DXY was up again last night:

But so was AUD:

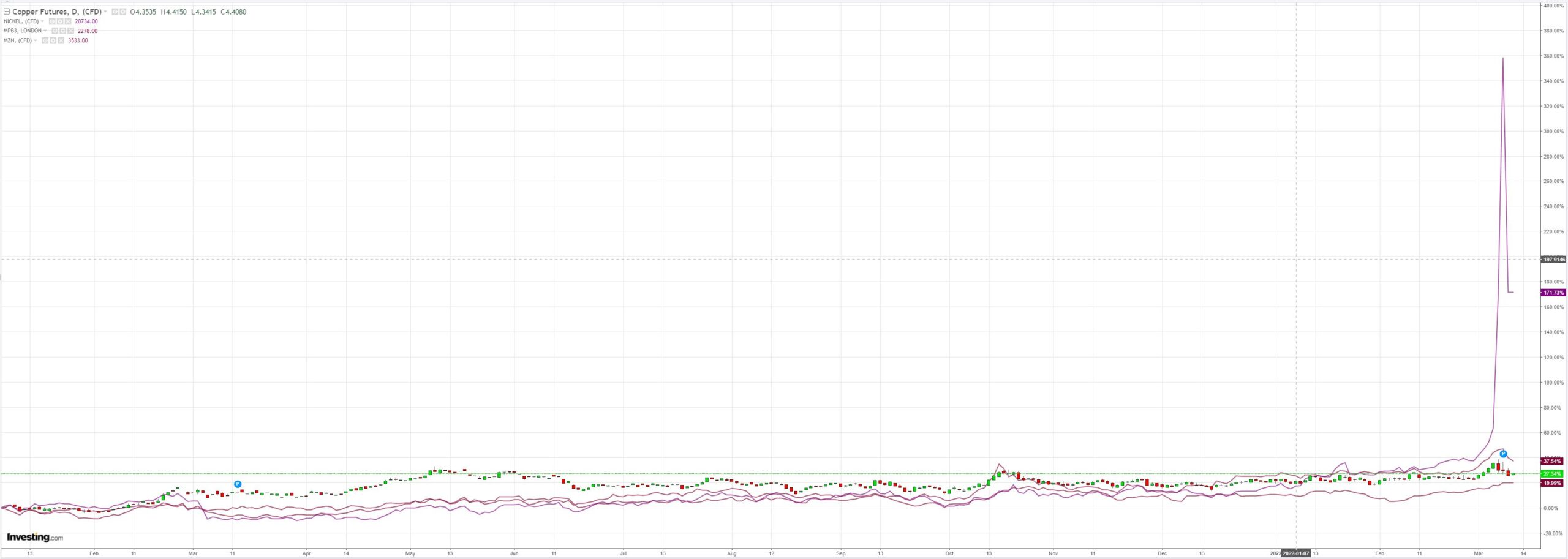

Base metals faded:

