This post was written exclusively for Investing.com

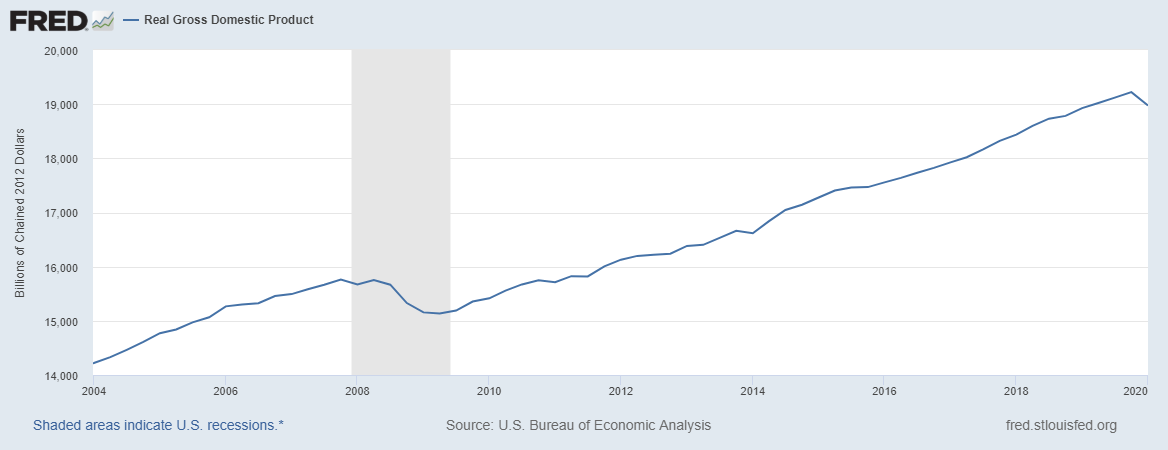

The stock market has raced to record highs in 2020, fueled by investor euphoria over the potential bounce-back in the economy as the US reopens. Despite this optimism, the US economy finds itself in a rather tight spot, with data that shows improvement, but that in reality is only bringing us back to where the economy was in the depths of the Great Recession of 2008 and 2009.

And that ended up taking stocks, and the economy, a reasonably long time to recover. To put it in perspective, from the time it hit 13-lows in March 2009, It took the S&P 500 another four years to rally back to where it had been trading prior to the onset of the financial crisis.

Even the Federal Reserve maintains a gloomy outlook for the economy, pledging to keep rates near zero for the foreseeable future. Worse, inflation metrics are falling, and that is likely to send yields on the 10-year Treasury lower over time, potentially even towards 0% as well .

At some point, the absence of inflation, meaningful economic growth, and lower rates may spook stocks, which is not all that different from what we witnessed in March, when yields tumbled, dragging stocks along with them.

Fed Issues Weak Outlook

At the latest FOMC meeting, the Fed projected GDP would contract by 6.5% in 2020, and then rebound by 5% in 2021 and 3.5% in 2022. This suggests the central bank does not expect the economy to get back to where it was in 2019 until some time in mid- to late-2022. That would imply an even steeper deterioration in GDP than in 2008, but, based on the Fed’s projections, a slightly faster recovery.

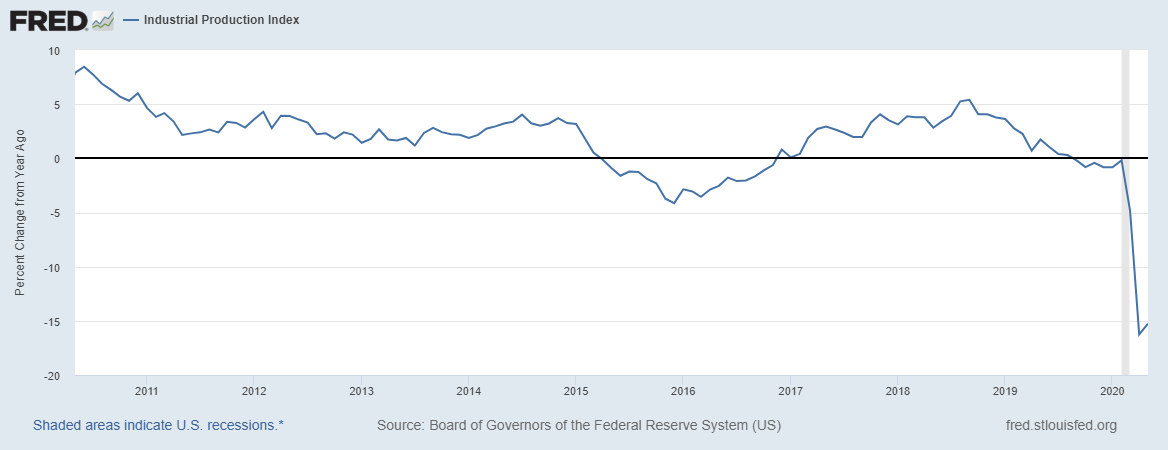

The macro data also shows the current recession caused by the pandemic has been significantly worse than that of 2008-09, and that the economy is just now getting back where it was before the downturn. Retail sales in May showed a giant month-over-month gain of about 17.7%. However, on a year-on-year basis, those numbers were significantly worse than the monthly print, falling by more than 6%, which is on par with some of the worst readings recorded in 2008-09. Meanwhile, other data points, like industrial production have fallen dramatically as well, and saw almost no meaningful bounce in May.

Some of the unemployment data has been even worse, with the latest reports showing continuing claims have remained around 20.5 million for the past four weeks, about three times greater than at the depths of the last recession. The big bump up in May employment may have been overstated as well, with about 4.9 million workers having been misclassified. Without the misclassification, May's non-farm payrolls would have registered a rise in the number of unemployed to 25.4, compared with the reported 20.4 million, which, in turn, would have increased the unemployment rate to 16.1%, versus the reported 13%.

Meanwhile, critical inflation readings such as the consumer price index, producer price index, and even the trimmed mean PCE readings have fallen to some of their weakest levels in years. With low inflation and an economy that is in its worst recession in living memory, on par at least with that of 2009, if not worse, there may be a significant drag lower on interest rates over time, should these economic conditions not improve soon.

The technical chart shows that a drop in the 10-year Treasury rate below approximately 55 bps could result in a steeper decline, potentially back to the March lows at 40 bps, or even lower, should market participants begin to take the view that we may be in for a much longer, and drawn-out recovery. Such a decline could result in equities being dragged lower, as investors grapple with a slower return "to normal" than expected.

At the moment, the stock market is in celebratory mode over the prospects for recovery, aided by an unprecedented wave of government and central-bank stimulus. The biggest problem is that this recovery is, at best, is getting us back to levels that were once consiedered dire enough to call the downturn of 2008 and 2009 "The Great Recession."

It doesn’t seem like much to celebrate at this point.