- EUR/USD's 1.09 breakout remains likely ahead of the Eurozone CPI and ECB decision.

- Right now, the pair is in an uptrend.

- Eventually, it will attempt to break out above 1.09 once again.

- Unlock AI-powered Stock Picks for Under $8/Month: Summer Sale Starts Now!

Last Friday's release of US inflation data was overshadowed by a failed assassination attempt on Donald Trump during an election rally. The incident theoretically boosts Republican election prospects and could strengthen the US dollar.

However, the trajectory of the greenback in the weeks ahead will ultimately hinge on macroeconomic data and signals from the Federal Reserve. Currently, market expectations indicate a nearly 90% likelihood of a rate cut as early as September, with no chance of rates remaining unchanged.

This expectation could sustain downward pressure on the US dollar, favoring gains in major currency pairs like the EUR/USD. Key events this week include Eurozone inflation readings and the ECB meeting, expected to keep interest rates unchanged.

Rate Cut Probabilities Keep Rising

Federal Reserve Chairman Jerome Powell recently boosted expectations of interest rate cuts during an interview at the Economic Club of Washington DC. He expressed increased confidence that recent macroeconomic data indicates inflation moving toward the Fed's 2% target.

This sets the stage for a potential rate cut in September, barring negative surprises in July's data. The next Fed meeting is scheduled for late July, and a cut is unlikely at that time.

The US dollar is currently testing a critical support level of around 103.80. A breach of this level could trigger further depreciation.

Therefore, the price action in this area remains crucial. The next targets for sellers are the levels of 103 and 102.30.

EUR/USD: CPI Data Could Trigger Trading Opportunities

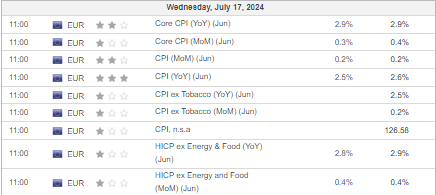

This week's macroeconomic calendar is set to bring heightened activity for the euro. On Wednesday, the focus will be on inflation figures, with expectations for a slight decrease in consumer inflation while core CPI likely holds steady.

Thursday will see the ECB will decide on the monetary policy. With previous indications pointing towards unchanged interest rates, the Council aims to evaluate the economic impact of recent decisions.

However, if CPI fails to rebound above 3%, there could be potential for two additional 25-basis-point cuts by year-end.

EUR/USD Maintains Uptrend

Despite the recent test around the 1.09 region, where local highs remain, demand-side momentum continues to favor the bulls. Key resistance lies at the 1.09 level, a breach of which could target March's peak near 1.0980.

A critical bearish signal would be a break below the local trend line, potentially triggering a modest correction towards 1.0840.

***

This summer, get exclusive discounts on our subscriptions, including annual plans for less than $8 a month!

Are you tired of watching the big players rake in profits while you're left on the sidelines?

InvestingPro's revolutionary AI tool, ProPicks, puts the power of Wall Street's secret weapon - AI-powered stock selection - at YOUR fingertips!

Don't miss this limited-time offer.

Subscribe to InvestingPro today and take your investing game to the next level!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.