- Disney is 43.5% below the 12-month high closing price

- Q2 earnings missed expectations

- Disney+, Hulu and ESPN+ continue to grow at a healthy rate

- Wall Street consensus rating is bullish

- If you’re interested in upgrading your search for new investing ideas, check out InvestingPro+

Launched in November of 2019, the Disney+ streaming service was well-positioned to surge during COVID. Disney+ surpassed 130 million global subscribers in early 2022. The Walt Disney Company (NYSE:DIS) also owns Hulu and ESPN+, bringing the company’s total paid streaming customers to almost 200 million by the end of 2021. While streaming media giants enjoyed phenomenal growth during the pandemic, Disney’s other business lines—which include theme parks and related resorts—faced unprecedented challenges, largely due to the shutdowns and restricted access to theme parks and cruise lines.

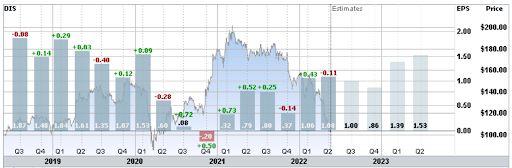

DIS reported Q2 results May 11, missing expectations on earnings, even with continued robust growth in streaming subscriptions.

Source: Investing.com

Since reaching a 12-month high closing price of $185.91 on Sept. 9, 2021, the shares have fallen 43.5%. DIS missed estimates on EPS for Q4, reported on Nov. 10, 2021, which served as a catalyst in driving the sell-off.

Even though earnings substantially beat expectations for Q1 of 2022, reported on Feb. 9, the broader market sell-off and investor concerns overwhelmed any positives. High gas prices heading into summer, along with a resurgence of COVID, are a concern with regard to Disney’s destination-based revenues.

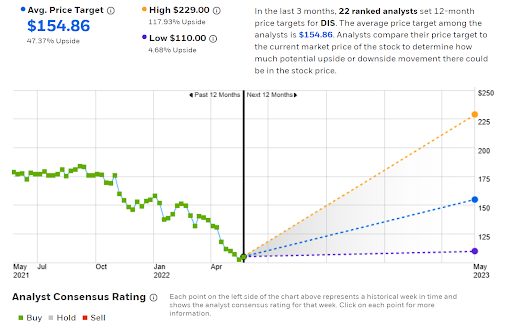

Source: E-Trade

DIS suspended its dividend in May 2020 to conserve cash in the face of the pandemic-driven collapse in revenues. It is unknown when the dividend may resume.

DIS has a trailing 12-month P/E of 69.3, but the forward P/E is 24.8. The challenge in assigning a rating for the stock is in estimating the many factors that determine how quickly the earnings will recover from the pandemic-era collapse. Rather than attempting to build my own bottom-up valuation, I rely on two forms of consensus outlooks for DIS. The first is the well-known Wall Street analyst consensus rating and price target. The second is the market-implied outlook, which represents the consensus view from the options market.

For readers who are unfamiliar with the market-implied outlook, a brief explanation is needed. The price of an option on a stock reflects the market’s consensus estimate of the probability that the stock price will rise above (call option) or fall below (put option) a specific level (the option strike price) between now and when the option expires. By analyzing the prices of call and put options at a range of strike prices, all with the same expiration date, it is possible to calculate a probable price forecast that reconciles the options prices. This is the market-implied outlook. For a deeper discussion, see this monograph published by the CFA Institute.

On Sept. 27, 2021 I upgraded the stock to a buy rating. At that time, earnings were on a solid upward trajectory coming out of the pandemic-driven collapse, and the Wall Street consensus rating and the market-implied outlook were both bullish. The shares have fallen 40% since that post, triggered largely by the significant earnings miss for Q4 and the overall declines for global equity markets.

I have calculated the market-implied outlook for DIS to early 2023 and compared this with the Wall Street consensus outlook in revisiting my rating.

Wall Street Consensus Outlook For DIS

E-Trade calculates the Wall Street consensus outlook for DIS by combining the views of 22 ranked analysts who have published ratings and price targets over the past three months. The consensus rating for DIS is bullish, as it has been for the past year. The consensus 12-month price target is 47.4% above the current share price. One concern with regard to the consensus outlook is the very wide dispersion in the individual price targets, with the highest being more than twice the lowest. High dispersion in the analyst price targets reduces the predictive value of the consensus. As a rule of thumb, I discount the meaningfulness of the consensus price target when the difference between the highest and lowest price targets exceeds 2X, which is the case here.

Source: E-Trade

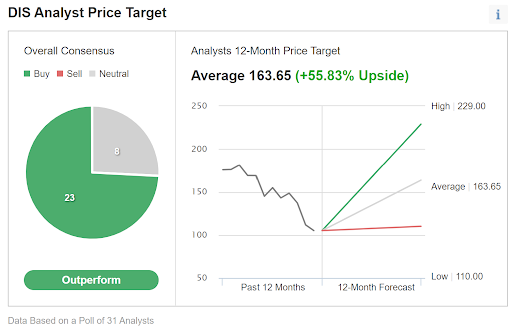

Investing.com’s version of the Wall Street consensus is calculated using ratings and price targets from 31 analysts. The consensus rating is bullish and the consensus 12-month price target is 55.8% above the current share price. The individual analyst price targets exhibit the same high dispersion as in E-Trade’s results.

