to exit Russia, were the highest since 2014, while Chevron’s were the best since 2012.

Energy Supercycle

According to a recent note by JPMorgan, the global energy complex is in the midst of a supercycle that identified many companies that should be on investors’ buy lists.

As energy demand grows and countries look to shore up their fuel reserves, the firm said that capital would flow to areas across the energy complex.

Its note adds:

“In a period of overall energy tightness, we think that XOM could see a synchronized period of above-normalized earnings across the entire portfolio.”

JPMorgan has a $100 target on the stock, about 14% above where the stock closed on Wednesday.

Morgan Stanley also reiterated Exxon as overweight, saying the oil and gas giant remains “uniquely positioned” due to its integrated energy complex. As explained in Its note:

“XOM’s large downstream footprint makes it an outsized beneficiary of strong refining margins relative to peers.”

Political Headwinds

As oil majors enjoy the most supportive pricing environment since 2014, they are also coming under increasing pressure to expand their output and help ease record-breaking gas prices.

Key Democrats in the US House of Representatives demanded Exxon and peers Chevron, Shell (NYSE:SHEL), and BP (NYSE:BP) immediately halt dividends and share buybacks until the war’s conclusion and scolded them for “profiteering off the crisis in Ukraine.”

According to a report in Bloomberg, the lawmakers faulted Exxon and the other three oil explorers for collectively spending $44 billion on buybacks and payouts last year and planning to shell out another $32 billion in 2022.

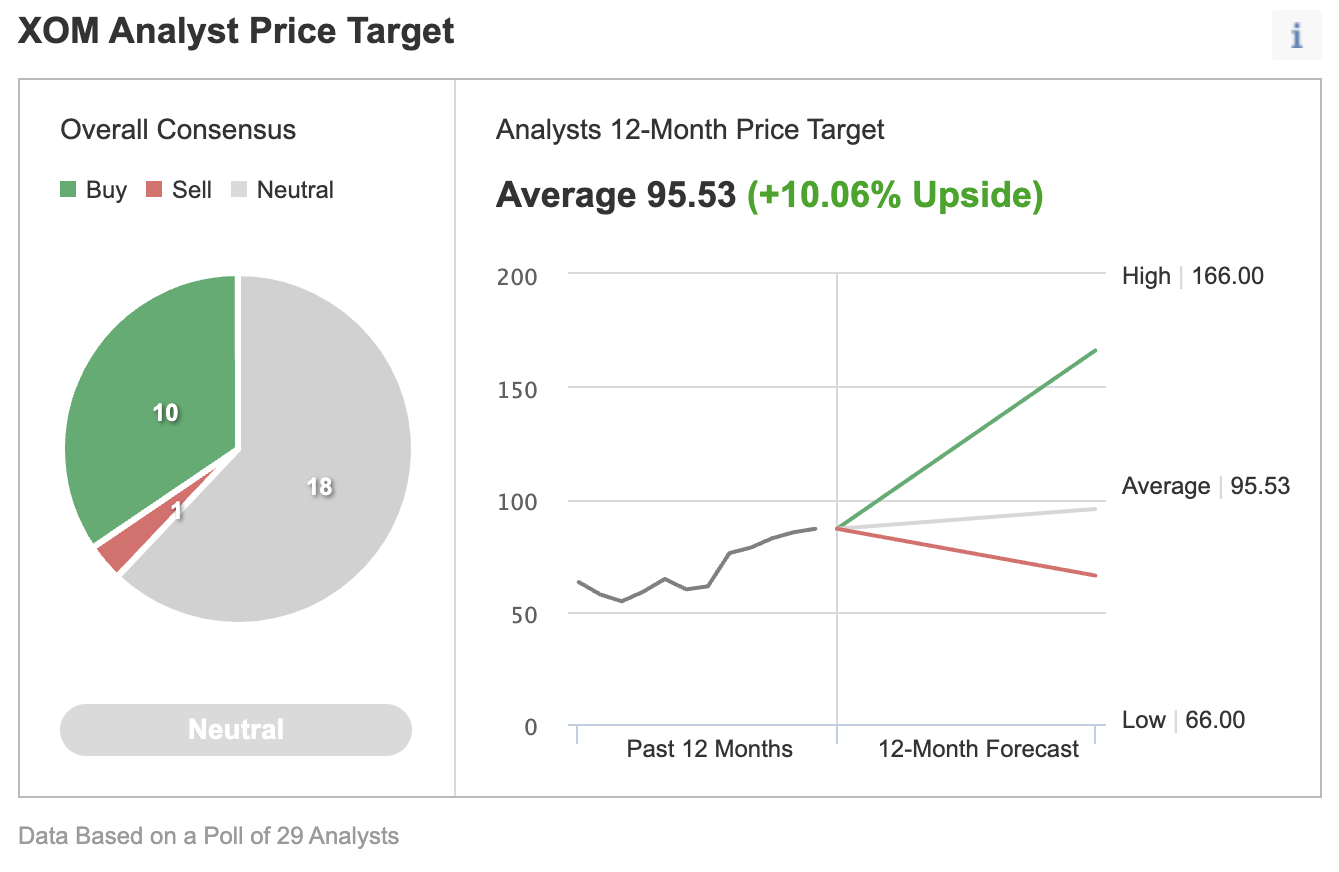

These political pressures and the risk of a recession are perhaps the reasons behind the neutral consensus rating on XOM stock, according to an Investing.com poll of 29 analysts.

Source: Investing.com

Bottom Line

XOM stock is an excellent long-term candidate to benefit from the current boom in energy markets. However, as risks mount, a sustained share price growth will depend on the company keeping spending under control and focusing on returning more cash to shareholders.

Interested in finding your next great idea? InvestingPro+ gives you the chance to screen through 135K+ stocks to find the fastest growing or most undervalued stocks in the world, with professional data, tools, and insights. Learn More »