- Shares are down 67% over the past 12 months as earnings growth has slowed

- Wall Street consensus rating is bullish

- The range of price targets is a concern

- The market-implied outlook is moderately bearish to early 2023

Shares of payments technology platform PayPal (NASDAQ:PYPL) fell 54% so far in 2022 and are down 67% over the past 12 months. Earnings growth in the online payment provider has stalled, reinforcing concerns the company does not have the enduring advantages needed to dominate the digital payments space.

While PayPal is huge, with more than 400 million active registered accounts, there are a host of formidable competitors. Some are focused on e-commerce and digital payment solutions such as Block (NYSE:SQ) and Shopify (NYSE:SHOP). While Google Pay (NASDAQ:GOOGL) and Amazon Pay (NASDAQ:AMZN) leverage the inherent advantages of being embedded in much larger product and service ecosystems.

PYPL has expanded the reach of its “buy now, pay later” functionality with PayPal Pay and PayPal Credit, but it is not clear what benefit these provide relative to alternatives.

Source: Investing.com

Earnings growth in the San Jose, California headquartered payments provider has been very modest over the past two years. The decline in the share price has brought the P/E to 24.5, a level that can be justified with fairly low growth assumptions. The lack of EPS growth in recent quarters has clearly been a catalyst for declines and the modest miss for Q4 of 2021, reported on Feb. 1, triggered a rapid drop. There have been 29 downward revisions of analyst EPS expectations over the past three months.

Source: E-Trade

On Feb. 1, the company reported a drop of 33% in net new active accounts and a decline of 1% in GAAP EPS in FY 2021, although net revenues grew by 17%. The company provided disappointing earnings guidance for FY 2022, with a decline in GAAP diluted EPS vs. FY 2021 and essentially flat non-GAAP EPS per diluted share.

On Nov. 1, 2021, a week before the Q3 2021 earnings report on Nov. 8, I was cautiously bullish with regard to the near-term performance following earnings, but neutral out to the middle of 2022. The Wall Street consensus rating at the start of November was bullish, with a 12-month consensus price target that was 40% above the share price at that time. The options market was telling a somewhat different story, however.

The price of an option on a stock reflects the market’s consensus estimate of the probability that the share price will rise above (call option) or fall below (put option) a specific level (the option strike price) between now and when the option expires. By analyzing the prices of put and call options at a range of strike prices, all with the same expiration date, it is possible to calculate a probable price forecast that reconciles the options prices. This is called the market-implied outlook and represents the consensus view among buyers and sellers of options.

At the start of November, the market-implied outlook was slightly bullish to early 2022 and neutral to mid-2022.

With almost six months since my last analysis, and with earnings to be reported after market close on Apr. 27, I have calculated the market-implied outlook through the end of 2022 and compared this with the current Wall Street consensus outlook, as in my previous analysis.

Wall Street Consensus Outlook For PYPL

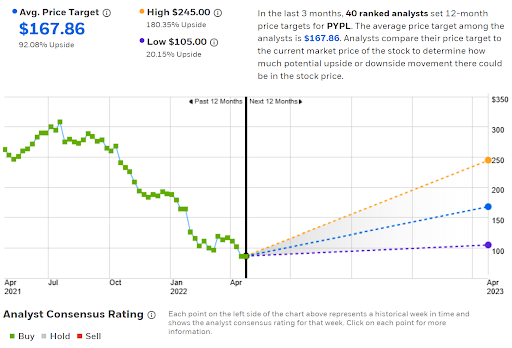

E-Trade calculates the Wall Street consensus outlook for PYPL by aggregating the views of 40 ranked analysts who have published ratings and price targets over the past three months. The consensus rating is bullish, as it has been for all of the past 12 months, and the consensus 12-month price target is 92% above the current share price. The bullishness of the consensus view is tempered by the large spread among the individual price targets. The consensus 12-month price target tends to have predictive value for stocks only if the dispersion among individual price targets is not too high. In fact, when the dispersion is high, there is a negative correlation between the return implied by the price target and the subsequent realized returns for a stock (high expected return predicts low future return). As a rule of thumb, I strongly discount the meaningfulness of the consensus outlook when the highest 12-month price target is more than twice the lowest, which is the case for PYPL.

Source: E-Trade

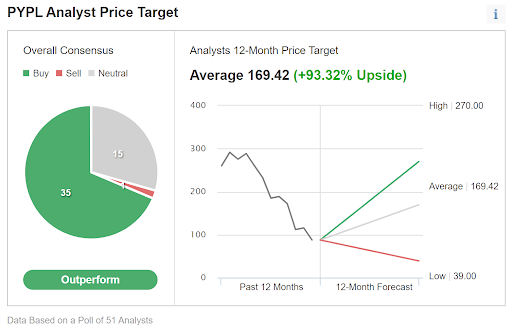

Investing.com’s version of the Wall Street consensus outlook is calculated using ratings and price targets from 51 analysts. The consensus rating is bullish and the consensus 12-month price target is 93.3% above the current share price, very close to E-Trade’s results.

