- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

ECB Watch: Will Draghi Help Or Hurt Euro?

By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

Thanks to the strongest increase in private payrolls since April 2014, the U.S. dollar extended its gains against all of the major currencies. ADP reported a 298K rise in corporate payrolls in February, which was not only higher than the previous month but also significantly better than the 187K forecast. Economists believe that job growth slowed last month but Wednesday’s report will have investors looking forward to a solid labor-market report on Friday. A lower unemployment rate and stronger wage growth had been on the docket for some time but payroll growth was expected to slow from 227K in January to 174K in February. However after Wednesday's ADP report, the consensus forecast climbed to 200K and could increase further as banks adjust their estimates. The problem for the dollar is that Fed fund futures are now pricing in a 100% chance of a March rate hike and a solid NFP cannot increase those odds further. Where it will make a difference is in June as the futures currently show only a 50% chance of tightening at the next quarterly meeting. Judging from Wednesday’s move in the dollar, there is still money on the sidelines waiting for hawkishness from Janet Yellen, so there could still be a push higher on FOMC day if Yellen signals more rate hikes in the near future. In the meantime, we expect buyers to sweep in on USD/JPY dips ahead of Friday’s nonfarm payrolls. USD/JPY tested its March 114.75 high Wednesday and failed to break resistance. We still believe that 115 will be tested pre-NFP. Jobless claims and the Challenger layoff report are scheduled for release Thursday and these reports are likely to confirm labor-market strength.

