The EUR/USD was holding near the August high of 1.12 handle, still finding mild support from China’s announcement yesterday of large-scale stimulus measures. That announcement sent stocks surging and provided support for all procyclical currencies, especially commodity dollars.

The Chinese attempts to boost their economy certainly had an impact, along with the weaker US consumer confidence seen yesterday. This added to the optimism triggered by the Federal Reserve’s rate cut last week.

But despite these international factors, domestic concerns remain for the German economy, discouraging traders from being heavily positioned long on the euro, despite the dollar’s overall bearish trend.

So far, we haven’t seen a bearish reversal in the EUR/USD but that could soon change if eurozone data continues to remain soft.

Eurozone’s growth engine spluttering

Recession concerns for Germany, the Eurozone’s largest economy, intensified this week after a rather poor set of PMI data that were released on Monday, especially for the manufacturing sector where activity seems to be contracting at a faster pace every month, with the PMI now at 40.3. The services Sector PMI also came in below expectations. In fact, the French and Eurozone PMIs were also quite weak.

With those disappointing PMI readings, no one was expecting yesterday’s release of the German Ifo Business Climate, which is a composite index based on 9,000 surveyed manufacturers, builders, wholesalers, services, and retailers, to show any improvement. That proved to be the case with a reading of 85.4, which was not only below 86.1 expected but was also down from 86.6 the previous month.

EUR/USD upside capped

With the ECB hesitant to cut rates faster, and China’s economy far from its growth goal to support Eurozone exports, you do have to wonder where growth for the Eurozone might come from. That’s why traders are not rushing to buy the euro despite the big surge in Chinese equities as a result of the latest round of stimulus measures.

Lighter US calendar today

There are not any major data releases from the US as attention shifts stateside in the second half of the day. But the US economic calendar does get a little busier later this week. Key data releases this week include New Home Sales (today), the Final GDP estimate (Thursday), and the Core PCE index (Friday).

Thursday will also feature several speeches from Fed officials. Yesterday, we had a gauge of US consumer confidence by the Conference Board, which was projected to rise to 103.9 in September from 103.3 in August. However, it came in at 98.7 and thus disappointed expectations, keeping the EUR/USD supported.

The outlook for the US dollar now largely hinges on upcoming economic data. The Fed’s decision to cut rates by 50 basis points last week was partly anticipated, and that surprise is already factored into the market. For further weakening of the US dollar, traders will need to see more signs of an economic slowdown, particularly in the jobs market.

Last week, the Fed cut rates by 50 basis points and indicated another 50-point cut is likely before year-end, while also lowering its growth and inflation forecasts. The Fed Chair described this cut as a step in unwinding the historic tightening cycle, aiming to reduce the risk of a downturn while the economy remains strong.

Future moves will depend on labour market and to a lesser degree inflation data. While inflation is no longer a major concern for the Fed, any upside surprises in the Core PCE data could disrupt the current outlook and potentially turn the EUR/USD forecast bearish.

EUR/USD technical analysis and trade ideas

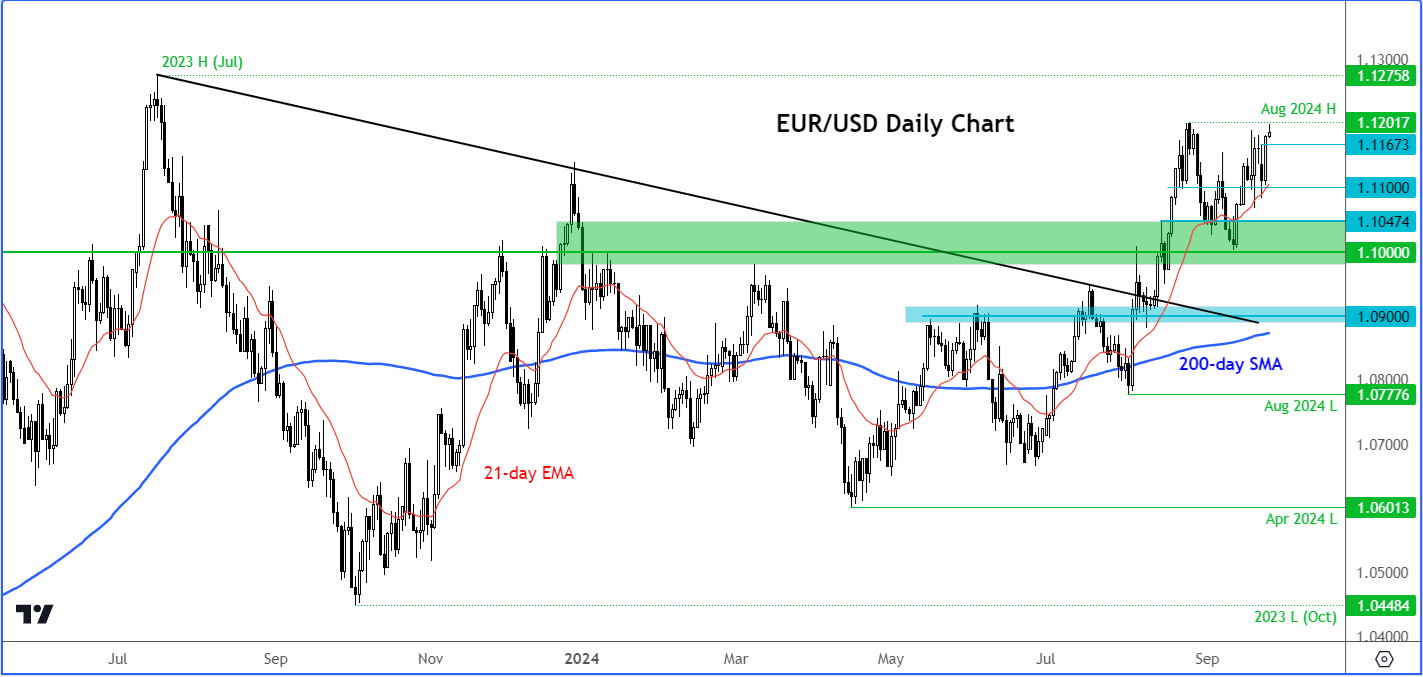

Consolidation is the name of the game for the EUR/USD, which is being supported almost entirely by a weak US dollar right now and renewed optimism over China (one Europe’s large exports destinations).

Source: TradingView.com

Support around 1.1100 has held for now – a closing break below it could potentially lead to a drop towards 1.1000 or even lower in the days ahead.

Resistance comes in around the 1.1200 handle, where it peaked in August. So far, we haven’t seen a bearish reversal stick in the charts but that could soon change should economic data from the Eurozone continue to disappoint.

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.

Read my articles at City Index

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI