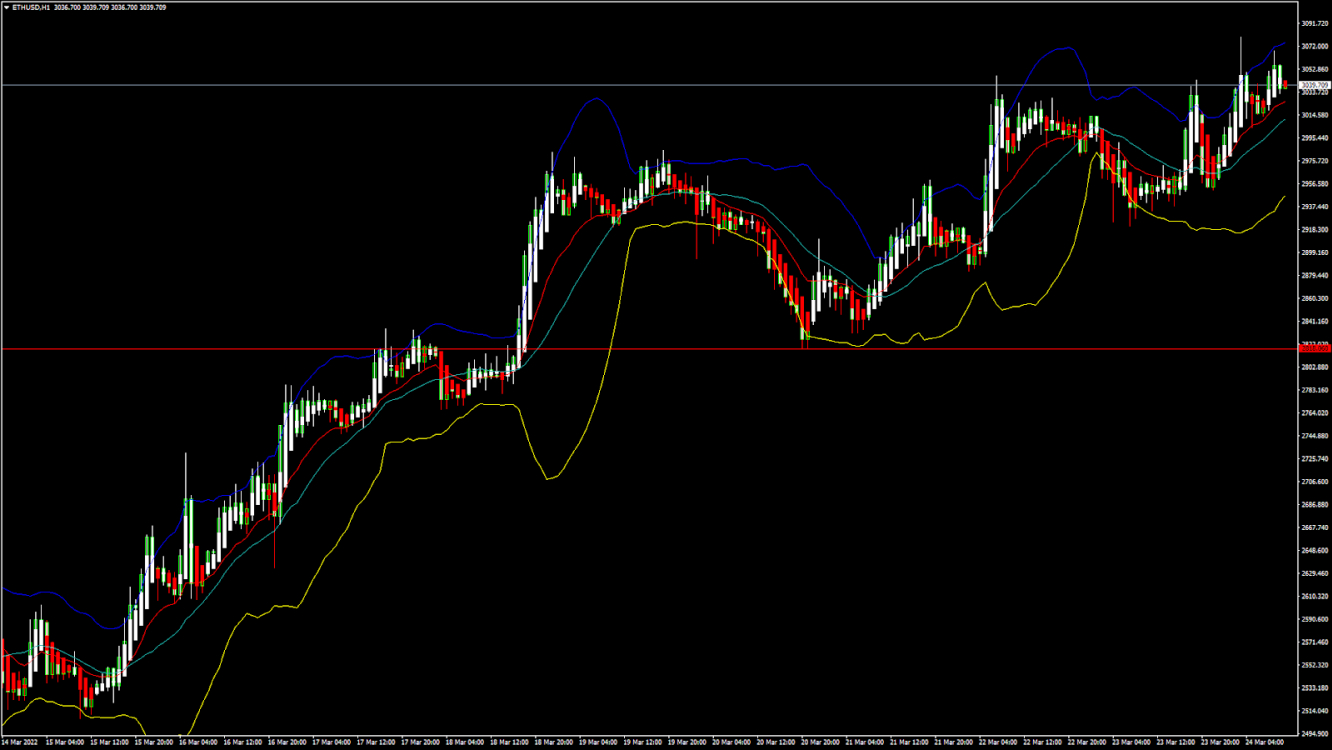

ETHUSD: Double Bottom Pattern Above $2,800

Ethereum continues its upwards momentum from last week and has managed to cross the $3,000 levels in today’s European trading session.

The continued appreciation in the price of ETHUSD is a result of an increased demand for holding ETH amid its transition to ETH 2.0.

In today’s early Asian trading session, Ethereum touched an intraday high of $3,078 and an intraday low of $2,972.

We can clearly see a double bottom pattern above the $2,800 handle, which is bullish, and signifies the end of a bearish phase and the start of a bullish phase in the markets.

ETH is now trading just below its pivot level of $3,055 and moving within a bullish channel. The price of ETHUSD is testing its classic resistance level of $3,067 and Fibonacci resistance level of $3,079 after which the path towards $3,200 will get cleared.

The relative strength index is at 57 indicating a STRONG demand for Ethereum and the continuation of buying pressure in the markets.

All of the technical indicators are giving a STRONG BUY market signal.

All of the moving averages are giving a BUY signal, and we are now looking at the levels of $3,200 to $3,300 in the short-term range.

ETH is now trading above both its 100 hourly and 200 hourly simple moving averages.

- Ether continues its bullish momentum above the $2,800 mark

- The short-term range appears to be strongly BULLISH

- The daily RSI is above 50 at 61, indicating a BULLISH market

- The average true range is indicating LESSER market volatility

Ether Continues Bullish Momentum Above $2,800

ETHUSD has gained a strong bullish momentum with the price trading above the $3,000 handle in the European trading session today.

We can see continued gains in the prices of Ethereum since it touched a low of $2,171 on January 24th, which translates to a gain of 39% in 2 months.

Ethereum is now moving in a bullish continuation pattern which indicates further appreciation in the prices of ETHUSD this week.

ETHUSD is now facing its immediate resistance level of $3,070, after which we will see a linear progression towards $3,200.

This week’s key support level to watch is $3,000, and key resistance level is $3,100.

ETH has gained 3.06% with a price change of 90.27$ in the past 24hrs, and has a trading volume of 17.442 billion USD.

We can see a 25.59% increase in the total trading volume in the last 24 hrs. as more long-term investors are coming back into the markets.

The Week Ahead

At present, Ethereum bulls have managed to push the prices of ETHUSD above $3,000. If the price of ETHUSD remains above these levels, we may see a linear progression towards $3,200 and $3,300 this week.

The immediate short-term outlook for Ether has turned strongly BULLISH, the medium-term outlook has turned bullish, and the long-term outlook for Ether is NEUTRAL in present market conditions.

This week, Ether is expected to move in a range between $3,000 and $3,200, and next week, Ether is expected to enter a consolidation phase above $3,200.

ETH 2.0

Ethereum is to enter into a proof-of-stake consensus mechanism which will eliminate the high energy mining requirements and also bring down the ETH transaction fees.

This Ethereum 2.0 upgrade will happen in phases. The final transition will reduce the total energy requirements by 99% and at the same time scale the network capacity by increasing the number of transactions to 100,000 transactions per second (TPS). In comparison, at present, the leading payment service network VISA can process up to 65,000 TPS.

Technical Indicators:

