Originally published by Guppytraders

We know every good horror movie has a nasty ending but that doesn’t stop us from flinching, or screaming, when it happens. The Dow Jones Industrial Average retreat is the same. The potential to lift US interest rates has been a topic of discussion for more than a year. Like a good horror movie the clues have been piling up, but markets like to pretend they have been caught by surprise.

One month ago we wrote that the Dow retracement was waiting to happen. We set a short term upside target near 26,200 which was achieved. Last week speaking on CNBC Street Signs I noted that the Dow was in bubble territory and primed for a substantial retreat.

Investors who understand chart analysis have been prepared for this retracement. More importantly, they are prepared for the rebound and continuation of the long term uptrend. Forget the doom and gloom, because herein lies opportunity.

A retracement is when the market diverges significantly from the current trend and then falls, or retraces, to the underlying trend line. If the divergence between the current high and the underlying trend is very large then it is a bubble collapse.

The value of the long term underlying trend line which started in 2011, October is currently near 22,500. This is a divergence of 4,000 index points and definitely a bubble.

A retracement to this level is uncomfortable for investors, but a rebound from the trend line support level is a buying signal for a continuation of the long term uptrend.

A retracement is a drop of less than 10% from the index high. A fall of more than 10% is generally seen as a signal for a trend change.

This is a problem for the Dow trading near 26500. A 10% fall takes the Dow to 23,850 and this is above the current long term trend line support value near 22,500. However the 23,500 level is near to a minor support level. This is a small consolidation band between 23,200 and 23,600. This is a very weak consolidation support area so there is a high probability the market will plunge below this level before rebounding.

A fall below 23,500 finds the next strong historical support level near 22,500 which is the value of the long term uptrend line. This line starts in 2011 so its placement and value is approximate. Investors will look for the Dow to pause and consolidate in this area before entering again for a continuation of the long term uptrend.

Traders remain short but tighten stops as each of these support levels is tested.

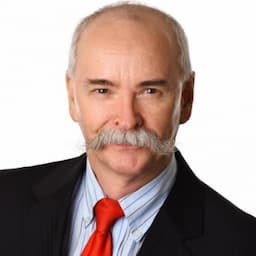

Daryl Guppy is a leading international financial technical analysis expert and special consultant to Axicorp. Guppy appears regularly on CNBC Asia and is known as "The Chart Man". Disclaimer: Daryl Guppy is not a financial advisor. These notes are for educational purposes only and provide an example of applied technical analysis.