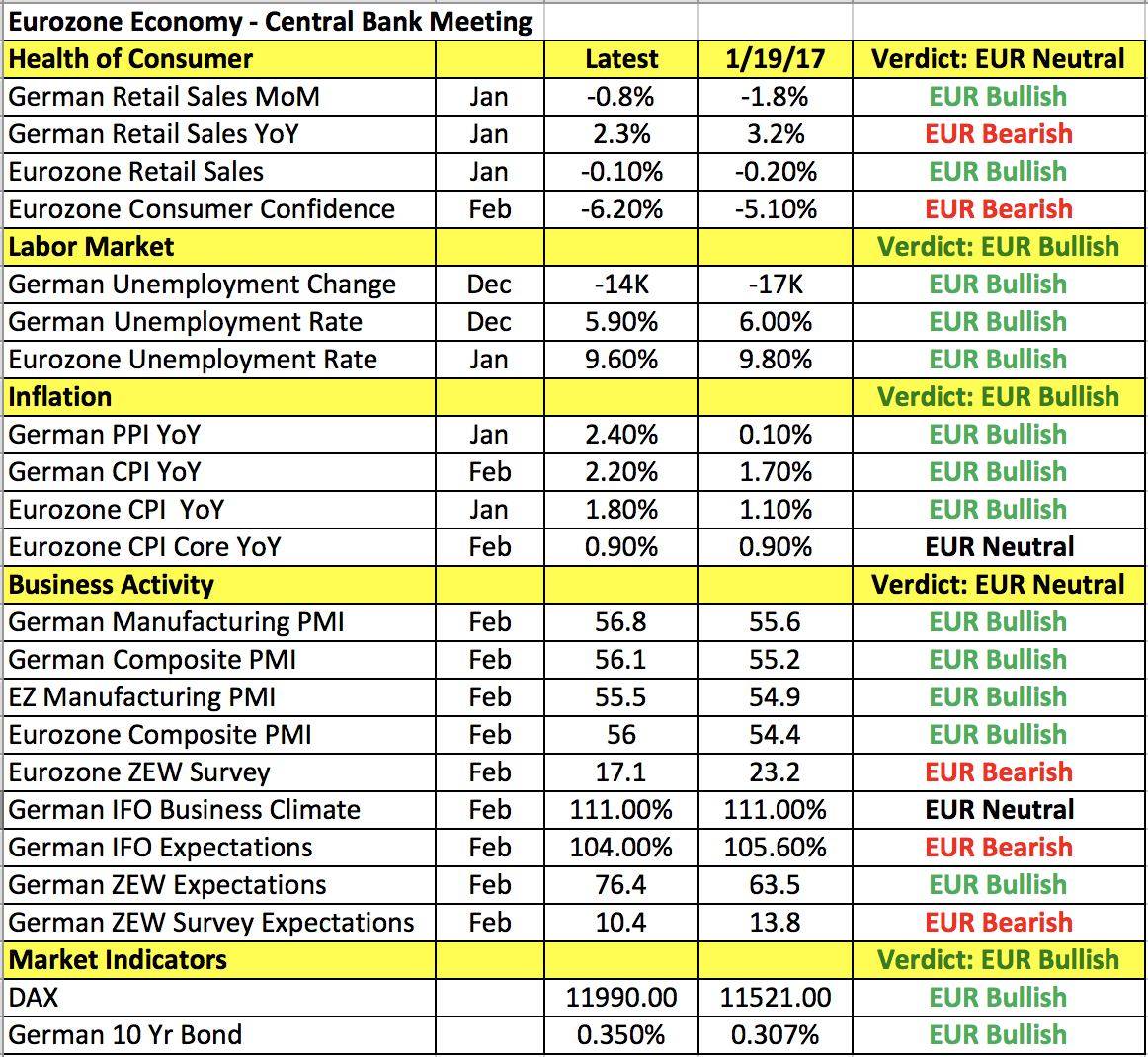

While NFPs will be in the back of everyone’s minds, the European Central Bank’s monetary policy announcement will be front and center on Thursday. The ECB is widely expected to keep policy unchanged but between its quarterly economic forecasts and Mario Draghi’s press conference, we can be assured that there will be wild swings in Thursday's EUR/USD. Since the last monetary policy meeting in January, inflation picked up significantly with widespread improvements in manufacturing- and service-sector activity. The German labor market also benefitted from healthier labor-market conditions but the ECB said on a few occasions that it would look past temporary increases in inflation. More recent data like the German IFO report, trade balance and industrial production showed pockets of weakness. And that will worry a central bank that's not convinced that the rise in inflation and the general recovery is durable. So while EUR/USD could pop on upgraded economic forecasts, Mario Draghi will most likely talk down the currency, which could erase any earlier gains. At the end of the day, the ECB wants the euro to remain weak to support the economy and it will do everything in its power to prevent the euro from rising including downplaying or flat out dismissing upgraded inflation and GDP forecasts. EUR/USD support is at 1.05 and resistance is at 1.0640.

All 3 commodity currencies traded lower on the back of U.S. dollar weakness and surprisingly soft Chinese trade numbers. While everyone was looking for a smaller Chinese trade surplus in February, no one anticipated a deficit. China reported its weakest trade balance in 3 years as exports fell and imports soared. Part of the deterioration had to do with Lunar New Year distortions but higher commodity prices and stronger domestic demand also contributed to the shift. Exports are expected to recover in the coming months but China’s currency and trade balance will remain a hot topic for the Trump Administration. In the near term, the pressure on AUD and NZD will come from the U.S. dollar or commodity prices -- not China’s economic outlook. Nine days have past without a rally for NZD/USD. The currency extended its losses on the back of Tuesday’s drop in dairy prices. Although New Zealand’s economy has been struggling, NZD weakness will help to boost inflation and support growth. USD/CAD came within striking distance of 1.35 as oil prices tumbled. Stronger-than-expected Canadian housing data failed to stem the slide in the currency. The trend is strong but 1.35 is an important resistance level that USD/CAD may find difficult to break ahead of Friday’s Canadian and U.S. economic reports.

The British pound extended its losses versus the U.S. dollar despite the government’s decision to upgrade GDP forecasts to 2% for 2017 from a previous forecast of 1.4%. Growth estimates for 2018, 2019 and 2020 were revised lower. These changes in the U.K.’s Spring Budget are a reflection of the government’s view of how Brexit will impact the economy. This year will be about planning and initiating the U.K.’s divorce from the European Union and the next few years will be when the pain is felt. The Office for Budget Responsibility expects a deficit of 2.6% of GDP in 2016-2017 and plans to cut borrowing by GBP23.5 billion pounds over the next 4 years. With that in mind, the government also plans to build a reserve fund in case extra spending is needed to help navigate Britain’s economy through a Brexit slowdown. In the meantime, spending will be supported by higher taxes -- the government announced a reduction in the tax-free dividend allowance and a two-tier sugar tax. As we can see in GBP's performance, these changes did not help the currency. Investors remain nervous about holding sterling ahead of the potential trigger of Article 50 next week.

Related Articles

The dollar’s rebound faces a key test as traders assess Fed expectations, geopolitics, and slowing spending. With inflation cooling and rate-cut bets rising, markets eye jobs...

As markets assess the implications of the Zelenskyy-Trump clash on Friday, the focus today is whether US tariffs on Mexico and Canada will go ahead. The FX market is not pricing...

In response to criticism of tariff 'confusion', President Trump stepped in emphatically yesterday to announce that tariffs would be going ahead on Canada, Mexico, and China next...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.