In our last update from two weeks ago, see here, we knew for the Nasdaq 100, based on the Elliott Wave Principle, that,

“An impulse consists of five waves; so far, there have been only three waves since the January 5th low. Hence, we must expect another grey W-v to ideally $17738-890 once the current minor correction since last week’s high has run its course while staying above critical price levels. Note that the grey W-iv typically reaches the 100% Fib-extension level but can also bottom at 123.60% (shallow) or 76.40% (deep).”

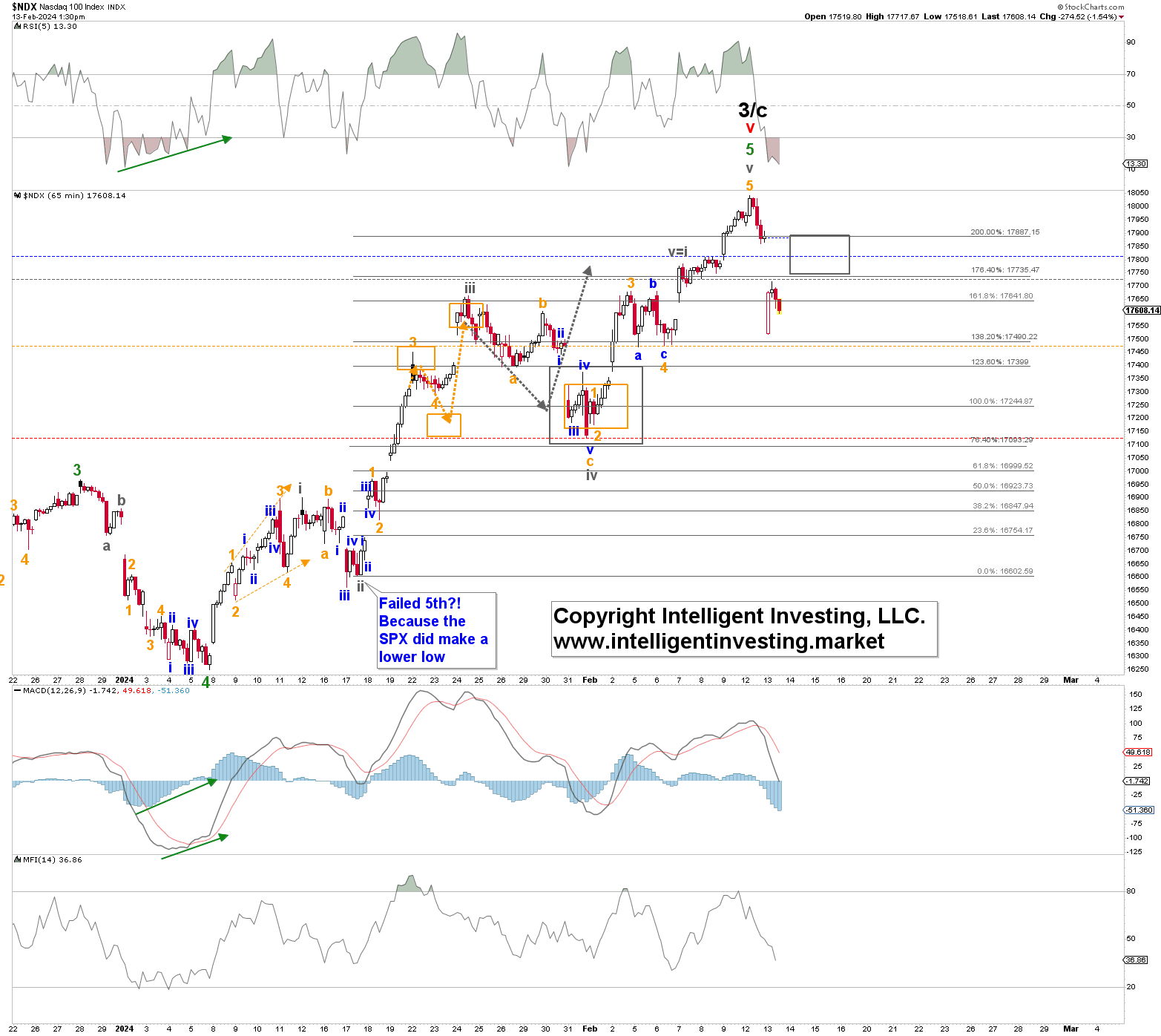

Fast-forward, and the index bottomed out on “FED-day” right at the 76.40% level ($17128 vs. $17093) for grey W-iv and rallied up to yesterday to $18041 for grey W-v, only to fall out of bed today. See Figure 1 below. Moreover, the colored boxes and dotted arrows show the corresponding wave target zones and the general path forward based on the standard Fibonacci-based EWP impulse pattern forecasted on January 19, respectively. Please note we can only outline the potentials the markets have, not the certainties. But by using the EWP, we always have price levels above or below which we know if the market is still on the right path or not.

Figure 1. NDX hourly chart with detailed EWP count and technical indicators Today, the index broke below two of the four colored warning levels we presented to our premium members yesterday. I.e., the colored dotted lines (blue, grey, orange, and red) subsequently increase the warning levels for the Bulls, which can be used to prevent havoc on one’s portfolio. A drop below the red line from current price levels will strongly suggest that the rally from the January 5th low and even the October 26th low has ended.

