Wall Street pays close attention to firms at the forefront of disruptive technologies, such as artificial intelligence, the Internet of Things and distributed ledger systems like blockchains.

According to the British Accounting Review:

“[They] involve unpredictable, volatile markets, rapidly changing environments and complex technologies.”

Today, we introduce two thematic exchange-traded funds (ETFs) that could appeal to investors wishing to allocate capital to emergent and disruptive technologies.

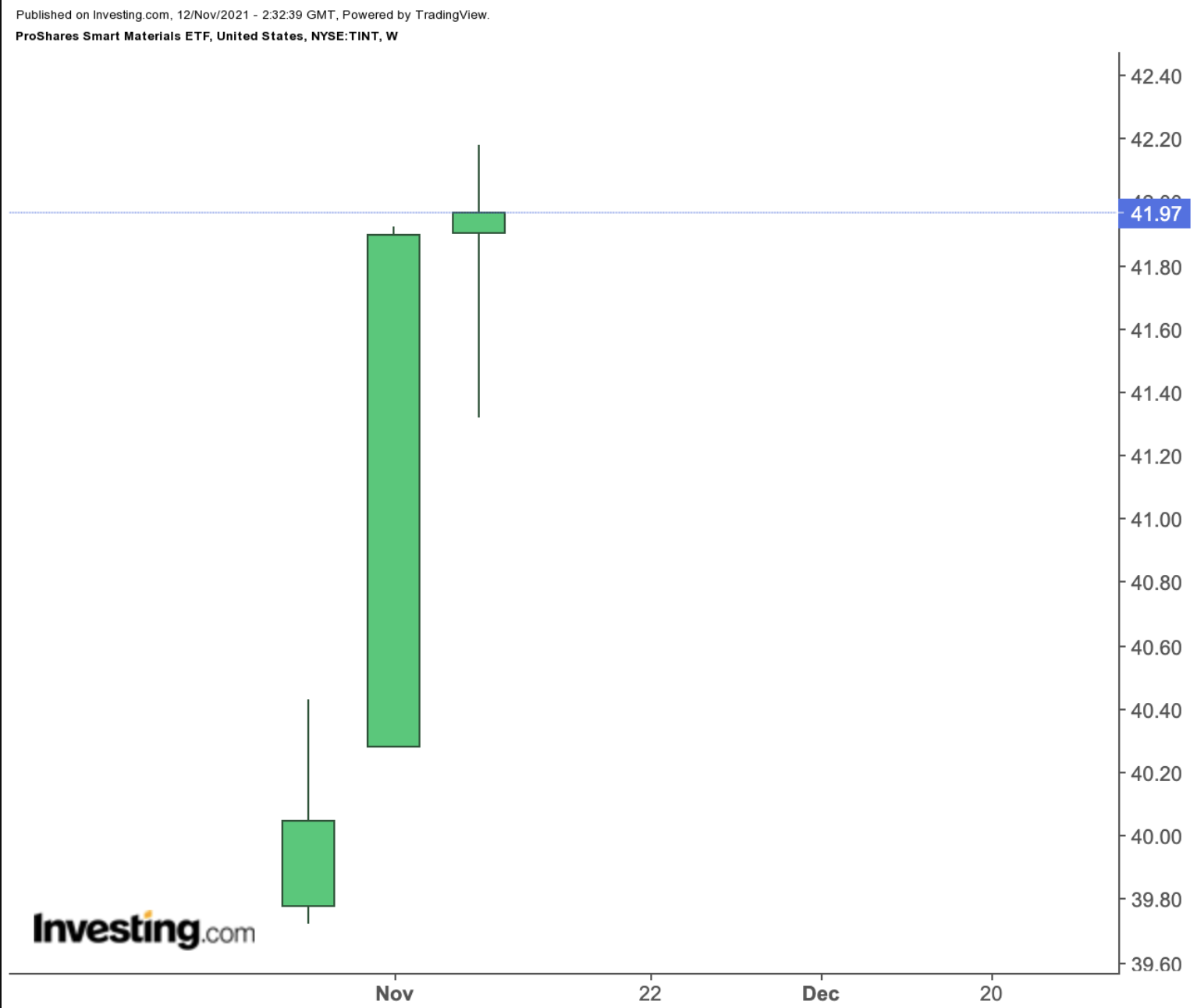

1. ProShares Smart Materials ETF

- Current Price: $41.97

- 52-Week Range: $39.72 - $42.18

- Expense Ratio: 0.58% per year

This fund focuses on smart materials, “which can sense and respond to a broad range of stimuli, including electric and magnetic fields, temperature, pressure, mechanical stress, hydrostatic pressure, nuclear radiation and pH change.”

The ProShares Smart Materials ETF (NYSE:TINT) started trading in late October. As a pure-play fund, it invests in firms that are leading the way in the smart materials space. For example, these companies could be involved in research and development as well as manufacturing of smart materials. End markets for smart materials extend to defense and aerospace, automotive, electronics, health care as well as consumer goods.

TINT, which tracks the Solactive Smart Materials Index, currently has 30 stocks. More than 51% of companies are based in the US. Others come from South Korea (17.26%), France (11.57%), Switzerland (4.84%), Belgium (4.49%) and others.

The materials sector has the biggest slice, with 67.87%, followed by information technology (16.97%), industrials (13%) and health care (2.16%). The leading 10 holdings comprise more than 45% of net assets of about $5 million.

Among the leading names in the fund are the South Korea-based chemicals group Hansol Chemical; manufacturer of paints and coatings firm Sherwin-Williams (NYSE:SHW); Swiss chemicals name Sika (OTC:SXYAY); French aluminium rolled products manufacturer Constellium (NYSE:CSTM); and chip heavyweight Applied Materials (NASDAQ:AMAT).

