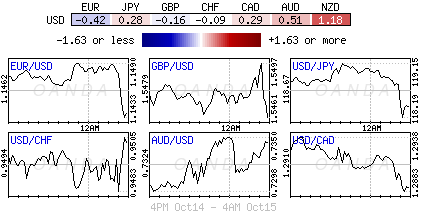

Lackluster U.S data over the past 24-hours (retail sale, PPI and beige book) has further diminished the market odds for a 2015 rate lift off (Oct. +2.5%, Dec. +32.5%). This is putting the dollar very much on the back foot across the board (dollar index hitting a three-month low), a relief for EM and some commodity sensitive currency pairs in particular. The ‘lower for longer’ debate is giving global equities the “green” light, despite some mixed U.S earnings reports this week, and has U.S 10-years trading again below the psychological +2% handle (+1.975%). The markets focus will now return stateside to today’s release of CPI data, the last inflationary snapshot for the Fed to consider ahead of their next meeting in two-weeks time. Market expectations are for a second consecutive negative print (-0.2% m/m).

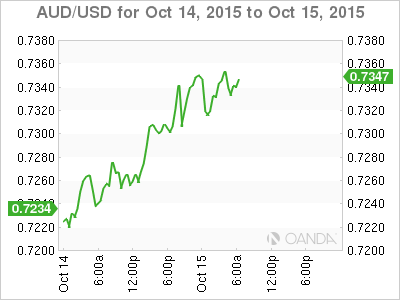

Down-under rate debate heats up: A Reserve Bank of Australia (RBA) rate cut expectations are on the rise again, especially after the neutral or debatable soft Aussie employment report in the overnight session. The FI market is also focusing on the rise in mortgage rates, suggesting that a further ease by the RBA will be required to help the consumer, as higher mortgages will only add to the risks of higher unemployment. Australia employment change recorded its first decline in five-months (-5k vs. +10k e). Certainly not a bad headline, but the mix from full-time to part-time job losses was disappointing (FT fell -13.9k while PT increased +8.9k). The jobless rate held steady at + 6.2%, while the participation rate slowed. On the bright side, the total hours worked were at an eight-month high.

Same old, same old with BoK: As expected, the South Korean Central Bank held rates steady in the overnight session at +1.5% for the fourth-consecutive month. However, not a surprise, they have lowered their projections for growth and inflation, somewhat in line to other Asian and EM central bankers. They have cut 2015 GDP to +2.7% from +2.8% and also its 2016 growth number to +3.2% from +3.3%. This years CPI is cut to +0.7% from + 0.9%, while 2016 CPI target is down one tick to +1.7%. In the post statement, the BoK noted that the economy and domestic demand are showing signs of recovery, but uncertainty related to China slowdown, Fed liftoff, low energy prices, and currency volatility all pose risks. With the USD under global pressure – markets unwinding six-months of rate divergence premium – the KRW uptrend has been hardly altered on the revisions. KRW is straddling near its three month lows outright ($1,123).

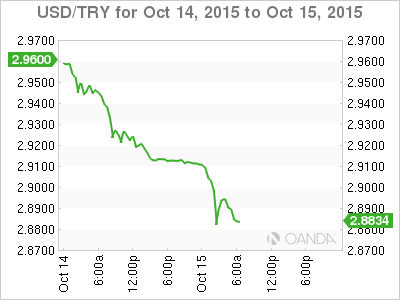

EM currencies celebrate: The Turkish lira (TRY) is another good example of the broader context of the dollar’s demise. Domestic benchmark indices are up in line with the emerging-market rally. With investors rapidly unwinding the “big” dollars rate divergence premium is giving a massive lift to the currencies that have born the brunt of the dollars weight over the past summer. TRY has gained another +0.8% in the overnight session (TRY$2.9924). Turkey’s benchmark 10-Year bond yields have dropped to +10.54% from +10.65% while its main stock index has risen another +1.1% this morning. For the time being, with no Turkey specific story (geopolitical or economic), EM movements are expected to remain highly correlated to global trends. At least until the Fed proves the market wrong or a U.S data point blows past expectations.

EUR Stops dead at the top of its range again: It was getting interesting with the single unit about to take on the upper end of its contained summer range (€1.1100-1.1500) in the euro session. However and not a surprise, ECB policy doves have temporarily managed to be today’s EUR bull killjoy. Investors are always wary about possible jawboning from ECB officials, especially ahead of it’s meeting next-week. So far this morning, it was the Austrian ECB member Nowotny who managed to halt the EUR’s rise as he hinted that more action is needed in Europe. He reiterated that they were clearly missing inflation targets, that the regions biggest challenges were anemic growth and uncertainty. He indicated that the ECB were using all the policy instruments available to them, but more tools were needed (including structural ones). The EUR (€1.1428) thus far has managed to retreat aggressively from its Sept. 18 high (€1.1491-double top) as the market does not want to be caught “too long and wrong.”