The moving averages convergence divergence (12,26): at 15.93 indicating a BUY

The ultimate oscillator: at 54.44 indicating a BUY

Rate of price change: at 2.514 indicating a BUY

The Williams percent range: at -31.74 indicating a BUY

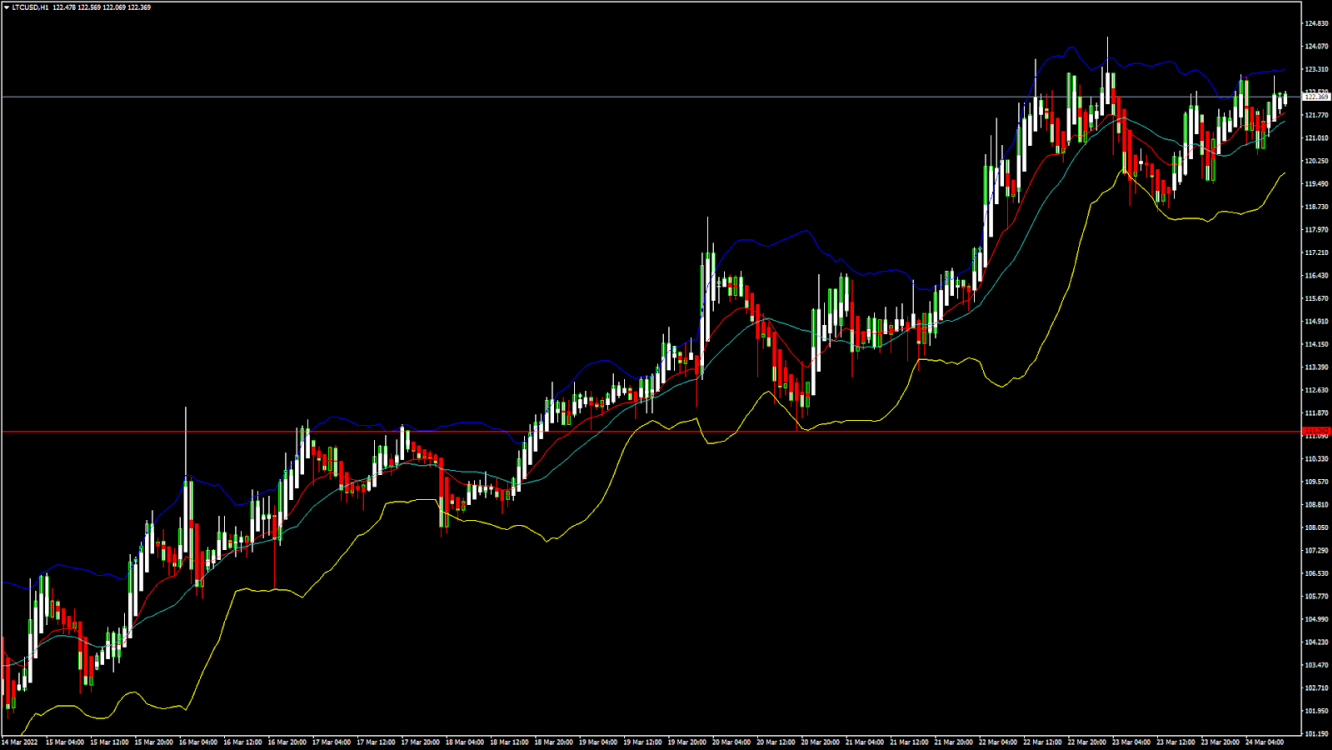

LTCUSD: Bullish Engulfing Pattern Above $111

Litecoin continues its bullish momentum against the US dollar, and the prices have broken the important resistance level of $120 in the European trading session today.

LTUCSD touched an Intraday high of 123.12 in the Asian trading session, and an intraday low of 120.46 in the European trading session today.

We can clearly see a bullish engulfing pattern above the $100 handle which signifies the end of a bearish phase and the start of a bullish phase.

Litecoin is now trading above its 100 hourly simple moving average and 200 hourly simple moving average. The price of LTCUSD is just below its pivot level of 122.33

The relative strength index is at 55 indicating a STRONG demand for Litecoin and the continuation of the bullish momentum in the markets.

The price of Litecoin remains above all of the moving averages, which are now giving a STRONG BUY signal at current market levels of 122.30.

Both the StochRSI and ultimate oscillator are indicating an OVERBOUGHT level, which means that the price is expected to decline in the short-term range.

After touching a low of 92.51 on February 24th, its prices continue to rise, trading at present levels of 122.36 with a gain of almost 32%.

The short-term outlook for Litecoin has turned strongly BULLISH.

- All of the technical indicators are giving a STRONG BUY signal

- Litecoin continues its bullish momentum above $110

- On-chain metrics are giving a BULLISH projection

- The average true range is indicating LESSER market volatility

Litecoin: Bullish Momentum Continues Above $110

The price of Litecoin continues to move in a strongly bullish channel below the $110 handle, and we can see a linear progression towards $125 this week.

We can see the 50-day EMA crossing the 200-day EMA, indicating the continuation of the bullish phase in the markets this week.

The price of LTCUSD is now facing its classic resistance level of 122.76 and Fibonacci resistance level of 123.03, after which the path towards $125 will get cleared.

The daily RSI is printing at 62 which also indicates a strong demand for Litecoin in the medium term.

LTC has gained 2.18% with a price change of 2.61$ in the past 24hrs, and has a trading volume of 0.804 billion USD.

Litecoin trading volume has decreased by 18.16% as compared to yesterday which appears to be normal.

The Week Ahead

We have seen that Litecoin continues to move in an up-channel pattern and is expected to consolidate above $120 today.

The on-balance volume is in line with the daily RSI indicating further appreciation in Litecoin next week.

The short-term outlook for Litecoin has turned strongly BULLISH, the medium-term outlook is BULLISH, and the long-term outlook is NEUTRAL at present market conditions.

This week, we are looking at levels of $120 to $125, and next week, Litecoin is expected to trade above $125.

Technical Indicators:

The moving averages convergence divergence (12,26): at 2.119 indicating a BUY

Stoch (9,6): at 77.85 indicating a BUY

The rate of price change: at 19.39 indicating a BUY

The commodity channel index (14-day): at 140.62 indicating a BUY