- Shares of Walt Disney are down almost 37% since the start of 2022.

- Investors pay close attention to streaming subscribers, theme parks attendance and per-capita spending.

- Long-term investors could consider buying DIS stock at current levels.

- For tools, data, and content to help you make better investing decisions, try InvestingPro+.

Shareholders of the global entertainment and media enterprise Walt Disney (NYSE:DIS) have seen the value of their investment decline 43.7% over the past 52 weeks and 36.8% so far this year By comparison, Dow Jones U.S. Media Index is down more than 31% in 2022. Meanwhile, shares of other leading entertainment companies Netflix (NASDAQ:NFLX) and Fox (NASDAQ:FOXA) have lost 69.8% and 10.8% so far in 2022, respectively.

Source: Investing.com

On Sept. 9, 2021, DIS shares went over $187, hitting a 52-week high. However, on June 22, they saw a multi-year low of $92.01. The stock’s 52-week range has been $92.01-$187.58, while the market capitalization currently stands at $178.1 billion.

Recent Metrics

Disney released Q2 metrics on May 11. Revenue went up by 23% YoY to $19.25 billion. Adjusted diluted EPS came in at $1.08, up 37% YoY from 79 cents seen in the prior-year period. Cash and equivalents ended the quarter at $13.3 billion.

On the results, CEO Bob Chapek stated:

“Our strong results in the second quarter, including fantastic performance at our domestic parks and continued growth of our streaming services—with 7.9 million Disney+ subscribers added in the quarter and total subscriptions across all our DTC offerings exceeding 205 million—once again proved that we are in a league of our own.”

In its most recent quarter, revenue in Disney's theme park segment skyrocketed to $6.6 billion, up more than 100% year-over-year. During the lockdowns, the company made significant adjustments to how the theme parks operate, leading to increased customer spending and profitability. Per-capita spending at its theme parks surged more than 40% compared with the same quarter in 2019.

Meanwhile, Disney+ grew 33% YoY to reach almost 138 million subscribers at the end of March. Management anticipates subscriber growth for Disney+ in the second half of the year to outpace that of the first half. By fiscal 2024, the company forecasts Disney+ will have between 230 million and 260 million subscribers.

Prior to the release of the second quarter results, DIS stock was changing hands around $105. At the time of writing on Tuesday afternoon, it is at $97.70.

