This article was written exclusively for Investing.com

Earnings season has been moving along briskly, and so far, it has been better than feared. That may not be saying much, considering expectations for the second quarter were already so low and anticipated to be horrendous. But more importantly, expectations for future quarters, at least until now, have shown some signs of stabilization—that is, they have stopped falling.

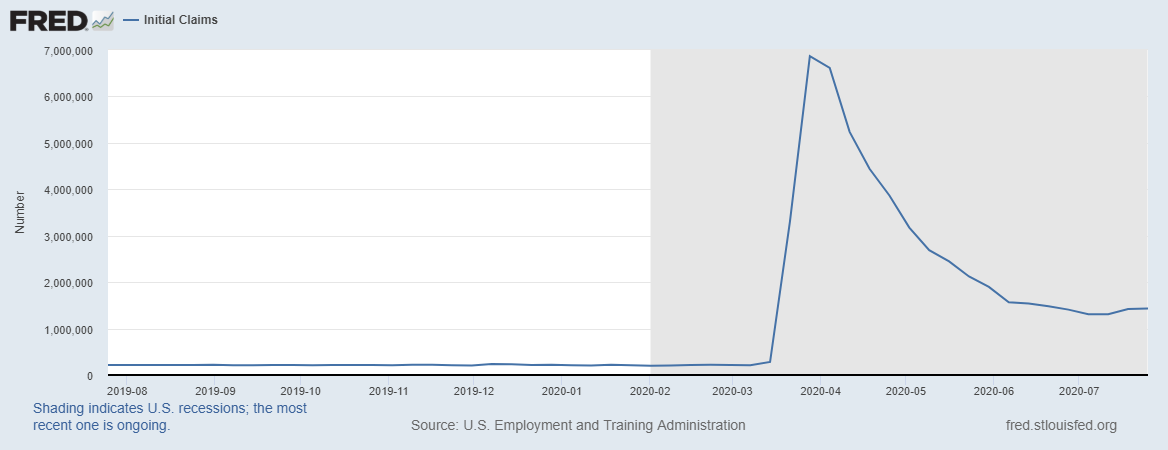

But not all is rosy, because the tone from some companies has been one of concern surrounding the economic outlook. Even the Fed pointed to signs of a slowing recovery at its latest FOMC press conference, as initial claims on July 30 showed job losses are once again trending higher.

Lowered Expectations

According to data provided by Thomson Reuters, 45% of the companies in the S&P 500 have reported results, with 81% of them beating analysts consensus estimates, while 18% have missed estimates, and 1% have met. It may not be saying all that much. After all, earnings estimates for the second quarter have fallen roughly 48% since the start of 2020 to $22.59 as of July 23, according to data from S&P Dow Jones. It is a decline of almost 44% from the second quarter a year ago.

But the good news, at least for now, is that earnings estimates for the third and fourth quarters have improved recently. Currently, the third quarter is forecast to have earnings of $31.26, while the fourth quarter is expected to be $35.88. That is better than the estimates of $30.89 and $35.74, respectively, as of June 30.

Slower Path

Still, some companies have noted, they are not as optimistic about the path of the economic recovery and see it potentially taking longer-than-expected. And this degree of pessimism spans the various sectors of the stock market. For example, on the earnings call for Anglo-Dutch consumer goods maker Unilever (NYSE:UN), a defensive stock, the CEO noted that a quick recovery is on the optimistic side. That a deep global recession has already started, as consumer habits have already changed. Boeing (NYSE:BA), one of the ultimate cyclicals, also indicated on its call that the recent uptick in COVID-19 cases had slowed the recovery, and any improvement may be uneven.