Source: Investing.com

While E-Trade and Investing.com agree that the consensus 12-month price target is about 93% above the current share price, the high level of dispersion among the individual price targets is a significant red flag. The consensus rating calculated by both E-Trade and Investing.com is bullish, but the consistent bullishness (shown in E-Trade’s results) over the past 12 months suggests that the analysts are too optimistic with regard to PayPal’s prospects.

Market-Implied Outlook For PYPL

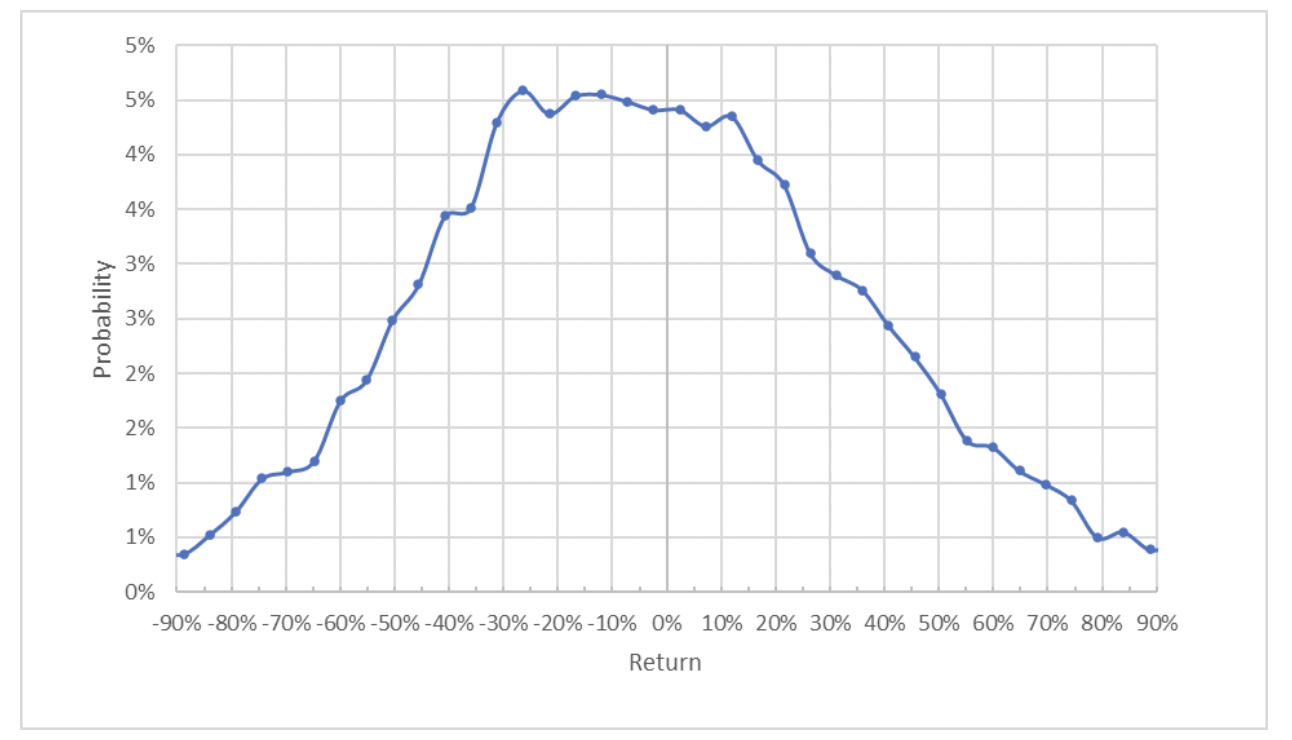

I have calculated the market-implied outlook for PYPL for the 8.8-month period from now until Jan. 20, 2023, using the prices of call and put options that expire on this date.

The standard presentation of the market-implied outlook is a probability distribution of price return, with probability on the vertical axis and return on the horizontal.

Source: Author’s calculations using options quotes from E-Trade

The market-implied outlook for PYPL indicates elevated probabilities of negative returns over the next 8.8 months. The highest probability outcomes primarily correspond to returns less than zero, a bearish view. The expected volatility calculated from this distribution is 56% (annualized), which is high for a large-cap individual stock and much higher than in my analysis in November (when it was around 40%). The higher expected volatility means that the options market views PYPL as significantly riskier than it was towards the end of 2021.

