- Airline stocks have given up the better share of their post-pandemic gains

- A toxic combination of higher interest rates and surging inflation is hampering the heavily-indebted sector

- However, Delta Airlines offers value due to its lower debt burden and larger market share of business travel

It was supposed to be the summer of rebound for the global airline industry. After two years of pandemic-induced slump, leisure travel demand finally surged to pre-pandemic levels, even as inflation forced people to pay much more for the air ticket than they did in 2019.

Unfortunately, reality proved to be very different. The U.S. Global Jets ETF (NYSE:JETS) is currently trading at only 25% above its COVID bottom in March 2020—and that's when most of the industry was completely shut down by health restrictions. By comparison, the broader S&P 500 surged 48% in the same timeframe, despite this year’s bear market.

So, what went wrong for one of the most popular reopening bets?

Well, many things. But first and foremost, the toxic macroeconomic combination of high interest rates and surging inflation.

The carriers are heavily indebted, and as interest rates and the cost of borrowing rise, and with inflation biting into consumers’ disposable income, investors don’t see an attractive risk-reward proposition in this trade.

Airlines also face severe labor shortages, operational hurdles at busy airports, high energy costs, and regulatory risks. And things could turn even worse as President Joe Biden plans new laws to force airlines to be more transparent about charges.

Business travel, which carries the largest margin for airlines, has also continued to lag. And while the demand for international travel is recovering, it may slow again if prices don’t fall and a recession hits the global economy, stopping people from spending on leisure travel.

The strong summer season, however, is expected to show up in the airlines’ earnings for the third quarter. Analysts expect carriers to report about $54 billion in Q3 sales, higher than the $49 billion recorded in the comparable period in 2019. Still, profit for the group is estimated to be around $2.7 billion, compared to $4.6 billion in the third quarter of 2019, reflecting the eroding margins amid cost pressures.

A Grim Picture

Analysts’ 2022 earnings estimates for the group paint an even gloomier picture. According to data compiled by Bloomberg Intelligence, the average profit expectations for U.S. airlines are down about 85% since the start of the year, and they’re down more than 35% for 2023.

These grim earnings forecasts suggest that investing in airline stocks should be a long-term bet with the belief that at some point, long-haul travel—the most profitable segment for airlines—will recover, and cost pressures will ease.

But that combination is hard to achieve in the current macroeconomic scenario. Even if fuel prices—a major factor for airlines’ profitability—continue to decline, the risk of recession will linger.

Delta, The Outlier

However, there are exceptions. Delta Air Lines (NYSE:DAL) is my favorite pick for those contrarian investors wishing to bet on the sector.

Down -31% during the last year, the Atlanta-based carrier is well-positioned to benefit from the slow recovery in global travel. About half of DAL’s sales are corporate, with 50% of that exposure belonging to small- and medium-sized business travel.

Although the full recovery of global business travel spending to the pre-pandemic level has been pushed back, the Global Business Travel Association is forecasting that 2026 is the year when that segment will hit its pre-pandemic level.

Source: Global Business Travel Association

Global business travel is expected to total $933 billion this year, 65% of 2019. According to the group, it should grow to $1.16 trillion in 2023, expand to nearly $1.4 trillion in 2025, and hit $1.47 trillion in 2026.

With the significant exposure to corporate travel demand, Delta is also a better-run airline than most of its peers.

In a note this week, Raymond Jones said that it favors Delta versus legacy peers due to the airline’s relatively lower debt burden, lack of a hefty aircraft order book, history of balance capital deployment, and structural advantages.