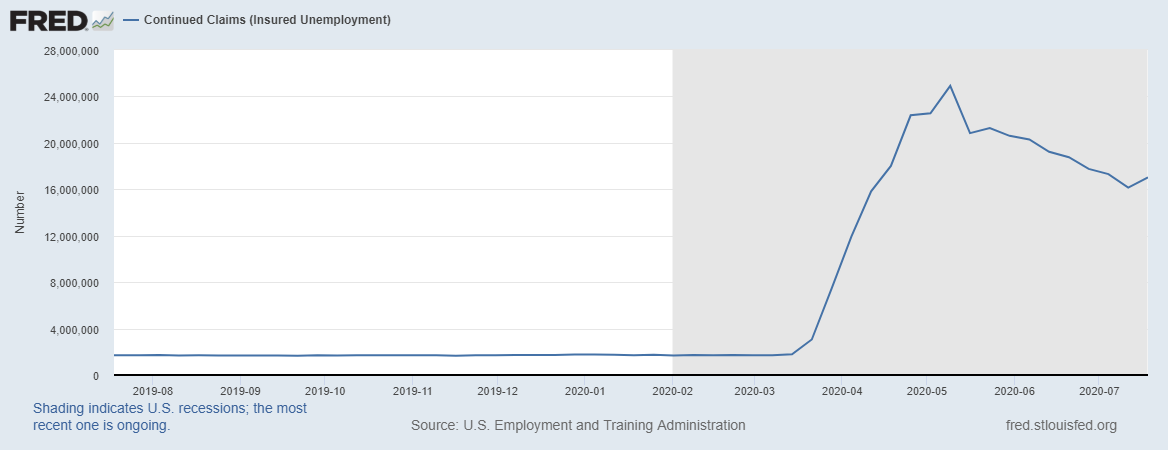

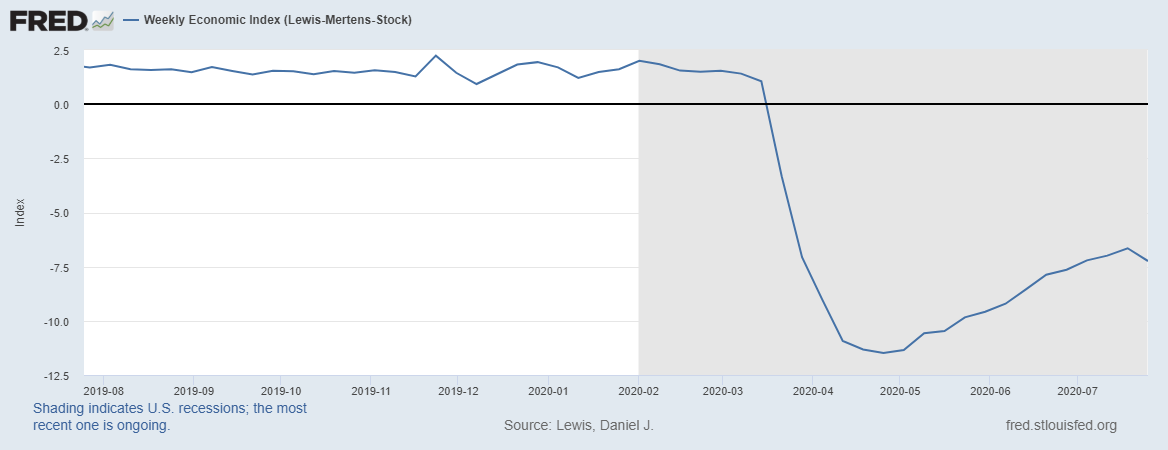

Additionally, there has been some economic data recently that suggests the pace of the recovery is slowing from the initial "post-lockdown boom" seen a couple of months ago. Recent data from the NY Fed Weekly Economic Index shows a flattening of activity since the first week of July. Also, the initial claims data has shown the number of people filing for unemployment benefits for the first time has risen over the past two weeks. Finally, the number of people continuing to receive unemployment benefits also rose for the first time since April this past week, at almost 17 million.

Two Paths

For now, there appear to be mixed signals regarding the pace of the recovery and how that may translate into corporate earnings. It could suggest that either earnings expectations for the second half of 2020 are too high and need to fall. Or that the concern over the resilience in the economic recovery will fade and allow a stronger rebound to take hold.

Investors will have a lot to weigh once earnings season ends. Factor those results with the lack of clarity around the economic recovery along with the current valuations in the market, and it could make for some choppy weeks to come.

Michael Kramer is a financial market strategist and the portfolio manager of the Mott Capital Thematic Growth Portfolio.