This article was written exclusively for Investing.com

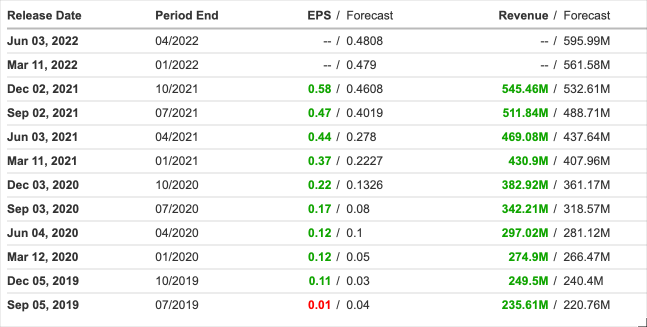

In recent months, DocuSign, Inc. (NASDAQ:DOCU) shares have been crushed, falling more than 60% since September. The company is expected to report fourth quarter results on Mar. 10 after the close. Consensus analysts estimate earnings to have increased by 29.3% versus last year to $0.48 per share. Meanwhile, revenue is forecast to have climbed about 30% to $561.6 million.

The stock is not cheap on a P/E ratio basis, trading approximately 50 times 2023 earnings estimates of $2.15 per share. But when considering, the company is expected to see its earnings more than double in the fiscal year 2023, the valuation may not be all that bad, especially if the company surprises investors to the upside when it reports results.

Source: Investing.com

Betting On A Big Gain

DocuSign has topped earnings and revenue estimates nine quarters in a row. It could even help explain why some traders are betting the stock moves higher in the weeks following results.

The open interest levels for the May 20 $85 calls have increased by 20,000 contracts since Feb. 25. The data shows a block of 10,000 contracts was traded on the ASK and most likely bought on Feb. 25 for roughly $33 per contract. Meanwhile, another block of 10,000 contracts was also traded on Feb. 28 and was purchased for about $36.85 per contract.

The bullish options bets could also be a hedge against a short position. But it doesn’t change the trader’s intention, believing that the stock may have significant upside in the weeks following results.

Based on the purchase price of the last block trade, the trader would need the shares to trade above $121.85 to earn a profit if holding the contracts until the expiration date.

Improving Trends

It would amount to a gain of almost 15% from the stock’s current price of roughly $108 on Mar. 3. Even the technical chart may suggest there is a positive development with the chance to reverse its massive downtrend.

The most significant indication is the rising relative strength index versus the falling stock price, a bullish divergence. Additionally, the shares have found meaningful support at $102, and if that level can hold, there is a case to be made for the equity to rebound to $135. A break of support at $102 would indicate lower prices are likely to come with the potential to fall to around $80.

Given the company’s strong track record for reporting better than expected results, it certainly makes sense to see bullish sentiment going into the report. However, what the company says about the upcoming quarter and year will determine if it rises or falls.

Guidance is expected to be strong, with revenue forecast to grow by more than 25% in the fiscal first quarter of 2023 to $595.9 million and by more than 25% for the year to $2.6 billion. But given the stocks decline and expectations of a strong forecast, it will likely take not only a big beat but guidance that is better than estimates to get the shares moving higher.