What To Expect From Disney Stock

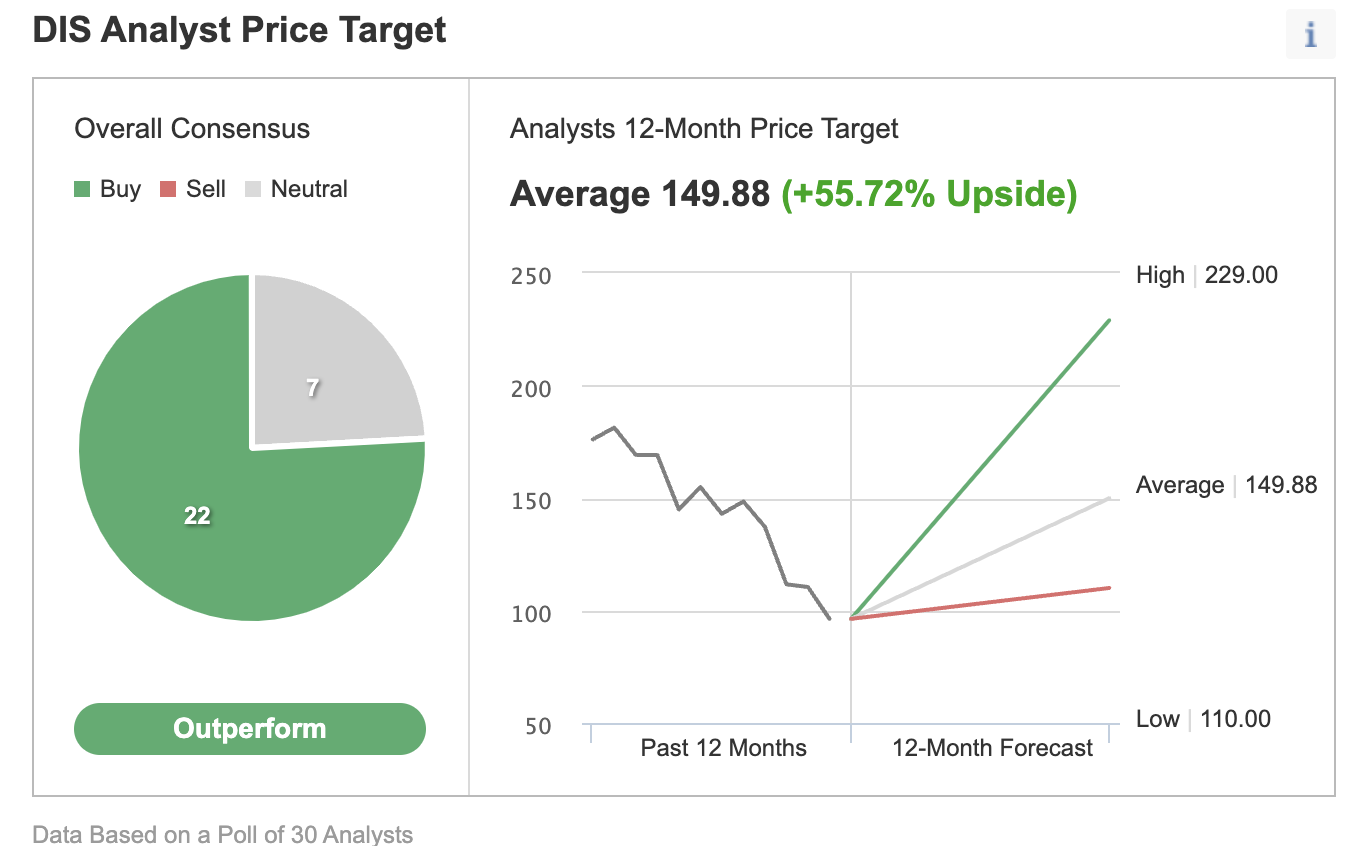

Among 30 analysts polled via Investing.com, DIS stock has an "outperform" rating. Wall Street has a 12-month median price target of $149.88 for the stock, suggesting an increase of 55.7% from the current price. The 12-month price range currently stands between $110 and $229.

