- Crude oil prices started the week lower, but a bullish breakout is still possible given recent positive trends.

- Traders will watch China's return, Nvidia's earnings, and Thursday's PMI data for oil price cues.

- Despite challenges, a bullish outlook persists if WTI holds above $76.00.

- Invest like the big funds for under $9/month with our AI-powered ProPicks stock selection tool. Learn more here>>

Following two days of consecutive gains toward the end of last week, crude oil has begun the new week on a downward trajectory. Early in European trading, when this report was written, oil prices were showing a decline of about half a percent.

However, based on what I interpret as positive price movements in recent weeks, the likelihood of a bullish breakout seems more plausible than a sell-off, possibly occurring later in the week.

What will oil traders focus on this week?

The US markets will be closed on Monday for Presidents' Day, leaving the week devoid of significant macroeconomic events to closely monitor. However, attention will shift to China's return from a week-long holiday, which is expected to inject liquidity into global markets. Additionally, Nvidia (NASDAQ:NVDA)'s earnings mid-week could influence risk sentiment.

Another focal point for oil traders will be Thursday's release of global manufacturing and services PMIs, particularly from Germany and the Eurozone, where economic growth has trailed behind the US. These PMI data will offer insights into the health of major developed economies, many of which are net importers of oil. Stronger-than-expected PMI data could provide support to oil prices, indicating potential strength in demand. Conversely, weaker PMI data may raise concerns about recession, thereby exerting downward pressure on oil prices.

Meanwhile, the weekly crude oil inventories report from the US will be delayed by a day, scheduled for Thursday instead of Wednesday, due to the bank holiday on Monday. More on this later.

What has been driving oil prices?

Oil has been quite choppy in recent weeks, partly due to the strength of the dollar. Despite supportive factors such as tensions in the Middle East, ongoing intervention by OPEC, and hopes for improved economic conditions in China, the impact of the dollar has counteracted these measures.

Another factor contributing to oil's challenges is the less-than-optimistic US oil inventories reports of late. Last week, the Energy Information Administration (EIA) reported a much larger-than-expected increase in inventories at 12.0 million barrels, following a higher-than-anticipated addition of 5.5 million barrels the previous week.

This build was primarily driven by reduced refinery utilization rates, leading to a decline in gasoline stocks by 3.66 million barrels over the week, marking the second consecutive week of decline and pushing gasoline inventories below their 5-year average.

A continued increase in commercial crude inventories may signal lower demand or higher supply, both of which are negative indicators for oil prices. However, the lower refinery run rate could also be attributed to seasonal maintenance. Let’s await this week's report to provide further clarity.

Despite these challenges, I maintain a perspective that the risks for oil remain tilted to the upside, as there are few other negative influences, besides those mentioned, to weigh on crude prices. Nonetheless, a technical "buy" signal is now necessary as the momentum of the recovery has waned.

WTI technical analysis and trade ideas

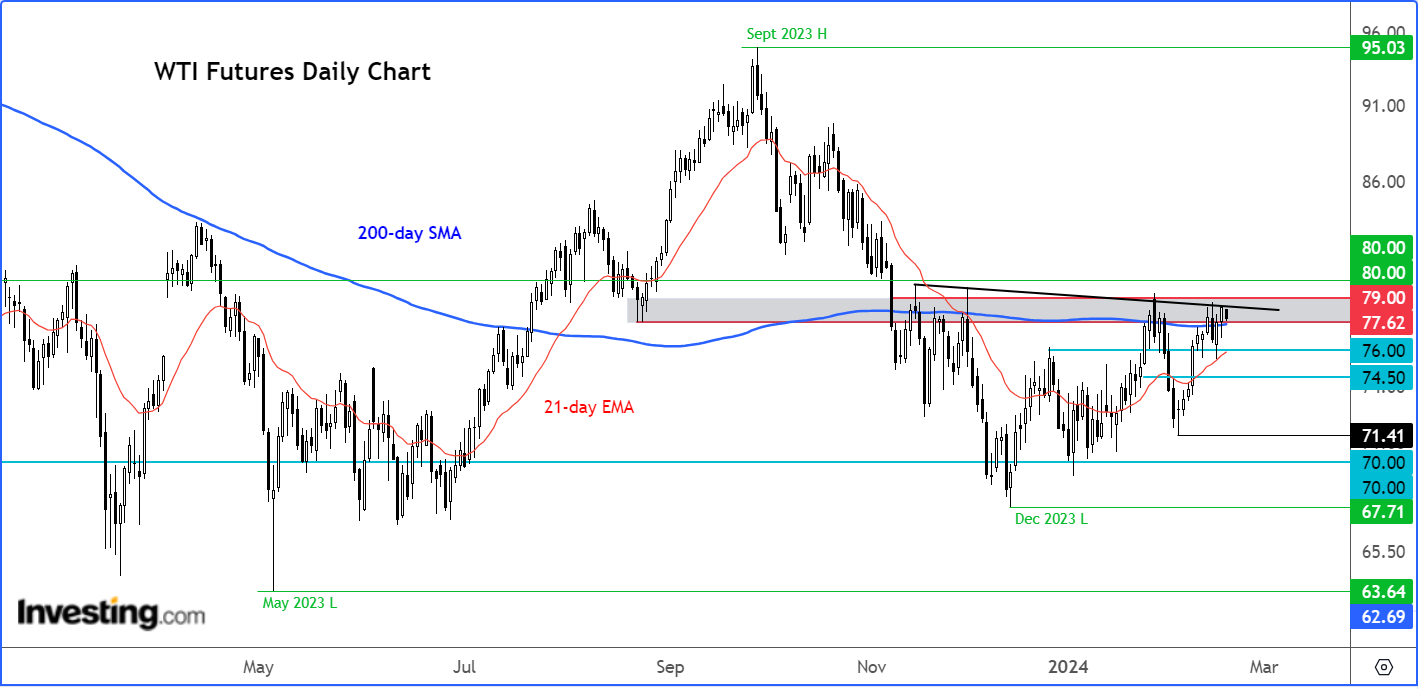

From a technical point of view, WTI has been consolidating in recent weeks, showing a slight bullish inclination thanks to a higher close in January. After dipping below the 200-day moving average in November, WTI has made several attempts to reclaim this average but has struggled to sustain its position above it for more than a few days.

However, last Friday, it managed to close above the MA, signalling a positive end to the week and suggesting a bullish trend for the week ahead. Therefore, the weakness observed in today’s session may be temporary.

To maintain its short-term bullish bias, WTI needs to stay above the 200-day average around the $77.50-60 range. If it does, this could lead to further upward movement toward $80.00 and potentially higher levels.

Even if WTI dips slightly below the 200-day average, it may not significantly alter the outlook, as long as support levels around $76.00 followed by $74.50 hold firm. However, a drop below the $74.50 mark would be considered bearish, in my view. In such a scenario, a revisit of $70 or even lower cannot be ruled out.

Overall, considering the recent bullish price action and mostly supportive macro factors, my expectation is for the bullish scenario to unfold.

***

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. As with any investment, it's crucial to research extensively before making any decisions.

InvestingPro empowers investors to make informed decisions by providing a comprehensive analysis of undervalued stocks with the potential for significant upside in the market.

Subscribe here for under $9/month and never miss a bull market again!