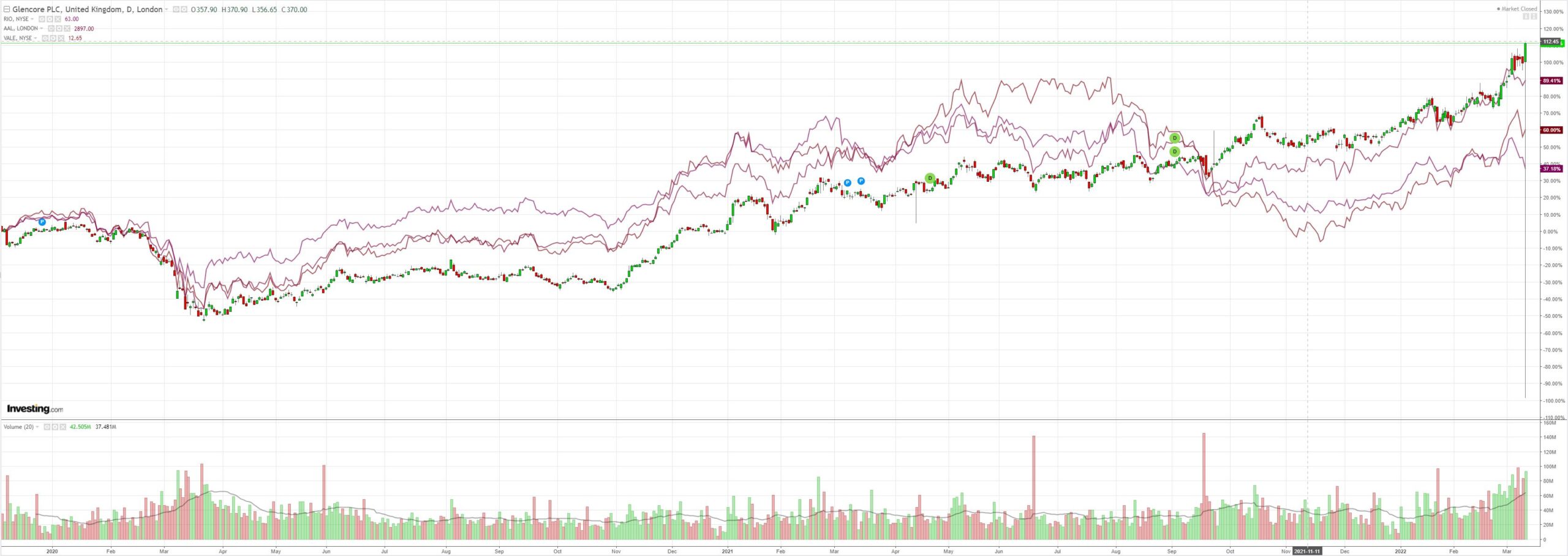

Big miners (LON:GLEN) were mixed:

EM stocks (NYSE:EEM) do not look at all well:

Led by junk (NYSE:HYG) headed into Mariana Trench:

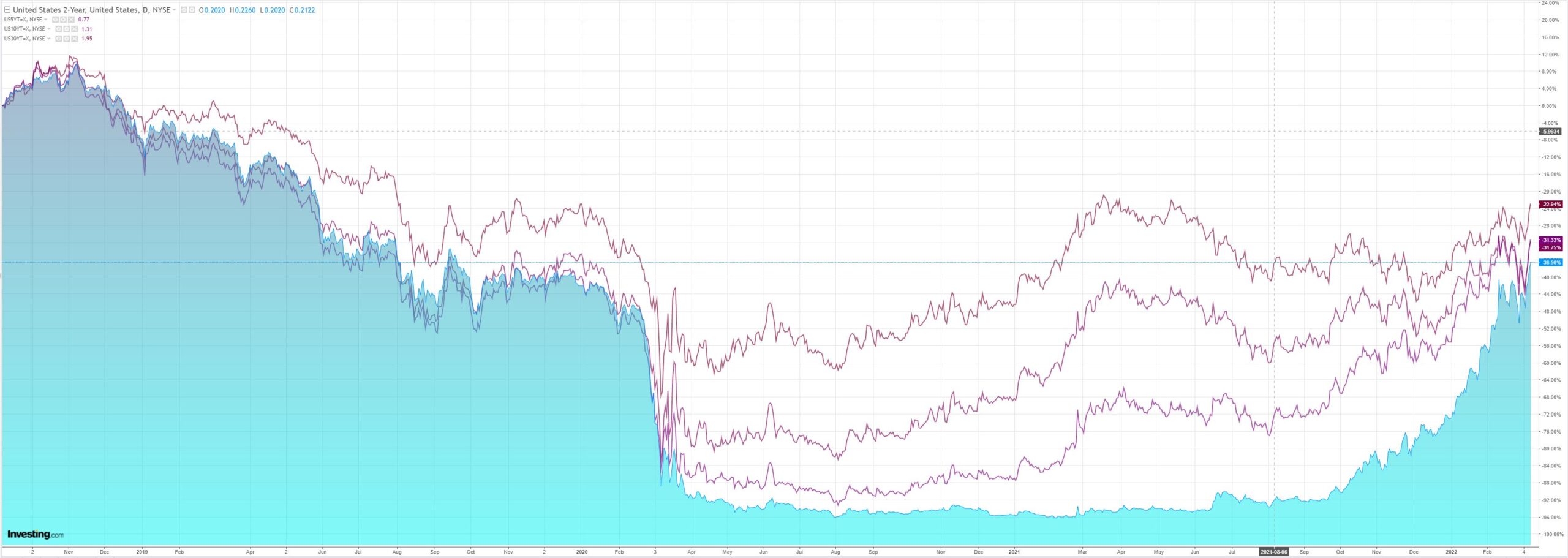

As yields blew higher:

And stocks were snuffed out:

Westpac has the wrap:

Event Wrap

US CPI inflation in February matched expectations at 0.8%m/m and 7.9%y/y (a 40-year high), as did the ex-food and energy measure at 0.5%m/m and 6.4%y/y. Price gains were again widespread.