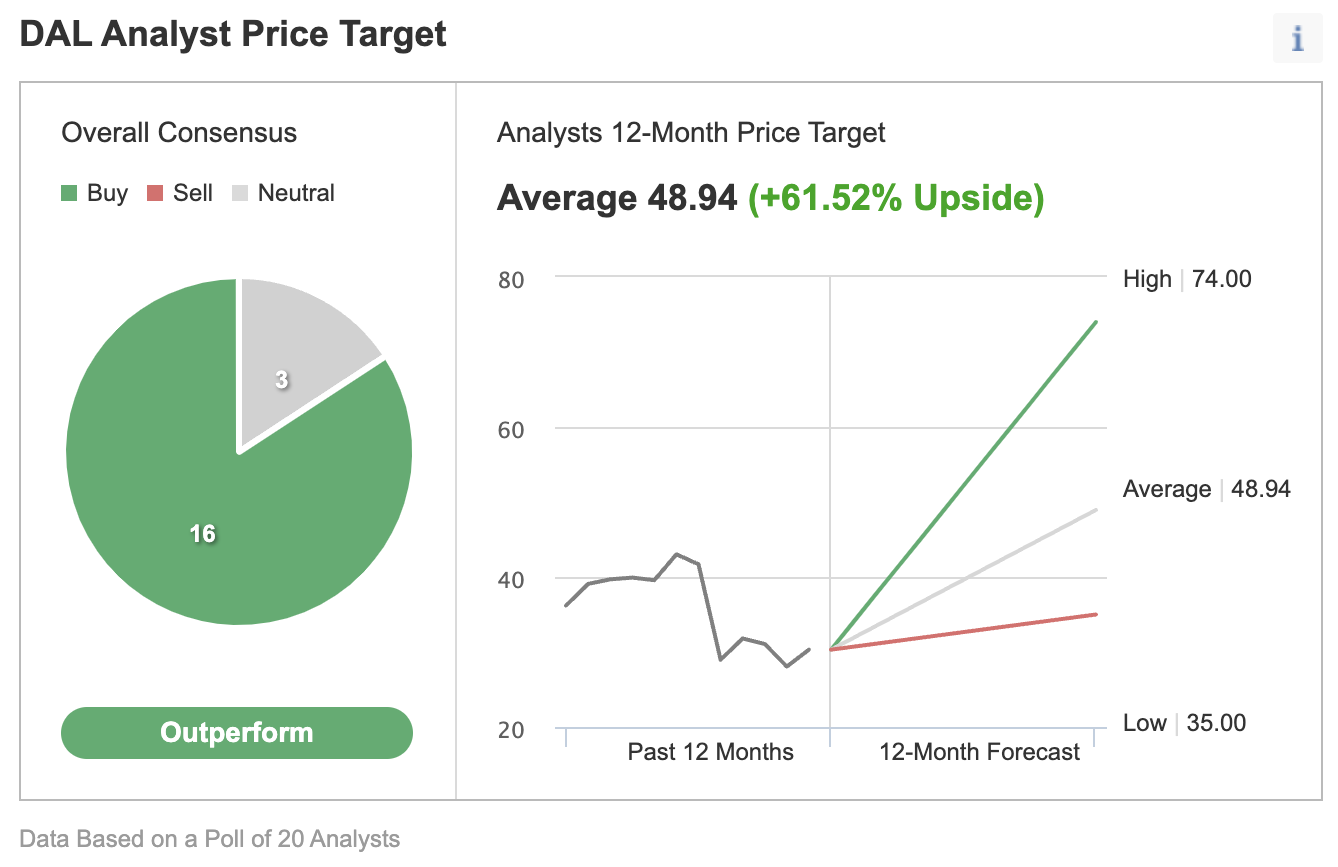

The brokerage firm has a $52 price target on the Delta stock, implying a 73% upside potential from today’s price, much in line with Investing.com's consensus estimates.

Source: Investing.com

Bottom Line

Most airline stocks are back to their 2020 levels, hurt by inflation and a growing risk of recession. If these headwinds don’t subside, airline stocks won’t make a good investment case. For contrarian investors, who want to take advantage of this weakness, Delta is a good recovery bet, given the company’s exposure to lucrative business travel and its better balance sheet.

Disclosure: The author doesn’t own Delta shares. The views expressed in this article are solely the author’s opinion and should not be taken as investment advice.