Source: Investing.com

In September, the consensus 12-month price target was about $215, which was about 22% above the share price at that time. Today, the consensus price target is about $160, which is about 57% above the current share price. The share price has fallen faster than the consensus price target, such that the expected price appreciation has increased. The current price targets suggest that DIS is substantially oversold.

Market-Implied Outlook

I have calculated the market-implied outlook for DIS for the 7.9-month period from now until Jan. 20, 2023, using the prices of call and put options that expire on this date. I selected this specific expiration date to provide a view through the end of 2022 and because the options that expire in January tend to be among the most actively traded.

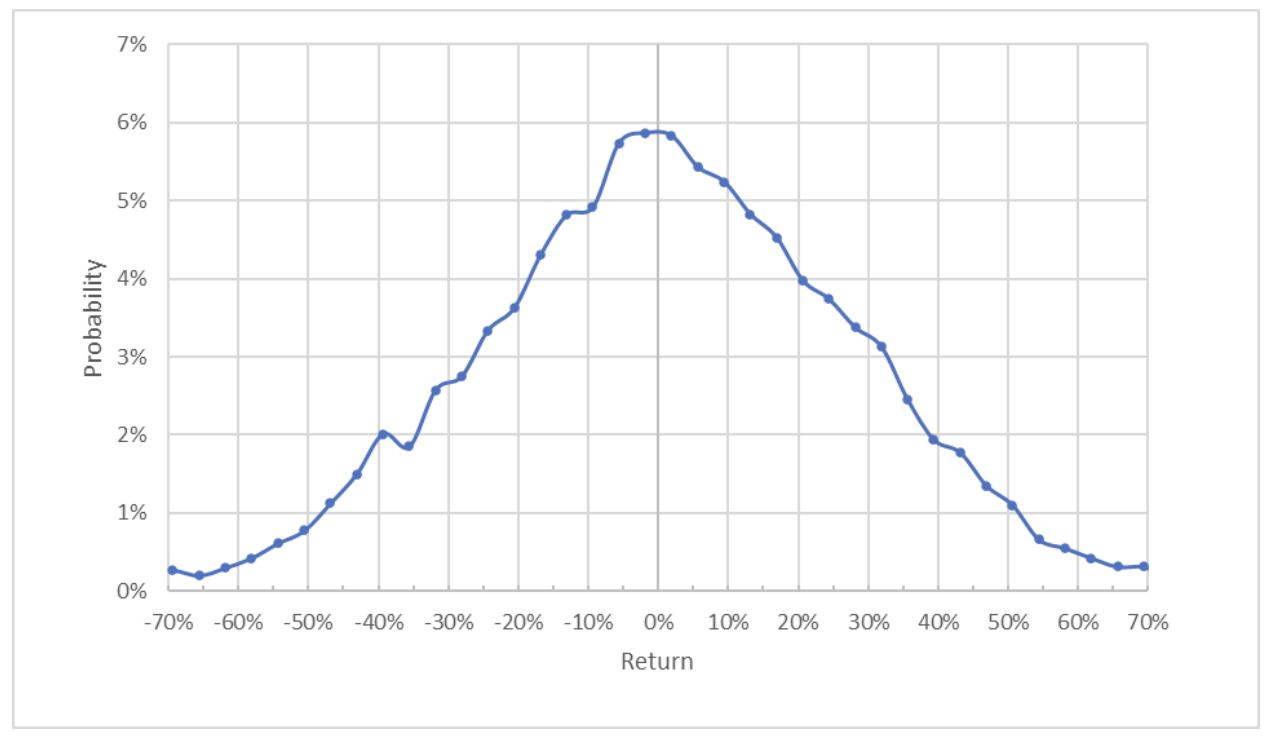

The standard presentation of the market-implied outlook is a probability distribution of price return, with probability on the vertical axis and return on the horizontal.

Source: Author’s calculations using options quotes from E-Trade

The market-implied outlook to early 2023 is quite symmetric, with comparable probabilities for positive and negative returns. The peak in probability is at 0% return. The expected volatility calculated from this outlook is 35% (annualized). For comparison, E-Trade calculates a 34% implied volatility for the January 2023 options. The expected volatility from the September analysis was somewhat lower, at 28%.

