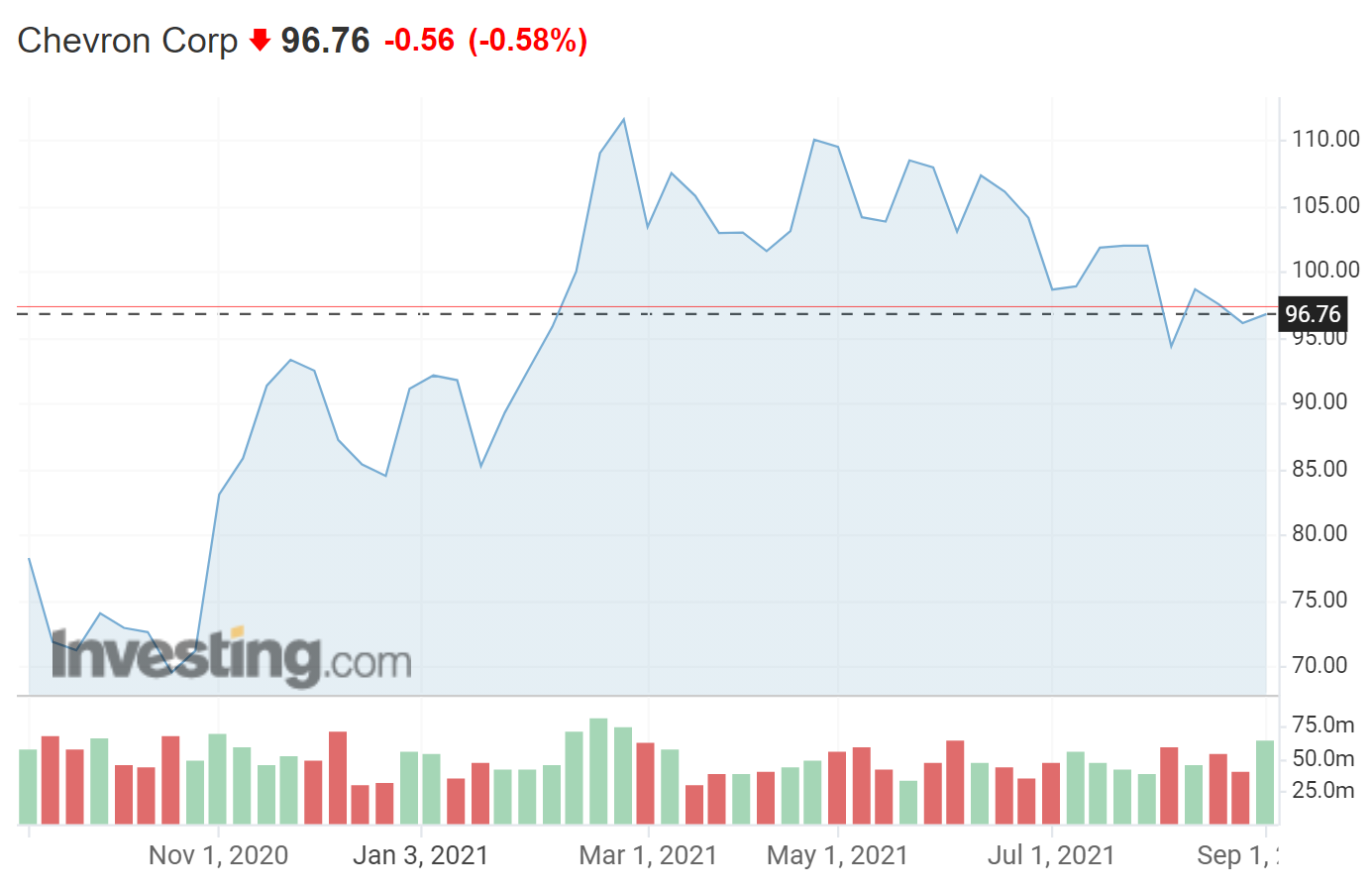

Chevron Corporation (NYSE:CVX) is the second largest oil and gas company in the US (market cap of $187 billion vs. Exxon Mobil (NYSE:XOM) at $234 billion). Chevron’s share price has moved dramatically during 2021.