The ECB left its policy rates on hold, as was widely expected, but it did accelerate the pace of QE reduction. Purchases under the APP will now be EUR40bn in April, EUR30bn in May and EUR20bn in June, and potentially ending in Q3 2022 (compared with previous guidance of EUR40bn per month through Q2, EUR30bn through Q3, and then EUR20bn in Q4, with no end date specified). Policy rates were expected to be raised “some time after” the end of APP, data dependent.

Event Outlook

Aust: RBA Governor Lowe will take part in the Banking 2022 Conference panel in Sydney at 9:15am.

NZ: The February manufacturing PMI should reflect a softening of business conditions with the spread of omicron. Meanwhile, a lift in the February food price index is anticipated as grocery prices continue to firm (Westpac f/c: 0.6%).

Japan: Despite the lifts in costs, pent-up demand from the delta recovery should see strength in January’s household spending (market f/c: 3.4%yr).

UK: Volatility in the trade balance will likely be present in January as the UK continues to navigate COVID-19 and Brexit uncertainties (market f/c: -£2.4bn)

US: Inflation and interest rate concerns are expected to continue dampening consumer sentiment in the University of Michigan’s March survey (market f/c: 61.0).

The ECB threw a spanner. Via TD Securities:

We got the hawkish pivot that we had been expecting from the ECB today, with an announcement today that the APP programme will wind down relatively rapidly. This is much more aggressive than many had assumed– indeed, it echoes broad expectations before the war in Ukraine, and suggests that despite the potentially severe hit to euro area growth in the coming months, the upside risks to inflation still dominate GC’s minds.

• APP: Reduced rapidly through Q2, with purchases of €40bn/mo in April, €30bn/mo in May, and €20bn/mo in June. The Governing Council says that they now anticipate the QE programme will wind down in 2022Q3 if data evolves in line with their expectations (this likely hints at upward revisions to 2024 inflation in their projections, which we’ll hear about shortly).

• PEPP: No change, with confirmation that the programme ends this month.

• Interest Rates: No change.

• Refinancing Operations: No major changeAs we head into the press conference at 1:30pm GMT, the tone is likely to remain fairly noncommittal, with emphasis on high uncertainty, flexibility, and optionality. But look for President Lagarde’s degree of worry over rising inflation data (from before the Ukraine invasion). At this point, today’s policy decision leaves a rate hike on the table anytime in H2, though with the removal of guidance that rates would rise “shortly” after the APP concludes, there could be a longer gap between QE ending and lift-off. That leaves our base case of a 25bps hike in December still plausible, even if QE ends a few months earlier than expected.

Market Commentary

• Rates: 10y Bunds yields are higher by 8bps and the curve bear flattened as markets price 25bps in rate hikes as soon as September. The BTP vs Bunds spread widened by 15bps.

• FX: The ECB announcement is helping to reinforce the tactical recovery of the EUR. We think positioning and valuations are significant knee-jerk drivers, given the market has been leaning dovish. Our dashboard underscores the shift in short-term drivers, highlighting that the EUR’s move last week pushed it towards the implied level. In other words, EUR has priced in most of the recent stress. The focus has been on European growth, linked to rising geopolitical tensions, but keep in mind they have an inflation mandate.There are many moving pieces relating to the ECB outlook, possible fiscal support, and the next phase of the geopolitical stress and the commodity price impact. On net, things are moving in a more positive EUR direction, but we wouldn’t chase the rally in EURUSD ahead of the Fed. Instead, we maintain long exposure to EURGBP (added last week at 0.8255).

Unemployment is at 6.8%. They have time to wait. That said, it’s another warning that central banks everywhere want to normalise and the market took it that way for both the Fed and RBA.

So long as the war rolls on, AUD isn’t going to fall back until the Fed sees the whites of the equity market eyes.