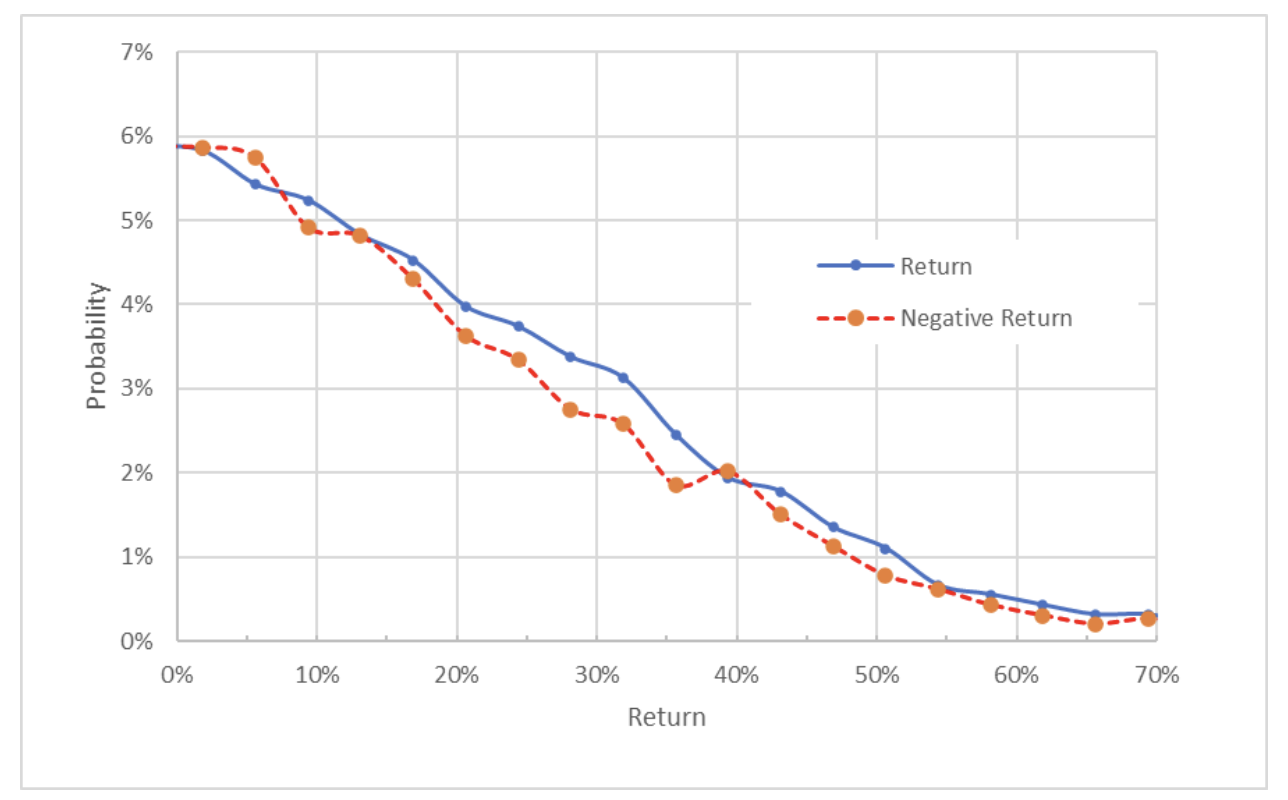

To make it easier to directly compare the relative probabilities of positive and negative returns, I rotate the negative return side of the distribution about the vertical axis (see chart below).

Source: Author’s calculations using options quotes from E-Trade

This view shows that the probabilities of positive returns are consistently, albeit mildly, higher than the probabilities of negative returns of the same magnitude (the solid blue line is above the dashed red line across almost the entire chart above). This is a slight bullish tilt for the market-implied outlook.

Theory indicates that the market-implied outlook is expected to have a negative bias because investors, in aggregate, are risk averse and thus tend to pay more than fair value for downside protection (e.g. put options). There is no way to measure whether this effect is present, but the expectation of a negative bias reinforces the bullish interpretation of this market-implied outlook.

Summary

Analyzing DIS presents unique challenges because of the unprecedented shocks to the company’s business lines during the pandemic, and uncertainty as to the trajectory for recovery. Disney’s streaming media businesses thrived but park, cruise and theater revenues went to zero during the lockdowns.

The pandemic occurred in the midst of a historic transition in media production and delivery, as well. The Wall Street analyst consensus rating continues to be bullish, with a 12-month consensus price target that is about 50% above the current share price. But the high dispersion in the individual price targets leads me to somewhat discount this price target.

With expected volatility of 35%, an expected return of half that implied by the consensus price target (e.g. 25%) would still be quite attractive. The market-implied outlook for DIS is slightly bullish. I am maintaining my bullish/buy rating for DIS.

******

The current market makes it harder than ever to make the right decisions. Think about the challenges:

- Inflation

- Geopolitical turmoil

- Disruptive technologies

- Interest rate hikes

To handle them, you need good data, effective tools to sort through the data, and insights into what it all means. You need to take emotion out of investing and focus on the fundamentals.

For that, there’s InvestingPro+, with all the professional data and tools you need to make better investing decisions. Learn More »