By Jesse Cohen

Of late, oil market players have been grappling with one key question: are prices of the commodity in the process of bottoming, or will futures see a further collapse to new lows in 2016?

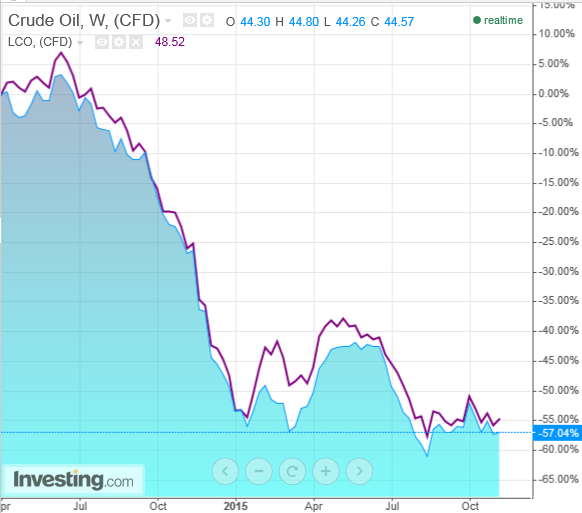

This past Friday, U.S. Crude futures ended the week at $40.70 a barrel, while Brent settled at $44.50. Just 18 months ago, in June 2014, a barrel of oil fetched more than $100.

So far in 2015, U.S. and Brent prices are down almost 18%. Dating back to June 2014, oil futures have lost approximately 60%. That’s a heart-stopping decline, and there’s no reason to believe it’s over yet.

Because of 5 bearish factors now dominating the market, I see oil prices falling even further in the coming year, to a range between $25-to-$35 a barrel.

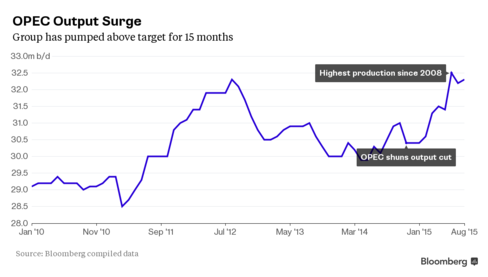

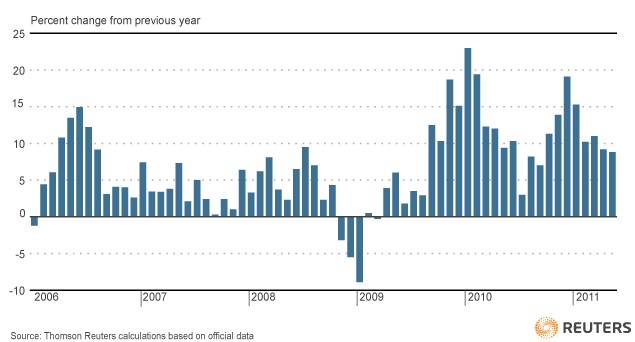

1. Global oil production is outpacing demand following a boom in U.S. shale oil output and after a decision by the Organization of Petroleum Exporting Countries (OPEC) last year not to cut their supply quota (see chart, below). According to recent estimates, OPEC pumped approximately 31.64 million barrels a day in October, close to record-highs, as major producers led by Saudi Arabia focused on defending market share by keeping production high.

2. OPEC supplies are expected to rise further once Iran begins boosting crude production when international sanctions are lifted early next year, following July’s nuclear agreement with major Western powers. Tehran wants to double oil exports to 2.3 million barrels a day by the middle of 2016, adding to the glut of oil that has already sent prices tumbling.

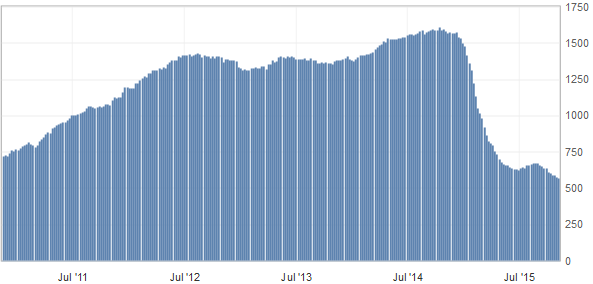

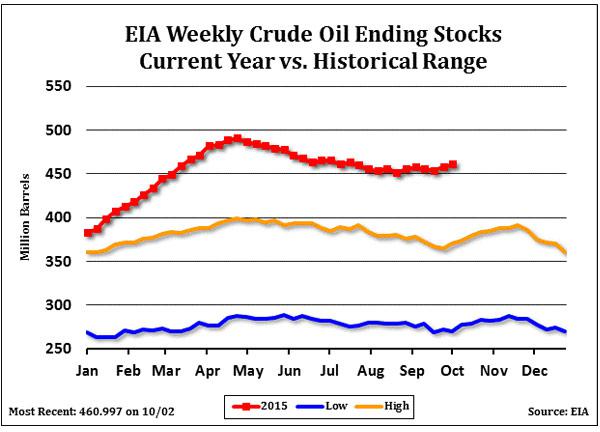

3. Worries over high domestic U.S. oil supplies, despite a declining rig count, will also pose a bearish risk for prices in the year ahead.

According to industry research group Baker Hughes (N:BHI), the number of rigs drilling for oil in the U.S. stood at 574 last week, remaining close to the lowest level since June 2010 (see chart, below). Over the prior 11 weeks, drillers in the U.S. have cut 101 rigs. Ironically, a lower U.S. rig count is usually a bullish sign for oil as it signals potentially lower production in the future.

However, U.S. oil production has held around 9.0 million barrels a day for the past year, close to the highest level since the early 1970s. At the same time, total U.S. crude oil inventories stood near levels not seen for this time of year in at least the last 80 years.

4. Adding to the bearish sentiment, ongoing worries over the weakening health of the global economy have fueled concerns that a global supply glut may stick around for longer than anticipated.

Widespread concerns over the soundness of China's sluggish economy and its impact on oil demand will remain a factor. The Asian nation is on track to post its weakest annual growth rate since the global financial crisis in 2015.

China’s third quarter GDP growth came in at 6.9%, just below the government’s 7% target. Industrial production figures, announced this past Wednesday, missed expectations and are clearly slowing; Fixed asset investment has flattened. As analyst Cam Hui points out, China's traditional growth engine—powered by industrial exports and infrastructure spending—"is decelerating along a number of dimensions."

China's implied oil demand slowed to 226,500 barrels a day in September, the weakest growth rate over the last 8 months. The Asian nation is the world's second largest oil consumer after the U.S. and has been the driver of strengthening demand.

5. Oil prices will also face headwinds from a stronger U.S. dollar once the Federal Reserve starts hiking interest rates and tightening monetary policy. The policy shift, which many anticipate will be announced in December, is expected to boost the dollar and make dollar-denominated oil futures contracts more expensive for buyers who use other currencies.

All these factors indicate that a rebalance in supply and demand is distant, insuring that oil prices will stay low for a long time.

Technical analysis further supports this view. After breaking below a trend line dating back to 1999, bearish chart signals show there is no clear support until prices reach the $25-to-$30-level.

Based on the numerous fundamental and technical signals currently flashing across the broader economic spectrum, I believe oil prices will continue to spiral lower, likely bottoming at $25 a barrel in 2016.