TINT started trading on Oct. 27 at an opening price of $39.78. It is now just shy of $42, up more than 5%. Due to increased use of smart material, we can expect to hear more about this niche segment in the future.

In fact, recent metrics suggest:

“The global smart materials market was valued at US$5451.6 in 2020 and will reach US$8,135.6 million by the end of 2027, growing at a CAGR of 6.9% during 2022-2027.”

2. ROBO Global Robotics and Automation Index ETF

- Current Price: $70.42

- 52-Week Range: $52.26 - $72.41

- Dividend Yield: 0.17%

- Expense Ratio: 0.95% per year

The Robo Global® Robotics and Automation Index ETF (NYSE:ROBO) gives exposure to artificial intelligence, robotics and automation companies.

Industry statistics highlight:

“The AI robots market is expected to grow from US$6.9 billion in 2021 to US$35.3 billion by 2026; it is expected to grow at a CAGR of 38.6 % during the forecast period. [It] has been witnessing significant growth over the past years, owing to rise in demand for industrial robot and rise in adoption of AI robots in health-care industry to control COVID-19."

ROBO, which has 83 holdings, tracks the returns of the ROBO Global Robotics and Automation Index.

In terms of sectors, we see manufacturing and industrial (17%) followed by health care (12%) and logistics automation (12%). The top 10 names make up about 16% of net assets of $1.96 billion.

Leading holdings include Brooks Automation (NASDAQ:BRKS), which supplies automation and instrumentation equipment; digital health-care group iRhythm Technologies (NASDAQ:IRTC), known for wearable bio-sensing technology; Stratasys (NASDAQ:SSYS), which offers 3D printing solutions; consumer robot company iRobot (NASDAQ:IRBT); and Intuitive Surgical (NASDAQ:ISRG), known for its robotic surgery product, the da Vinci Surgical System.

ROBO returned almost 16% in 2021 and 33% in the past 12 months. The fund also hit a record high in recent days. Therefore, a potential decline toward $68 would improve the margin of safety for buy-and-hold investors.