After starting the year at $84.45, CVX climbed 32% to a YTD high close of $111.56 on Mar. 12. The shares are currently trading at $96.76, 13.3% below the March peak.

The variability in CVX is partly explained by oil prices. Crude oil started the year at $48.50 per barrel, rising to a high close of $75.25 on July 13, and has since declined to the current level of $71.96 per barrel.

There are a number of other significant factors impacting CVX. First are expectations for increasing demand as the US and other nations ramp up travel following COVID. With the spread of the Delta variant, however, the outlook for demand recovery has weakened.

Oil prices are also coupled to inflation expectations and interest rates. The futures prices of commodities rise as the market expects higher inflation and interest rates.

Finally, there is increasing uncertainty as to regulatory and market pressures relating to climate change. The recent board upheaval at Exxon is a case in point. Investors have concerns as to the potential for taxes or other costs associated with carbon-intensive energy sources. The costs associated with reducing carbon emissions are difficult to estimate.

On Sept. 11, CVX gave a major presentation outlining the firm’s plans to reduce carbon output. The company is focusing on renewable, low-carbon fuels (such as hydrogen) rather than on electricity-generating renewables such as wind and solar.

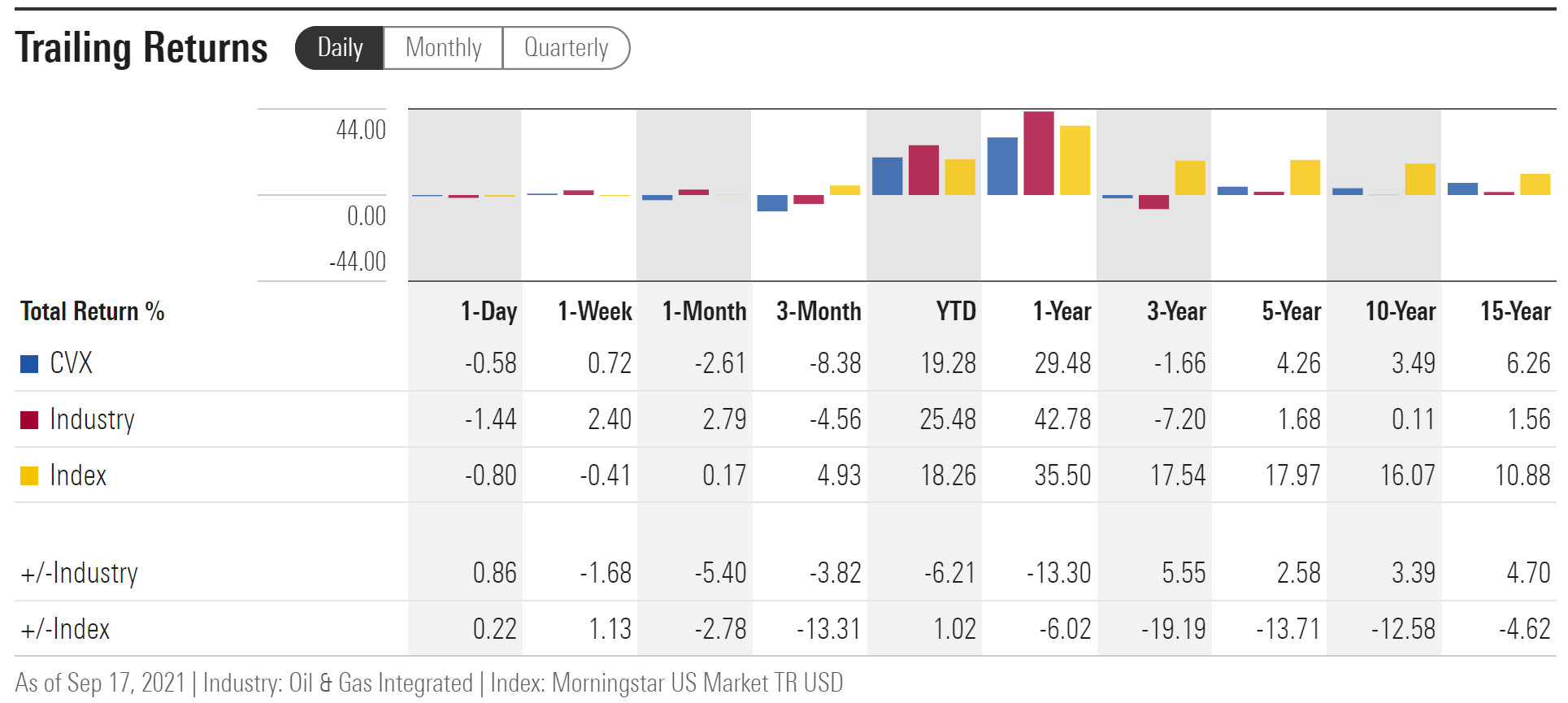

Looking at longer trailing periods, oil and gas producers have not provided attractive returns. Over the past 3 years, CVX has had a negative total return, albeit less negative than the industry as a whole.

Source: Morningstar

From a comparative ratio standpoint, CVX is relatively cheap compared to recent years, with a forward P/E of 14.4. The forward dividend yield is 5.54%. The 5-year (annualized) dividend growth rate is 4.2%.

