- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Dollar Extends Gains, GBP In BOE Hot Seat

By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

The mighty dollar’s persistent strength was Wednesday's biggest story of the day. The greenback’s broad-based gains can be attributed entirely to the upward drift in Treasury yields and President Trump’s promise of lower corporate taxes. Paul Ryan got the market excited Wednesday morning when he said his goal is for tax reform to become law by the end of the year. The Trump administration had many setbacks but this is one area where the president should receive widespread Republican support because it is the party’s best hope for a major legislative accomplishment before next year’s midterm elections. According to the House Ways & Means Chairman Brady, more details on the tax-reform plans will be released on September 25. So far, the market has been skeptical because the plan has been vague and while it's still unclear how much progress has been made, setting a specific date to share more information gives investors hope, which can go a long way. It helped investors shrug off the softer-than-expected producer price report that showed inflation growth rising less than expected in August. Thursday’s consumer price report should be stronger with Hurricane Harvey driving up gas prices last month. However Wednesday’s move took the dollar to important resistance levels versus euro and yen, which could be a perfect place for a profit taking or corrections.

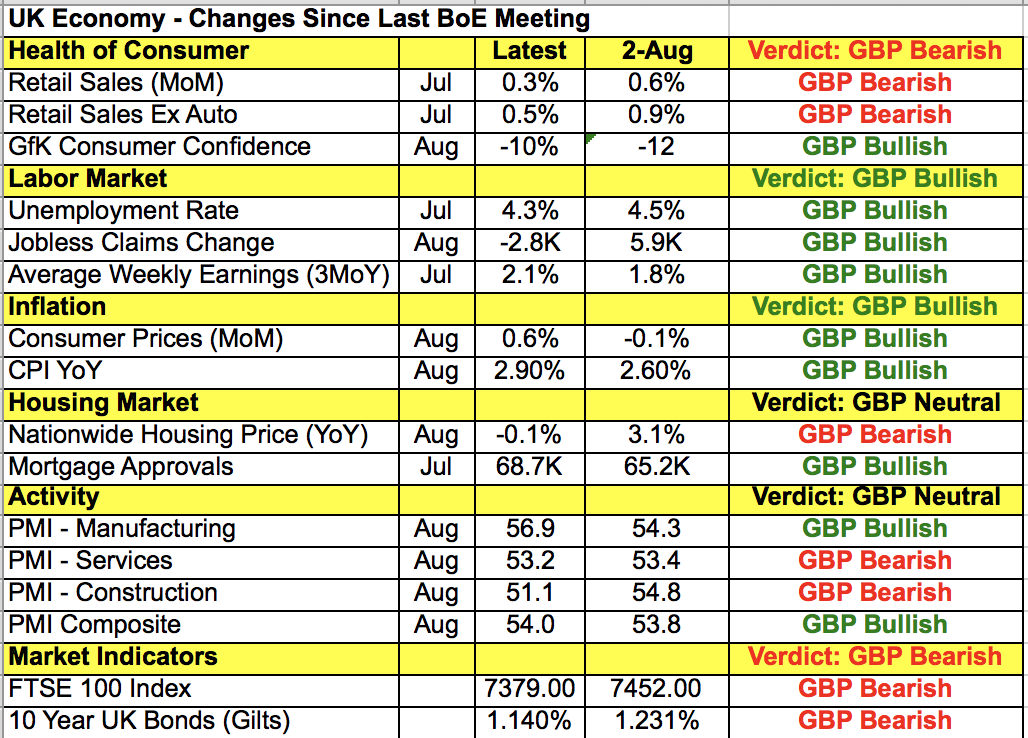

The U.S. CPI report is important but Thursday's big show will be the Bank of England’s monetary policy announcement. The BoE is widely expected to leave interest rates unchanged but with other central banks in the process or preparing to reduce stimulus, investors are looking to see if the BoE will do the same. A lot has changed since BoE's last monetary policy meeting in August. Six weeks ago it voted 6-2 to leave rates unchanged, cutting its forecast for GDP and wage growth, while expressing concern about the economic implications of Brexit. Since then we’ve seen cpi jump toward 3% and average weekly earnings growth accelerate from 1.8% to 2.1%. These positive developments are encouraging but as shown in the table below, the U.K. economy is not out of the woods. While manufacturing activity accelerated, service-sector activity slowed last month and most importantly, consumer spending took a hit from the prior slowdown in wage growth. Yet the BoE is an inflation focused central bank, which means it will be difficult for policymakers to ignore the rapid acceleration in price growth. It may try to downplay the increase but it could also suggest that the yield curve is too flat, implying that the market is underpricing the chance of tightening. For this reason, we expect a more hawkish BoE statement that will lead to an increase in interest-rate expectations and the GBP/USD. If the BoE votes 7-2 to leave interest rates unchanged, sending a hawkish signal to the market, GBP will rise. If Haldane — who previously suggested tightening could be necessary — dissents, leaving the vote at 6-3, GBP/USD will break 1.33 quickly and aggressively. However if BoE says it can look past the temporary rise in inflation and emphasizes the uncertainties ahead along with the risks to growth, GBP/USD will slip below 1.3100.

Wednesday night’s Australian labor-market numbers will also have a significant impact on the Australian dollar. AUD/USD peaked at the start of the week but a soft labor-market report is necessary for continued weakness. According to the PMIs, both the manufacturing and the service sectors experienced weaker job growth last month, which would be consistent with Tuesday’s softer business confidence report. We believe that the Australian economy is beginning to feel the strain of a stronger currency and data should start to reflect that. The Canadian dollar ended the day unchanged against the greenback but with yields rising strongly and oil prices jumping 2.3%, we expect USD/CAD to reverse course and head back toward 1.21. The New Zealand dollar, on the other hand, fell in lockstep with AUD and actually experienced steep losses comparable to the moves in EUR and GBP. New Zealand consumer confidence numbers were due Wednesday evening but Australian data and China’s retail sales and industrial production reports should have a more significant impact on the currency.

Last but certainly not least, EUR/USD broke below 1.19 Wednesday. With no major Eurozone economic reports scheduled for release this week, the currency took its cue from the market’s voracious appetite for U.S. dollars. Eurozone fundamentals have not changed. The ECB is still planning to reduce asset purchases next month but it will be difficult for EUR/USD to rise until the dollar stops falling. We still like buying EUR/USD on dips so if you’ve got tolerance for a stop near 1.17, Wednesday’s move down to the 20-day SMA would be a good place to start scaling into a long position. The Swiss National Bank also has a monetary policy announcement Thursday and its meeting will be far less eventful than the BoE’s. The SNB is widely expected to leave interest rates unchanged and it will continue to call for a weaker currency, showing no signs of moving toward tighter policy.

Related Articles

EUR/USD remains resilient after dipping below 1.05, hinting at a potential breakout. Weak US data and stagflation fears fuel Fed rate cut bets, pressuring the dollar. A break...

The German election results initially boosted optimism, but uncertainty over coalition talks is keeping pressure on EUR/USD. Trump's confirmation of tariffs on Mexico and Canada...

The US dollar has found a little support overnight after the House passed a budget blueprint bill laying the groundwork for President Trump's tax-cutting agenda. The focus on...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.