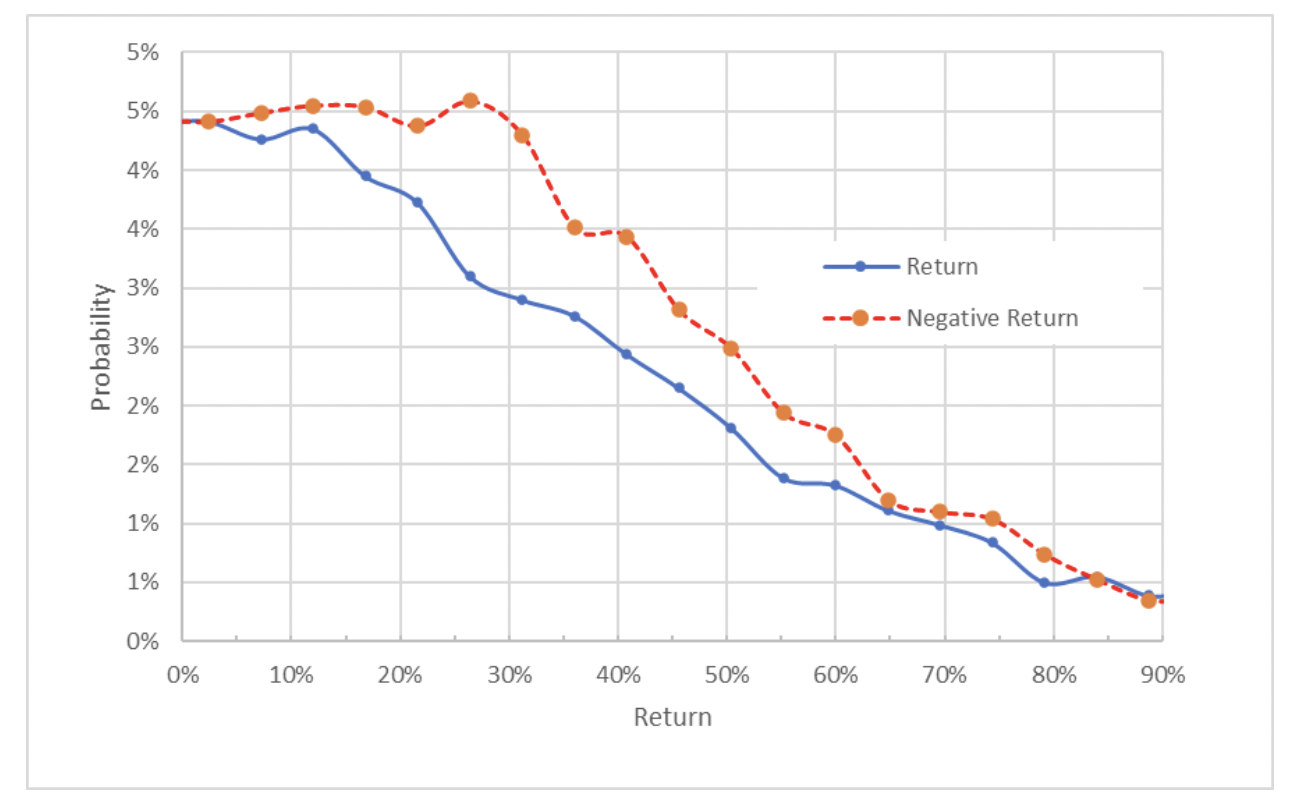

To make it easier to compare the probabilities of positive and negative returns, I rotate the negative return side of the distribution about the vertical axis (see chart below).

Source: Author’s calculations using options quotes from E-Trade

This view clearly shows the bearish tilt in the market-implied outlook, with probabilities of negative returns that are markedly higher than the probabilities of positive returns of the same magnitude, across a wide range of the most probable outcomes (the dashed red line is well above the solid blue line over most of the left two-thirds of the chart above).

Theory indicates that the market-implied outlook is expected to be negatively biased because investors, in aggregate, are risk-averse and thus tend to pay more than fair value for downside protection (put options). There is no way to directly measure whether this effect is present, but considering the expectation of such a negative bias suggests interpreting this market-implied outlook as moderately bearish rather than strongly bearish.

Summary

PYPL is trading at a huge discount to its 12-month high and compared with the share price 12 months ago. The shares have declined because the company has been delivering fairly anemic earnings growth and management guidance suggests continued slow growth over the next year.

The Wall Street analyst consensus rating is bullish and the consensus price target suggests that the shares are substantially oversold. The consensus rating has been continuously bullish as PYPL has fallen, suggesting that perhaps the analysts are collectively missing something.

In addition, the high dispersion in individual price targets is a warning not to put faith in the analyst consensus. The market-implied outlook for PYPL is moderately bearish, with high volatility.

Considering the fairly low current valuation (with P/E of 24.5%), the bullish Wall Street consensus outlook, and the moderately bearish market-implied outlook, I am compromising on a neutral rating to early 2023.