- Several factors are weighing on the EUR/USD at the moment.

- Strong US labor market data, along with political uncertainty in the EZ has put the currency pair under pressure.

- Can EUR/USD hold support or will tomorrow's US inflation data trigger a fresh wave of selling?

- Invest like the big funds for under $9/month with our AI-powered ProPicks stock selection tool. Learn more here>>

The EUR/USD pair has been in a downtrend after establishing a local peak just above 1.09. This decline is fueled by several key factors, such as:

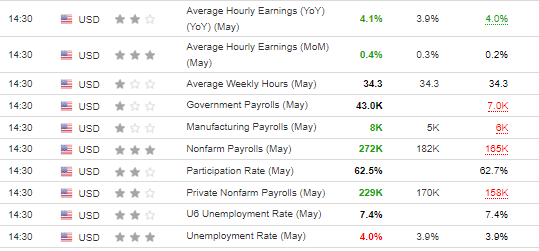

- Strong US Labor Data: Friday's better-than-expected jobs report bolstered the US dollar. The data, showcasing robust job growth and rising wages, reduced expectations of September rate cuts by the Fed.

- French Election Uncertainty: The surprise announcement of snap elections in France following President Macron's defeat has put the euro under pressure. The right-wing National Unity party's victory in recent legislative elections is causing market jitters.

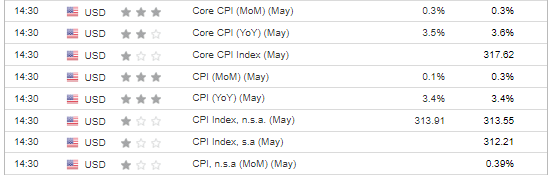

- Upcoming US Inflation Data and Fed Meeting: "Super Wednesday" in the US looms large, with the release of inflation data and another Fed meeting in the offing. This flurry of economic releases is expected to inject significant volatility into the market.

Against this backdrop, let's take a look at the key factors to watch for trader looking to play the increased volatility in the currency pair.

EUR/USD: US Data Remains Key for Next Direction

The US labor market continues to reign supreme as a key indicator for Fed monetary policy. Friday's data, with its positive surprises in nonfarm jobs and average hourly earnings, underscored the labor market's strength. Even a slight uptick in the unemployment rate couldn't alter the Fed's hawkish stance.

All eyes are on Wednesday's release of US inflation data for May. Forecasts suggest minimal changes, which, if confirmed, could dampen calls for the Federal Reserve to accelerate interest rate cuts.

But Wednesday isn't just about inflation. It's also "Super Wednesday" – the day the Fed makes its next interest rate decision. While rates are expected to stay put, all eyes will be on the accompanying statement and Chairman Jerome Powell's quotes for clues about future monetary policy direction.

EUR/USD Stalls After ECB Cut, Eyes on US Inflation and French Elections

The ECB delivered the anticipated 25 basis point rate cut last week, but their message lacked specifics about future policy.

This ambiguity kept the EUR/USD pair relatively stable. Investors are now waiting for next inflation data release, which will be critical for the ECB's next move in the bank's next meeting.

Adding to market uncertainty, Sunday's Parliamentary elections in Europe saw a rise in support for right-wing parties, particularly in France. Upcoming French parliamentary elections are now on investors' radars.

The EUR/USD pair has paused its downward movement near the 1.0740 support zone. While a break below 1.07 could lead to a test of 1.0670, the key target remains the yearly low around 1.06.

A clear break below 1.07, potentially triggered by higher-than-expected inflation data, is needed to confirm a continued downtrend for EUR/USD.

***

Become a Pro: Sign up now! CLICK HERE to join the PRO Community with a significant discount.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.