Crude oil traders are again preparing for falls as the latest API inventory data points to a 4.1 million barrel build in oil stocks.

The tumultuous path of crude oil has been an interesting study in markets as the black gold again appears to be swirling around the drain hole. Recent figures released by the American Petroleum institute signal a build in oil stocks when the official EIA figures are released later. WTI prices have subsequently been under pressure as the market grapples with the risk of further over-supply. The current stockpile sits at around 480 million barrels and its negative implication increases as every day passes.

Regardless of your view on the current “war” between OPEC and US shale producers, the reality is that the continual inventory builds indicate more about the broader macro-economy then they do about the state of the global oil industry. Crude oil has always been a vastly superior measure of economic activity, with a focus on trade and transport, then any of the “massaged” economic stats that emanate from government.

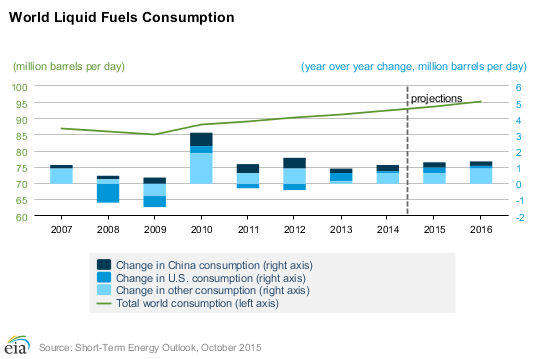

Subsequently, taking a look at world fuel consumption tells us that the global economy has a significant amount of ground to make up before we can consider ourselves “recovered” from the grips of the financial crisis. Domestic demand for liquid fuels is still relatively lacklustre and static and demonstrates none of the economic strength that market pundits (and the Fed) would have you believe exists.

The unfortunate reality is that WTI crude oil is likely to remain under pressure whilst the US economy underperforms. Given that the recent US Core Durable Goods Orders result slipped to -0.4% m/m, I wouldn’t be expecting that to occur any time in the medium term. Subsequently, expect to see the key $40.00 level come back into focus in the coming months as the extent of US economic softness becomes apparent.

Also complicating matters is a report that the US government intends to open up the Strategic Petroleum Reserve (SPR) to effectively “dump” the market to cover their budget deficit. This single act of recklessness will not only add to the downward pressure but will also draw questions of why the nation would seek to partially liquidate a state asset during a period of severely depressed prices .

Given that the SPR has historically been tapped during periods of elevated prices to signal additional supply it would beggar belief that the price signalling mechanism would be employed when crude is in the doldrums. Subsequently, one would have to conclude that the deal was struck as part of the recent debt ceiling negotiations and that no thought was put to the economic consequences of “calling” crude prices lower.

Irrespective of the political idiocy, one thing is for certain, WTI crude prices are heading south. It is highly probable that the key $40.00 a barrel level could be in focus within the next month. In fact, our forecasting places prices within the $39.45 - $42.00 range by the end of 2015.