- Today's spotlight is on the release of crucial U.S. inflation data, anticipated to show a decline in both the overall Consumer Price Index and the core CPI

- Market expectations include a decrease in the annual Core CPI from 3.9% to 3.7% and a drop in the Annual CPI from 3.4% to 2.9%.

- In this piece, we will analyze market scenarios in the event of disappointing or better-than-expected data releases.

- In 2024, invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

Today marks the release of the most crucial event of the week – the US inflation data report.

According to estimates from Investing.com's economic calendar, both the overall Consumer Price Index and the core CPI are expected to show a decline on an annual basis.

At the monthly level, markets anticipate no significant change.

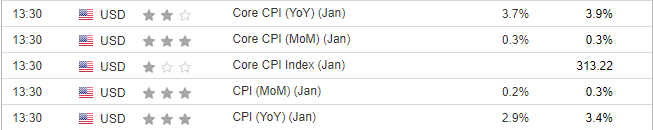

Specifically, these are the expectations:

- Annual Core CPI from 3.9% to 3.7%

- Annual CPI: 3.4% to 2.9%

- Monthly Core CPI: unchanged at 0.3%

- Monthly CPI: down from 0.3% to 0.2%

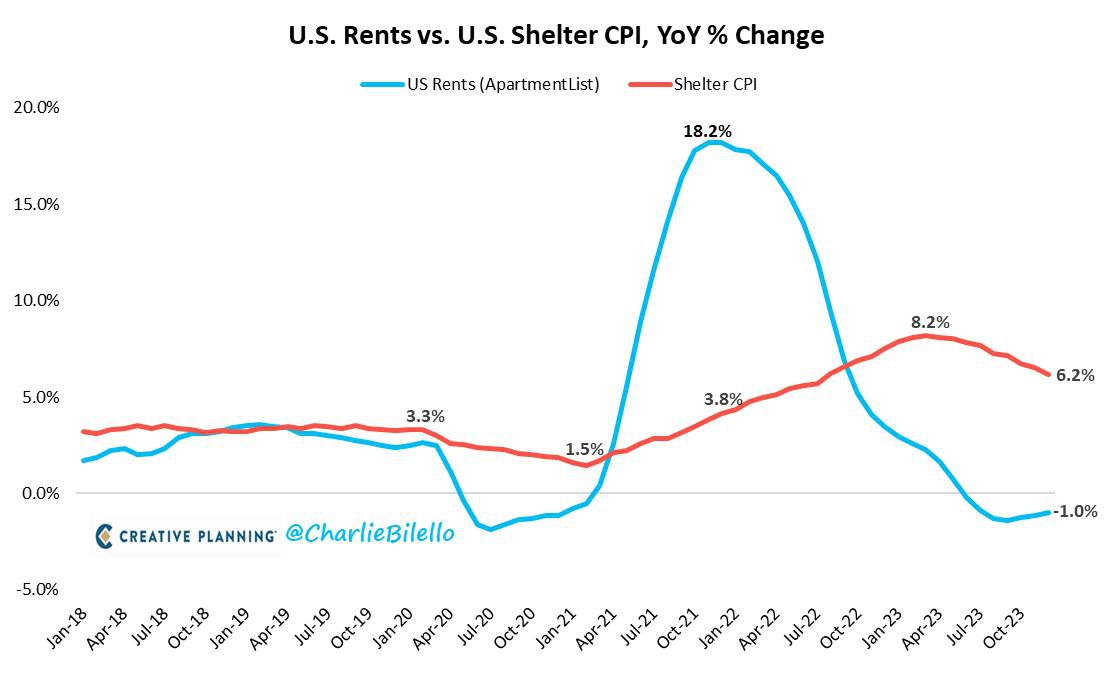

The housing component, specifically the Shelter component, remains a significant question mark. It is a 'lagging' component that, as depicted in the image below, has been on a downward trend for some time.

And since the Shelter component weighs about 33 percent of the total CPI, then we can well understand how important it is for the downward trend to continue to see steadily declining inflation.

Given the recent front-run of the pivot by the housing and real estate markets, all eyes will be set on this specific part of the reading today.

How to Read the Report

Investors must observe the treasury market as the main thermometer of general reaction to the numbers.

That's because markets will be pricing in the probability of the Fed's first rate cut in light of today's numbers. Remember that the bond market is much bigger than the stock market and often the main driver of investor sentiment.

If the inflation figure comes in lower than expected, the central bank might reconsider its stance on the first rate cut, potentially leading to further market gains.

Hence, higher yields would imply that the market is still expecting a higher cost of capital for longer. Conversely, subsiding yields would imply that the Fed's pivot is ready to start.

In case of good numbers (lowering inflation), interesting opportunities may arise in asset classes that have recently suffered, namely:

- Small Caps

- Precious Metals

- Bonds

Conversely, higher-than-expected CPI indicates that the Fed's job may still have room to run. In this case, assets classes likely to benefit are:

- The US Dollar

- Foreign markets with lower expected real rates

***

Take your investing game to the next level in 2024 with ProPicks

Institutions and billionaire investors worldwide are already well ahead of the game when it comes to AI-powered investing, extensively using, customizing, and developing it to bulk up their returns and minimize losses.

Now, InvestingPro users can do just the same from the comfort of their own homes with our new flagship AI-powered stock-picking tool: ProPicks.

With our six strategies, including the flagship "Tech Titans," which outperformed the market by a lofty 1,183% over the last decade, investors have the best selection of stocks in the market at the tip of their fingers every month.

Subscribe here and never miss a bull market again!

Don't forget your free gift! Use coupon code pro2it2024 at checkout to claim an extra 10% off on the Pro yearly and by-yearly plans.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.