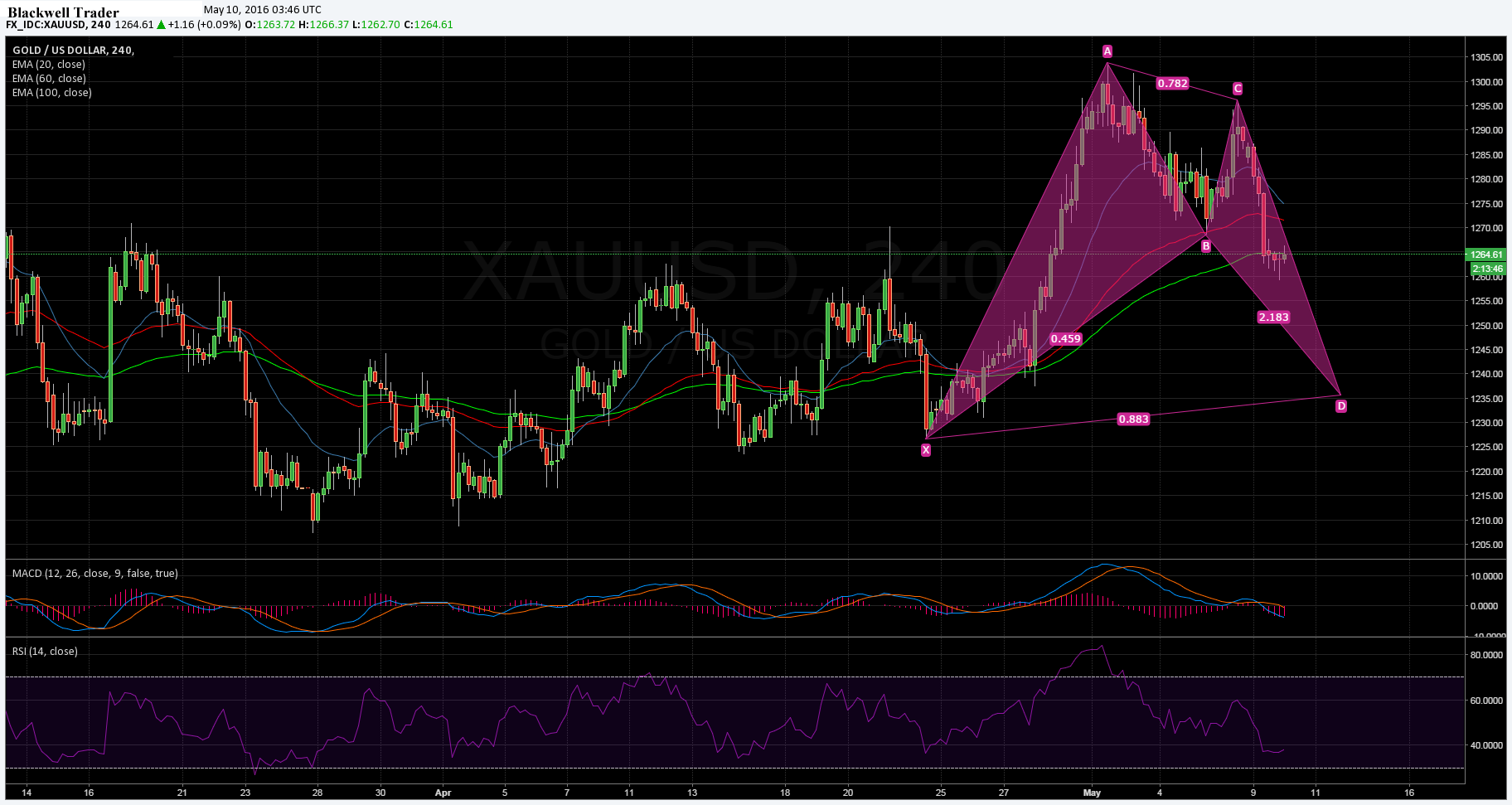

The past few days have been relatively negative for gold as the commodity has fought against a rising tide of US dollar strength. However, the rout is unlikely to be over yet as the daily charts are showing a bullish bat that still needs to complete its “D” leg.

Taking a look at the technical indicators is enlightening for a precious metal that is such a bellwhether for the state of the US economy. 2016 has been relatively positive for the metal as it appears to have broken through the top of the bearish channel. However, the commodity was largely rangebound between $1207 and $1284 before the presence of a bullish bat in late April dominated proceedings.

Subsequently, the next few days are likely to be relatively volatile for the metal as the bat largely predisposes gold to decline until it finally completes the “D” leg, around the $1235.00 mark. However, it should be noted that the RSI indicator remains relatively oversold and will need a period of sideways action before taking the next plunge. Subsequently, expect the precious metal to meander slightly before recommencing the move back towards strong support.

The fundamental point of view also largely predisposes gold towards the downside if you accept the Fed’s purported intent to tighten their monetary policy. The precious metal is likely to fare relatively poorly given an increase to the Federal Funds Rate.

However, as the year meanders on, the chance of the Fed hiking rates appears to be diminishing. Subsequently, the impact that fundamentals will continue to have on the downside is likely to be relatively limited in the short term.

Ultimately, the commodity is likely to continue to appreciate in the medium term as it looks to recouple with the underlying money supply which has significantly expanded over the past few years. In addition, there is some tangential evidence of slowing globally which will further impact the central bank’s ability to raise the benchmark rate.

Subsequently, for the short term outlook, the technical view appears to be the predominant one and the appearance of the bullish bat is likely to send the commodity tumbling back towards the $1235 level in the near term. However, keep a close watch on the pending US JOLTS Job Opening figures as the metric is typically one that causes some volatility within the precious metals.