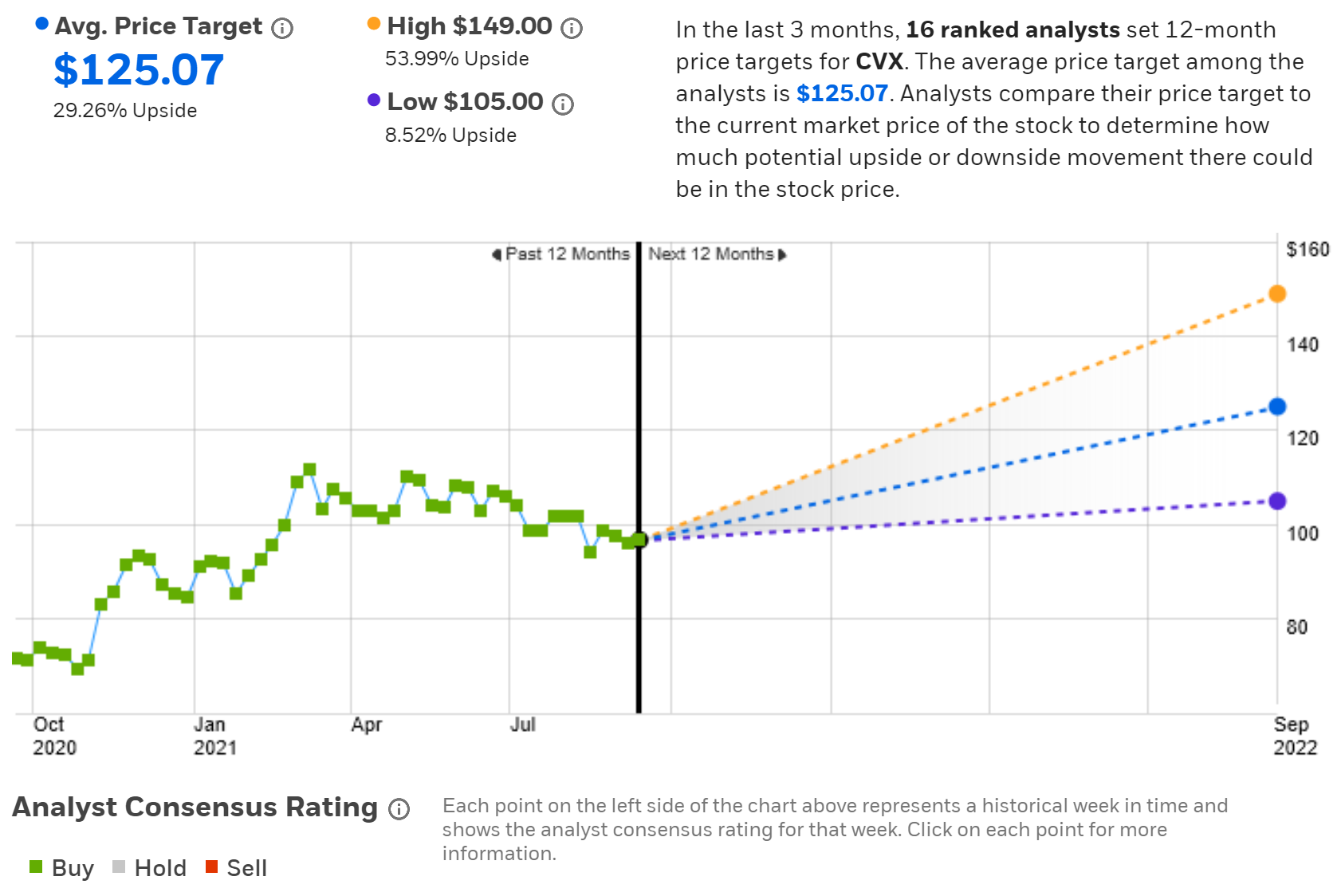

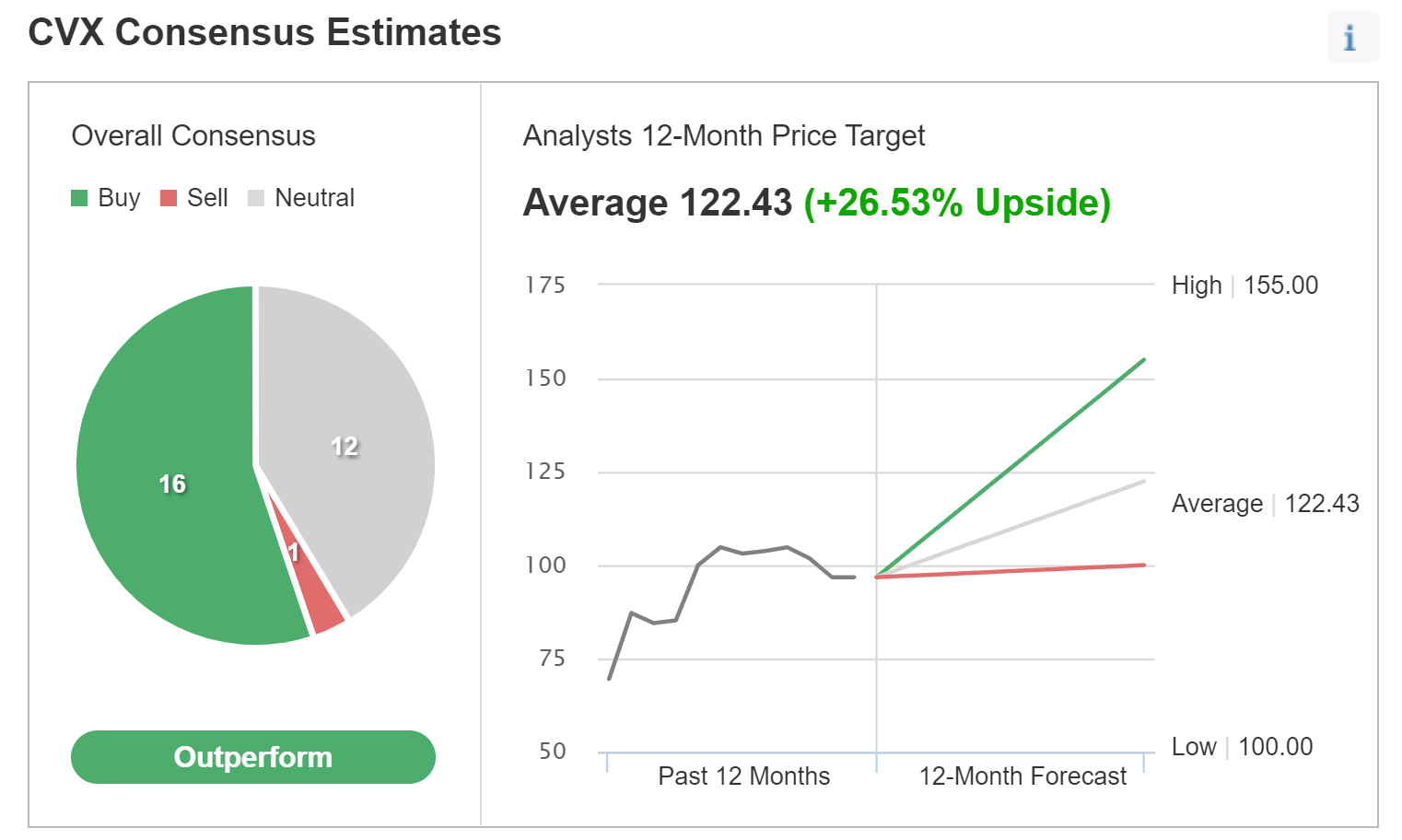

A great deal of the valuation of CVX depends on the outlook for earnings, as determined by commodity prices, demand growth, and regulatory/policy changes. I look at two forms of consensus outlooks. The first is the well-known Wall Street analyst consensus. The Wall Street consensus price targets have meaningful predictive value, as long as the dispersion among the analysts is not too high.

The second is the market-implied outlook, representing the consensus view of options traders. The price of an option represents the market’s consensus estimate of the probability that the share price of the underlying security will rise above (call option) or fall below (put option) a specific level (the strike price) between today and the option expiration date.

By analyzing call and put prices at a range of strikes and a common expiration date, it is possible to infer the consensus outlook of the options market from now until that date. This is the market-implied outlook. For those who are unfamiliar with this concept, I have an overview post, including links to the relevant financial literature. For a discussion of why consensus outlooks and estimates are especially useful, I recommend this book.