Source: Investing.com

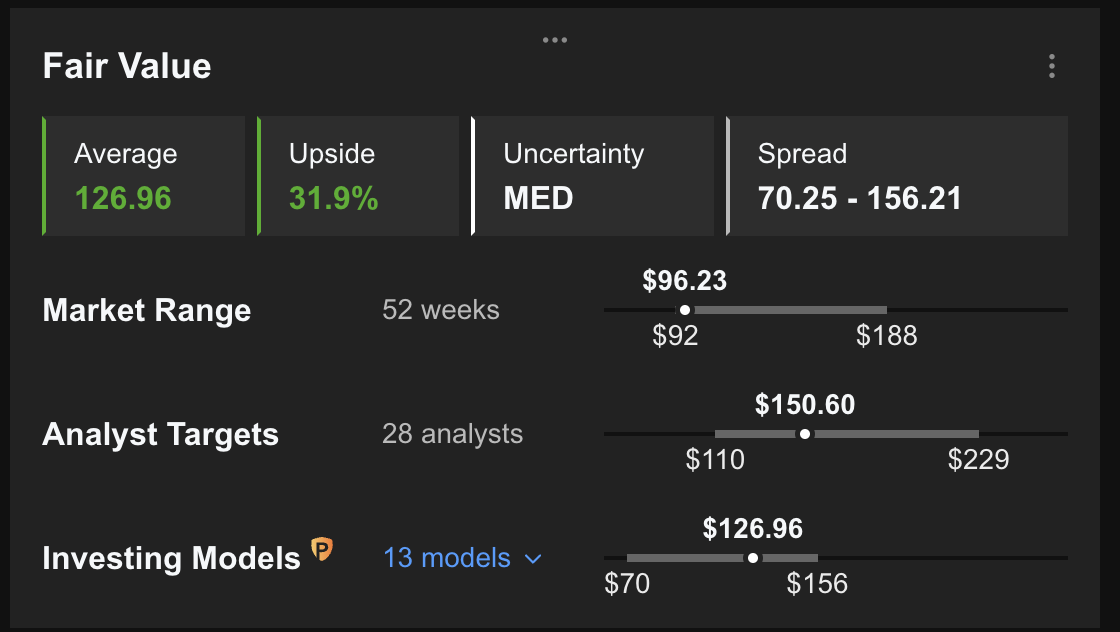

Similarly, according to a number of valuation models, like those that might consider P/E or P/S multiples or terminal values, the average fair value for DIS stock on InvestingPro stands at $126.96.

Source: InvestingPro

In other words, fundamental valuation suggests shares could increase by around 30%.

At present, Disney’s P/B and P/S ratios are 1.9x and 2.3x, respectively. Comparable metrics for peers stand at 2.2x and 1.8x, respectively.

Our expectation is for DIS stock to build a base between $95 and $105 in the coming weeks. Afterwards, shares could potentially start a new leg up.

Adding DIS Stock To Portfolios

Disney bulls who are not concerned about short-term volatility could consider investing now. Their target price would be $126.96, as per the valuation level suggested by quantitative metrics.

Alternatively, investors who expect DIS stock to bounce back in the weeks ahead could consider setting up a bull call spread.

Most option strategies are not suitable for all retail investors. Therefore, the following discussion on DIS stock is offered for educational purposes and not as an actual strategy to be followed by the average retail investor.

Bull Call Spread On Walt Disney Stock

Intraday Price At Time Of Writing: $97.70

In a bull call spread, a trader has a long call with a lower strike price and a short call with a higher strike price. Both legs of the trade have the same underlying stock (i.e., Disney) and the same expiration date.

The trader wants DIS stock to increase in price. In a bull call spread, both the potential profit and the potential loss levels are limited. The trade is established for a net cost (or net debit), which represents the maximum loss.

Today’s bull call spread trade involves buying the Sep 16 expiry 100 strike call for $5.90 and selling the 105 strike call for $3.85.

Buying this call spread costs the investor around $2.05, or $205 per contract, which is also the maximum risk for this trade.

We should note that the trader could easily lose this amount if the position is held to expiry and both legs expire worthless, i.e., if the DIS stock price at expiration is below the strike price of the long call (or $100 in our example).

To calculate the maximum potential gain, we can subtract the premium paid from the spread between the two strikes, and multiply the result by 100. In other words: ($5.00 – $2.05) x 100 = $295.

The trader will realize this maximum profit if the Disney stock price is at or above the strike price of the short call (higher strike) at expiration (or $105 in our example).

Finally, we can also calculate the break-even stock price at expiration. In our example, it is $100 + $2.05 = $102.05. In other words, we add the net premium paid to the strike price of the long call, which is the lower strike (or $100 here). Therefore, on the day of expiry, the trader would need Disney shares to close above $102.05 to break even from this trade.

Those traders expecting a gradual price increase in DIS stock toward the strike price of the short call (i.e., $105 here) could consider a bull call trade. Please note that the numbers we have used in the calculations do not include brokerage commission or fees.

Bottom Line

In recent months, Disney stock has come under significant pressure. Yet, the decline has improved the margin of safety for buy-and-hold investors who could consider investing soon. Alternatively, experienced traders could also set up an options trade to benefit from a potential run-up in the price of DIS stock.

***

The current market makes it harder than ever to make the right decisions. Think about the challenges:

- Inflation

- Geopolitical turmoil

- Disruptive technologies

- Interest rate hikes

To handle them, you need good data, effective tools to sort through the data, and insights into what it all means. You need to take emotion out of investing and focus on the fundamentals.

For that, there’s InvestingPro+, with all the professional data and tools you need to make better investing decisions. Learn More »