Today, the index broke below two of the four colored warning levels we presented to our premium members yesterday. I.e., the colored dotted lines (blue, grey, orange, and red) subsequently increase the warning levels for the Bulls, which can be used to prevent havoc on one’s portfolio. A drop below the red line from current price levels will strongly suggest that the rally from the January 5th low and even the October 26th low has ended.

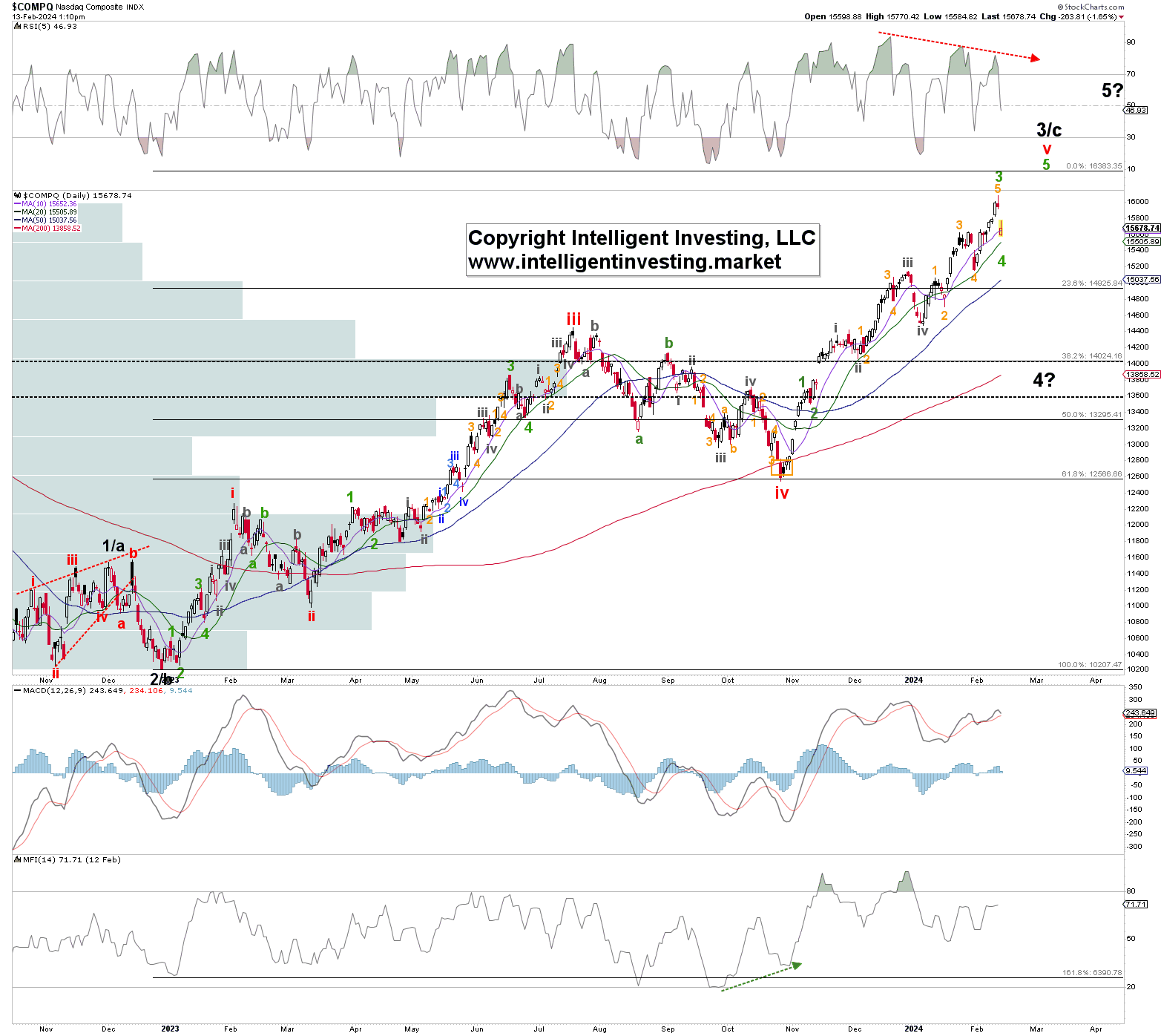

However, our alternative scenario using the regular NASDAQ, as shown in Figure 2 below, remains the same as last.

Figure 2. Daily NAS chart with detailed EWP count and technical indicators

Namely, given that the rally from the October 2023 low was essentially straight up with very consecutive few down days, besides the five-day decline into the January 5 low, the correct interpretation of the price action from an EWP perspective is more complex. As such, yesterday may only be the green W-3 of the red W-v. As found in our last update,

Namely, given that the rally from the October 2023 low was essentially straight up with very consecutive few down days, besides the five-day decline into the January 5 low, the correct interpretation of the price action from an EWP perspective is more complex. As such, yesterday may only be the green W-3 of the red W-v. As found in our last update,

“a pullback to around NDX17100+/-100 and NAS15250+/-100 for the green W-4, followed by another rally for the green W-5, should be anticipated.”

But, below the red warning level (the orange W-4 low on “Fed-day”) increases the odds the black W-4? is underway to ideally NDX15200+/-200, NAS13,800+/-200. That is where the 38.20% retrace of black W-3/c and the Volume-Price shelf resides. Lastly, please note that a break below the October 2023 low tells us the bull market is over.