Wall Street Analyst Consensus for CVX

eTrade’s version of the Wall Street consensus is derived using the views of 16 ranked analysts who have issued price targets and ratings within the past 90 days. The consensus rating is bullish and the consensus 12-month price target is $125.07, 29.3% above the current price. While there is quite a range among the individual analysts, even the lowest price target is 8.5% above the current price.

Source: eTrade

Investing.com calculates the Wall Street consensus from the views of 29 analysts. The consensus rating is bullish and the consensus 12-month price target is 26.5% above the current level, almost identical to eTrade’s calculation of the consensus price target.

Source: Investing.com

The consensus view of the Wall Street analysts is that CVX is substantially under-priced. A key question in determining whether CVX is a good buy, of course, is the level of risk that investors face.

Market-Implied Outlook for CVX

I have analyzed options expiring on Jan. 21, 2022 and Mar. 18, 2022 to generate the market-implied outlooks for a 4-month period and the next (almost) 6-month period, respectively. I chose these expiration dates because they tend to be quite liquid and because they provide insight through the end of 2021 and into 2022.

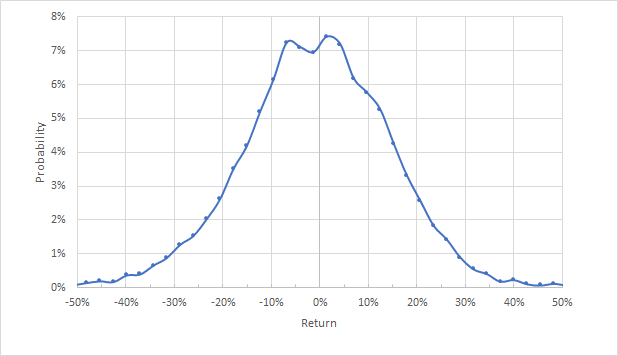

The standard presentation of the market-implied outlook is in the form of a probability distribution of price returns, with probability on the vertical axis and return on the horizontal.

Source: Author’s calculations using options quotes from eTrade

The market-implied outlook for the next 4 months (from now until Jan. 21, 2022) is generally symmetric, with similar probabilities for positive and negative returns of the same magnitude. There are two small peaks in probability, with the maximum of the two corresponding to a price return of +1.5%. The secondary peak corresponds to a price return of -6.8%. These peaks are not sufficiently distinct to be considered meaningful. The annualized volatility derived from this distribution is 29.5%.

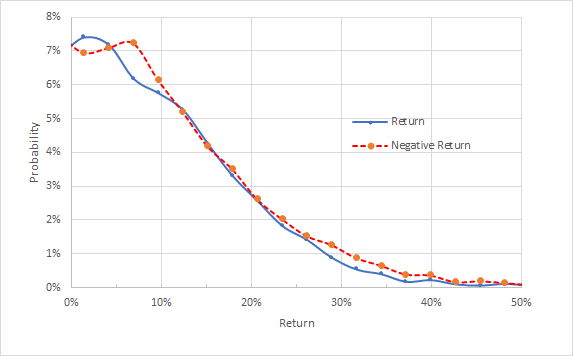

To make it easier to directly compare the options market’s outlook for the relative probabilities of positive and negative returns, I rotate the negative return side of the distribution about the vertical axis (see chart below)

Source: Author’s calculations using options quotes from eTrade. The negative return side of the distribution has been rotated about the vertical axis.

Aside from the small peaks, the probabilities of positive and negative returns of the same magnitude are very close to one another (the dashed red line is close to the solid blue line). Dividend-paying stocks tend to have a negative tilt in the market-implied outlook because the dividends reduce the potential price appreciation relative to declines.

In addition, theory suggests that the market-implied outlook should have a negative bias because risk-averse investors are willing to pay more than fair value for put options to limit losses. Considering these two factors, in light of CVX’s large dividend, I interpret the market-implied outlook as slightly bullish for the next 4 months.

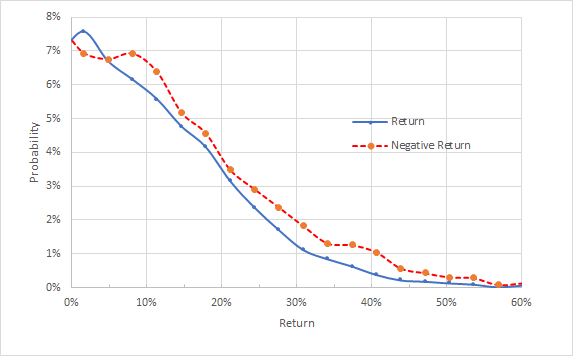

Looking out 6 months, to Mar. 18, 2022 (see chart below), the market-implied outlook is tilting somewhat more towards negative returns. The probabilities of negative returns are consistently higher than for positive returns (the red dashed line is consistently above the solid blue line). The peak probability, corresponding to a price return of +1.6%, is not large enough to be considered meaningful. The annualized volatility derived from this distribution is 29.0%. I interpret this market-implied outlook as being neutral with perhaps a slight bearish tilt.

Source: Author’s calculations using options quotes from eTrade. The negative return side of the distribution has been rotated about the vertical axis.

The market-implied outlook for CVX is slightly bullish into the start of 2022, turning neutral to slightly bearish for the six-month outlook. The expected volatility calculated from the market-implied outlooks is stable at about 29%. eTrade calculates implied volatility (IV) for the options expiring in January and March. The IV is 26% for the January options and the March options.

Summary

As a sector, energy equities generally, and CVX in particular, has been a disappointment over the past 3-15 years. The last year has seen a solid rally from COVID-driven lows, but the long-term average returns are low.

The equity analyst consensus for CVX for the next year is positive, with a consensus 12-month price target that is 25% above the current level. With this 5.5% dividend yield, the consensus total return is about 30%. The projected annualized volatility for CVX from the market-implied outlook is 29%. The IV calculated for the January and March options is a bit lower, at 26%.

As a rule of thumb for a buy, I want to see an expected 12-month return that is greater than half the expected volatility. CVX is at twice this level.

The market-implied outlook is slightly bullish for the period from now until Jan. 21, becoming neutral and even a bit bearish for the 6-month period. I am rating CVX as a buy, but will revisit my analysis in early 2022.